Master the Forex Markets with Technical Analysis: Your Gateway to Profitable Trades

Image: www.forexpeacearmy.com

In the ever-evolving world of finance, the foreign exchange (forex) market stands as a colossal arena where currencies from across the globe dance in a perpetual waltz of exchange. Amidst the relentless ebb and flow, skilled traders harness the power of technical analysis to decipher market patterns, predict price movements, and seize lucrative opportunities.

Technical Analysis: Unveiling the Language of the Markets

Technical analysis, a time-tested discipline, unlocks the secrets hidden within historical price data. It empowers traders to discern the underlying trends, identify potential entry and exit points, and make informed trading decisions. By scrutinizing candlestick patterns, moving averages, and oscillators, technical analysts discern the market’s sentiment, unraveling its hidden narratives.

Step-by-Step Guide to Technical Analysis

Embarking on the path of technical analysis is an enriching journey that begins with understanding the foundational concepts. Master the art of charting, the essential tool for visualizing price movements and identifying patterns. Embrace the wisdom of candlestick formations, each revealing a tale of market dynamics:

-

Bullish Engulfing Pattern: A testament to buying pressure, signaling an impending uptrend.

-

Bearish Engulfing Pattern: A warning bell, heralding a potential downtrend.

-

Doji: An indecisive candle, reflecting market uncertainty.

Moving Averages: Smoothing the Volatility

In the tumultuous waters of the forex market, moving averages emerge as beacons of stability. These smoothed trend lines help traders navigate market volatility, highlighting the underlying trend direction. Choose from a range of moving averages, including simple moving averages (SMA), exponential moving averages (EMA), and weighted moving averages (WMA).

Oscillators: Unveiling Hidden Impulses

Delve into the realm of oscillators, nimble technical tools that gauge the intensity of market momentum and potential overbought or oversold conditions. Among the most widely used oscillators are the Relative Strength Index (RSI), the Stochastic Oscillator, and the Bollinger Bands.

Expert Insights and Actionable Strategies

Empower your trading journey with invaluable insights from seasoned experts. Seamlessly integrate their time-tested strategies into your trading arsenal. Discover the secrets of:

-

Trend Following: Riding the market’s momentum for extended periods of profit.

-

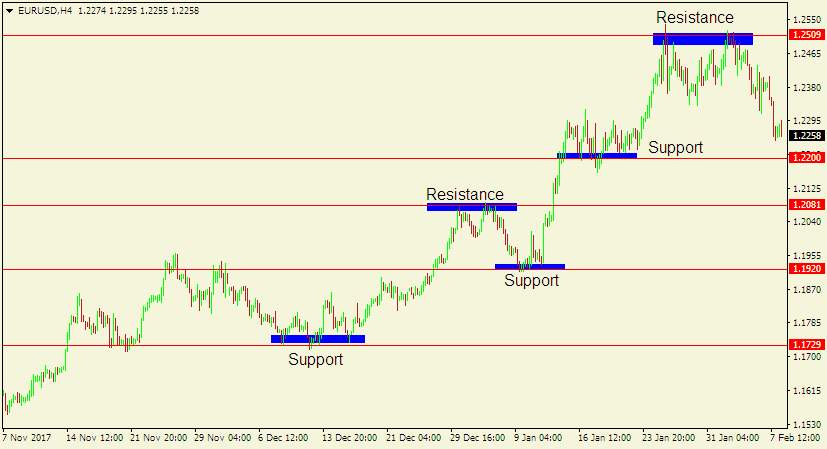

Range Trading: Exploiting the price action within defined boundaries for steady returns.

-

Scalping: Capturing quick profits from minuscule price fluctuations.

Conclusion

The world of forex trading is a boundless ocean of potential, where technical analysis serves as an indispensable compass. By mastering the art of charting, comprehending candlestick patterns, and judiciously utilizing moving averages and oscillators, you possess the knowledge and confidence to navigate the ever-shifting tides of the forex market. Embrace technical analysis, hone your skills, and unlock a world of profitable trading possibilities.

Image: www.youtube.com

Technical Analysis For Forex Trading Pdf Tamil