In the ever-dynamic world of forex trading, pinpointing ideal entry and exit points is paramount. Traders seek dependable indicators to discern market direction and predict potential turning points in price action. Among the vast array of technical tools, the Swing Turning Point Indicator (STPI) stands out as a highly effective instrument for identifying these pivotal market junctures.

Image: etibavubanako.web.fc2.com

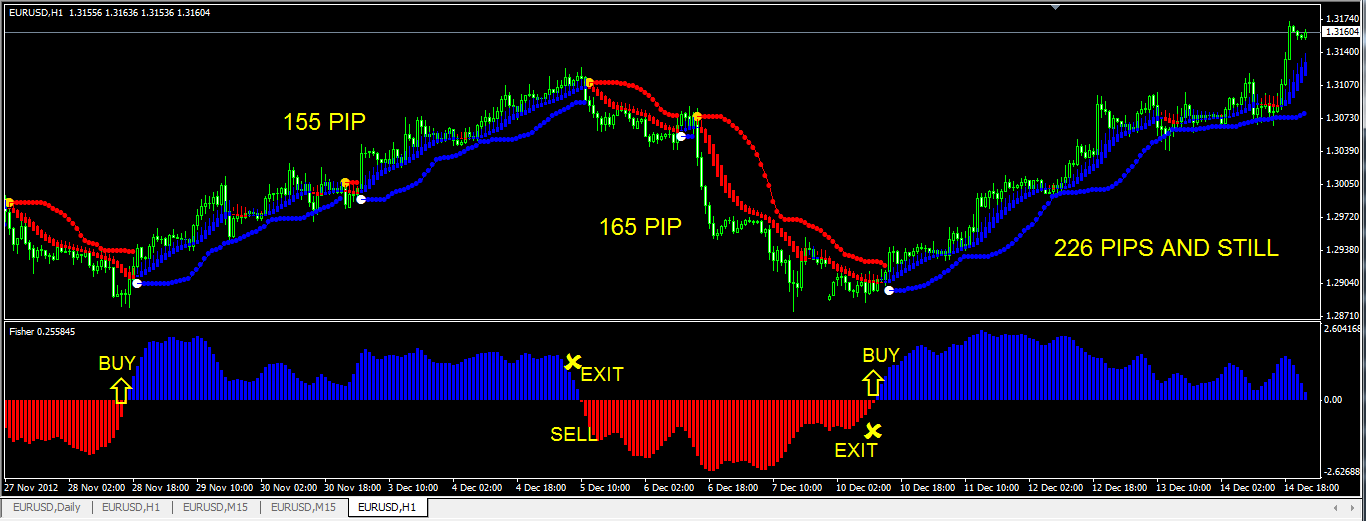

The STPI is a momentum-based indicator that gauges the strength and momentum behind price swings. Its fundamental principle lies in identifying significant peaks and troughs in price action, which often coincide with potential reversal points. By interpreting these key turning points, traders can better anticipate potential market shifts and tailor their trading strategies accordingly.

Understanding the Inner Workings of the STPI

The STPI is composed of two interconnected lines: the Positive Turning Points (PTP) Line and the Negative Turning Points (NTP) Line. The PTP Line is plotted above the price chart and tracks positive momentum, while the NTP Line is plotted below the chart and tracks negative momentum.

The PTP Line is generated when the closing price of a candle exceeds the highest closing price of the preceding two candlesticks. Conversely, the NTP Line is generated when the closing price falls below the lowest closing price of the preceding two candlesticks.

The positioning of the STPI lines in relation to the price action provides invaluable insights into market momentum. When the PTP Line is above the price chart and the NTP Line is below, it signifies that bullish momentum is dominating the market, increasing the likelihood of an upward trend. Conversely, when the PTP Line is below the price chart and the NTP Line is above, it suggests that bearish momentum is ascendant, hinting at a potential downtrend.

Leveraging the STPI for Profitable Trading

The STPI’s primary strength lies in its ability to pinpoint trading opportunities by identifying swing points in price action. Traders can utilize the indicator in various ways to enhance their trading decisions:

-

Identifying Potential Reversals: When the STPI lines intersect or diverge significantly from the price chart, it often signals a potential reversal in price direction. Traders can look to enter long positions when the PTP Line crosses above the price chart, and consider short positions when the NTP Line crosses below the price chart.

-

Confirming Existing Trends: The STPI lines can also validate existing market trends. If the PTP Line is consistently above the price chart and the NTP Line is consistently below, it indicates that the uptrend is likely to continue. Conversely, if the NTP Line is consistently above the price chart and the PTP Line is consistently below, it suggests that the downtrend is likely to persist.

-

Measuring Momentum Strength: The distance between the STPI lines and the price chart provides an indication of the strength of market momentum. Wider gaps between the lines suggest stronger momentum, while narrower gaps indicate waning momentum. This knowledge can help traders gauge the potential continuation or reversal of a trend.

-

Identifying Support and Resistance Levels: Past turning points identified by the STPI often become future support and resistance levels, as the market tends to react to these levels. Traders can exploit these levels for potential trading opportunities or risk management.

Cautions and Considerations

Like any technical indicator, the STPI is not a flawless crystal ball. Its effectiveness can be influenced by market volatility, noise, and false signals. Therefore, it’s crucial to use the STPI in conjunction with other indicators and technical analysis techniques for a more comprehensive market assessment.

Furthermore, the STPI parameters, such as the number of candles used to calculate turning points, can be adjusted to suit different trading styles and market conditions. Experimenting with different settings can optimize the indicator’s performance and enhance its relevance to a trader’s specific approach.

Image: theforexgeek.com

Swing Turning Point Indicator Forex

https://youtube.com/watch?v=DcoT90en6sM

Conclusion

The Swing Turning Point Indicator (STPI) is a powerful momentum-based tool that empowers forex traders to swiftly and effectively identify swing points in price action. Its dual Positive Turning Points (PTP) Line and Negative Turning Points (NTP) Line provide valuable insights into market momentum, enabling traders to discern potential market reversals, confirm trends, gauge momentum strength, and identify support and resistance levels.

While the STPI is not infallible, its inclusion in a trader’s toolkit can significantly enhance their technical analysis arsenal. By judiciously interpreting the STPI signals, traders can increase their chances of making well-informed trading decisions and maximizing their profitability.