Mastering Currency Conversions for Accurate Financial Reporting

As businesses expand globally, currency translation exercises have become indispensable. These exercises ensure accurate financial reporting and provide a clear understanding of the impact of currency fluctuations on a company’s financial statements. In this comprehensive guide, we delve into the world of currency translation, empowering you with the knowledge and skills to confidently navigate these exercises.

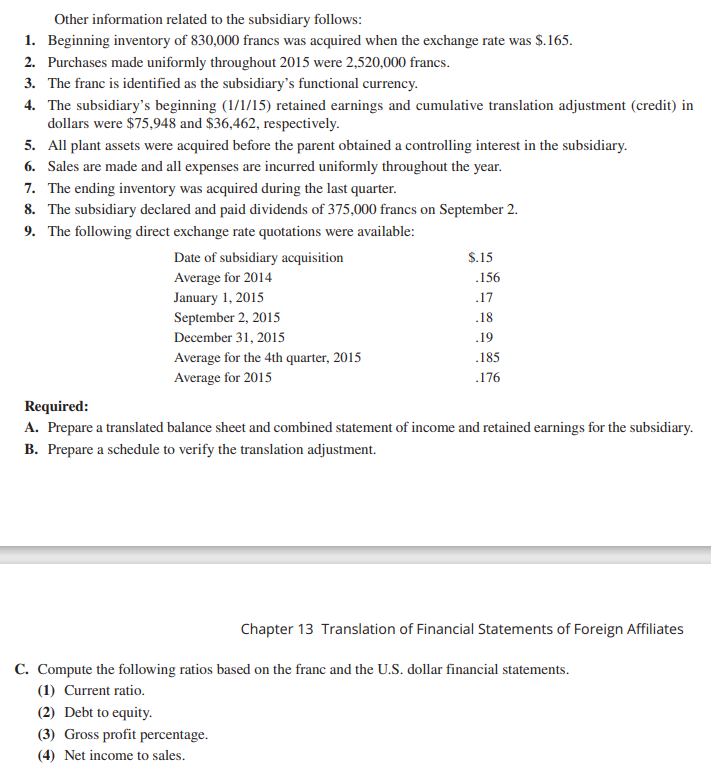

Image: www.scribd.com

Currency Translation: An Overview

In a globalized economy, companies often have transactions in multiple currencies. Currency translation exercises enable businesses to convert the financial statements of one currency into another, ensuring comparability across different currencies. This process is crucial for consolidated financial statements and to provide investors and stakeholders with a clear picture of the company’s financial performance.

Historical Cost Basis

The historical cost basis recognizes foreign assets and liabilities at their original cost. For example, if a company purchases inventory with a cost of €1,000, the inventory will be recorded as €1,000 in the company’s financial statements.

Current Rate Basis

Contrarily, the current rate basis values foreign assets and liabilities at their fair market value on the day of the transaction. For example, if the euro strengthens against the US dollar, the company will report a gain on its inventory, as its value in US dollars will have increased.

Image: www.chegg.com

Temporal Method

The temporal method records the gains and losses on currency translation over the duration of the transaction. This method provides insight into when the gain or loss occurs during the period of the transaction.

Tips for Successful Currency Translation Exercises

To ensure accuracy and reliability in currency translation exercises, consider these expert tips:

- Establish clear guidelines: Define consistent policies for currency translation to ensure uniformity and transparency in financial reporting.

- Leverage technology: Utilize automated systems to streamline the process and minimize errors.

These tips will significantly improve the efficiency and accuracy of your currency translation exercises, empowering you to make informed decisions based on reliable financial data.

FAQ on Currency Translation Exercises

To further enhance your understanding, here are some frequently asked questions and their corresponding answers:

Q: What is the purpose of currency translation adjustments? A: Currency translation adjustments eliminate the effects of changes in exchange rates on financial statements, ensuring consistency and comparability across different currencies.

Q: How do I choose the appropriate currency translation method? A: The choice of method depends on the nature of your business and the purpose of the translation. Consult with your accounting professional for guidance.

Solution Forex Currency Translation Exercises With Solution

https://youtube.com/watch?v=qFkg-Lm5VSw

Conclusion: Embracing Currency Translation for Accurate Reporting

Currency translation exercises are essential for multinational businesses to accurately report their financial performance. By understanding the concepts and best practices outlined in this guide, you can skillfully navigate these exercises, ensuring reliable financial statements and informed decision-making.

Are you interested in exploring currency translation exercises further? Consult professional resources or connect with experienced accountants for additional insights and tailored guidance.