Imagine being caught in a relentless storm, your boat tossing and turning at the mercy of the unforgiving waves. Just as you fear capsizing, a beacon of hope emerges: an anchor. It stabilizes your vessel, preventing it from succumbing to the storm’s fury.

Image: carlfajardo.com

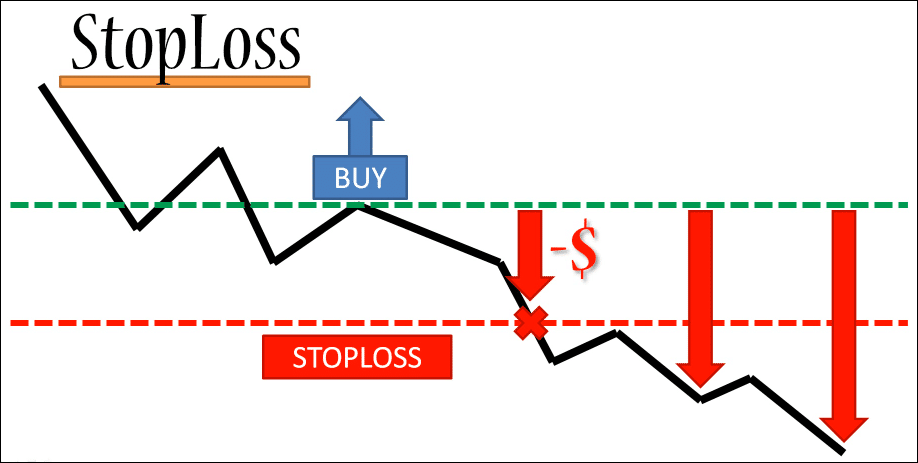

In the turbulent world of forex trading, the stop loss serves as your anchor, protecting your financial boat from the perils of market volatility. It is a crucial risk management tool that automatically closes your trades when the price moves against you, safeguarding your capital from severe losses.

Understanding Stop Losses

A stop loss is an order placed with your broker to automatically execute a trade when the market price reaches a predetermined level. When the price drops (for sell orders) or rises (for buy orders) to this level, the stop loss order is triggered, effectively closing your position to minimize potential losses.

To determine the ideal stop loss level, traders consider various factors, including market volatility, risk tolerance, and trading strategy. It’s essential to strike a delicate balance between placing the stop loss close enough to protect profits and far enough away to allow for temporary price fluctuations without triggering unnecessary exits.

Benefits of Stop Losses

- Risk Management: Stop losses mitigate losses by automatically closing positions when the market moves adversely.

- Trade Discipline: They enforce trade plans, preventing traders from holding onto losing positions out of emotions or overconfidence.

- Peace of Mind: Knowing that stop losses are in place provides peace of mind, especially during times of market uncertainty.

- Improved Performance: By limiting losses, stop losses enhance overall trading performance and profitability.

Expert Tips for Using Stop Losses

1. Use Realistic Targets: Avoid setting unrealistic profit targets or placing stop losses too tightly. Give your trades room to breathe and tolerate short-term price fluctuations.

2. Monitor Market Conditions: Regularly assess market volatility and adjust stop loss levels accordingly. In volatile markets, consider tighter stop losses to protect profits, while in calmer markets, allow for wider stop loss levels to avoid premature exits.

Image: howtotradeonforex.github.io

FAQs

Q1: Can I avoid stop losses altogether?

A1: Not advisable. Stop losses are essential risk management tools for protecting your trading capital and preventing catastrophic losses.

Q2: How often should I adjust my stop losses?

A2: Regularly monitor market conditions and adjust stop loss levels as needed. This ensures that your stop losses are effective in protecting your profits and limiting losses.

Q3: Can stop losses guarantee profit?

A3: Stop losses cannot guarantee profit. However, they help mitigate losses and protect your capital, increasing your chances of long-term profitability.

Stop Loss In Forex Market

Conclusion

Stop losses are indispensable tools in the arsenal of every forex trader. They provide a vital shield against market volatility, ensuring that your financial boat stays afloat amidst the stormy seas of forex trading. By embracing stop losses, you take control of your trades and empower yourself to navigate the challenges of forex with confidence and resilience.

Are you ready to harness the power of stop losses and elevate your forex trading journey? Begin incorporating these risk management strategies into your trading plan and witness firsthand how they can transform your trading experience.