Unveiling the Invisible: A Comprehensive Guide to Stoploss Lines in MQL Coding for Forex

Image: pt.fxssi.dev

Prologue

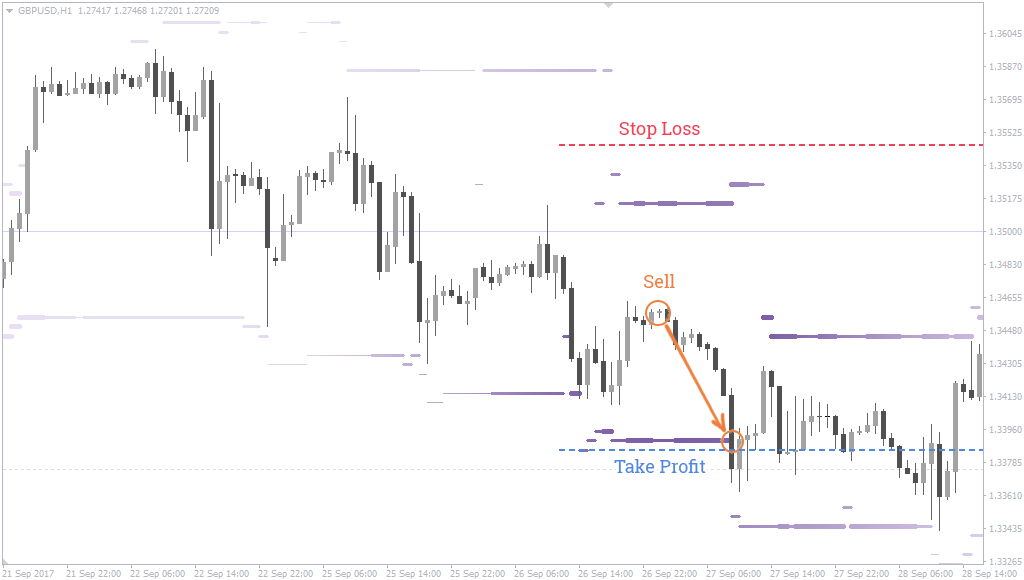

In the tumultuous waters of forex trading, setting an effective stoploss line is akin to erecting an impenetrable fortress against potential losses. It’s the trader’s shield against market volatility, safeguarding their hard-earned capital from catastrophic consequences. But in the enigmatic realm of MQL coding, the stoploss line often plays a deceptive game of hide-and-seek. Invisible to the naked eye, it lurks in the depths of code, waiting to catch unsuspecting traders off guard.

This comprehensive guide will embark on a journey to demystify the stoploss line in MQL coding, empowering you with the knowledge to harness its power and protect your investments. We’ll delve into its intricate functionality, unravel its secrets, and leave no stone unturned in equipping you with the tools to navigate the forex markets with confidence.

Unveiling the Nature of the Stoploss Line

At its core, a stoploss line is an invisible boundary in the world of forex trading. It represents a predefined price level at which a trading position will be automatically closed, mitigating losses in the event of unfavorable market movements. By setting a stoploss line, traders effectively cap their potential losses, preserving their capital for more promising trades.

In MQL coding, the stoploss line is not directly visible in the graphical representation of the chart. Instead, it resides within the intricate network of code that governs the trading platform. This enigmatic presence can be a source of confusion and frustration for novice traders who may be unaware of its hidden existence.

The Birth of a Stoploss

Creating a stoploss line in MQL coding is a crucial step in developing a sound trading strategy. The process begins with the OrderSend() function, which acts as the command to place a trade. This function requires several parameters, including the type of order (buy or sell), the symbol, the volume, and the stoploss level.

The stoploss parameter designates the price level at which the position will be closed. It can be specified in either pips or in the form of a percentage deviation from the current market price. Once the OrderSend() function is executed, the stoploss line is effectively established, silently standing guard over your investment.

Navigating the Hidden Depths of MQL

To access and modify the stoploss line in MQL coding, traders must venture into the realm of MetaEditor, the coding interface for the MetaTrader platform. Here, they can modify the stoploss level using the OrderModify() function. This function allows traders to adjust the stoploss price as the market evolves, ensuring that it remains a protective shield against potential losses.

For expert traders, MetaEditor opens up a world of possibilities for customizing stoploss lines. Advanced coders can create sophisticated algorithms that automate the placement and adjustment of stoploss lines based on complex market conditions. These scripts can help traders optimize their risk management strategies and enhance their trading performance.

Expert Insights and Actionable Tips

-

Choose your stoploss level wisely: The optimal stoploss level depends on your trading strategy, risk tolerance, and the volatility of the market. Avoid setting a stoploss that is too tight, as it could lead to unnecessary stop-outs.

-

Dynamic stoploss strategies: Employ dynamic stoploss lines that automatically adjust based on the market price. This strategy can help reduce losses while capturing more profit during favorable trends.

-

Multiple stoploss levels: Consider using multiple stoploss levels to enhance risk management. Place a primary stoploss to protect your capital and a secondary stoploss to maximize profits.

Empowering Conclusion

Mastering the art of stoploss lines in MQL coding is an essential step towards becoming a successful forex trader. By understanding the principles outlined in this guide, you can unleash the power of automated trading and safeguard your investments in the face of market uncertainties.

Embrace the invisible nature of the stoploss line. It is not a hindrance but rather a guardian angel, protecting you from the perils of volatile markets. Remember, the key to successful trading lies not only in maximizing profits but also in mitigating risks. With a solid understanding of stoploss lines in MQL coding, you can navigate the forex landscape with confidence, knowing that your capital is shielded against the unexpected.

Image: www.mql5.com

Stoploss Line Invisible In Mql Coding Forex