In the ever-evolving financial market, technical analysis and forex trading offer boundless opportunities for traders. Whether you’re a seasoned pro or a curious beginner, this comprehensive guide will equip you with the knowledge and strategies to navigate these dynamic landscapes.

Image: www.icmarkets.com

Technical analysis unlocks the secrets hidden within historical price data. It empowers traders with invaluable insights into market trends, price patterns, and potential future movements. Arm yourself with this powerful tool to make informed decisions and enhance your trading success.

Navigating the Forex Market: A Beginner’s Guide

The foreign exchange (forex) market is the world’s most traded financial marketplace, presenting countless opportunities for those seeking to profit from currency fluctuations. As a beginner, understanding the basics is crucial:

- Currency Pairs: Forex trading involves trading pairs of currencies, such as EUR/USD (euro against the US dollar).

- Bid and Ask Prices: The bid price is the price a trader is willing to buy a currency, while the ask price is the price they’re willing to sell.

- Lots: Forex is traded in standard units called lots, typically representing 100,000 units of the base currency.

- Leverage: Forex brokers provide leverage, allowing traders to control large positions with a relatively small amount of capital. However, leverage can amplify both profits and losses.

Technical Analysis Unveiled: A Powerful Tool for Market Insight

Technical analysis is the art of predicting future price movements by studying historical data, price patterns, and volume. Its fundamental principles include:

- Trend Analysis: Identifying the current market direction – uptrend, downtrend, or sideways movement.

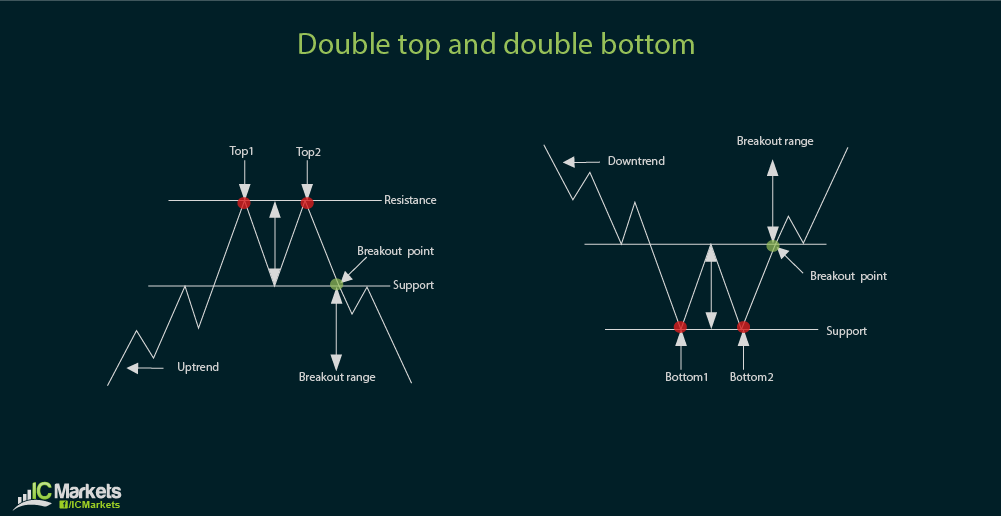

- Support and Resistance: Levels where a trend may pause or reverse, offering potential trading opportunities.

- Indicators: Mathematical formulas applied to price data, providing additional insights into market conditions.

- Candlestick Patterns: Graphical representations of price action that convey market sentiment and momentum.

- Risk Management: Implementing strategies to minimize losses and protect profits.

Mastering Technical Indicators: Empowering Your Trading Decisions

Technical indicators enhance the accuracy and objectivity of technical analysis. Some popular indicators include:

- Moving Averages: Smoothing out price fluctuations to identify long-term trends.

- Moving Average Convergence Divergence (MACD): Analyzing the relationship between two moving averages to gauge momentum.

- Relative Strength Index (RSI): Measuring the strength of a trend based on recent price changes.

- Stochastics: Comparing the closing price to the price range, providing insights into overbought or oversold conditions.

Image: www.investing-news.net

A Journey into Forex Trading: Strategies and Risk Mitigation

Successful forex trading involves employing sound strategies:

- Trend Following: Identifying and trading in the direction of the prevailing trend.

- Range Trading: Capturing profits within a defined price range.

- Scalping: Executing multiple small trades within a short time frame.

- Hedging: Reducing exposure to risk by simultaneously taking opposite positions in different markets.

Minimizing risk is paramount. Implement risk management measures such as:

- Stop-Loss Orders: Automatically closing positions when a predetermined loss level is reached.

- Position Sizing: Managing the size of each trade relative to your account balance.

- Risk-Reward Ratio: Ensuring potential profits outweigh potential losses.

Technical Analysis Or Forex Begineer

Conclusion: Embracing the Power of Knowledge

By mastering technical analysis and forex trading, you gain a competitive edge in the financial market. This guide has provided a comprehensive foundation, but continued learning is essential. Explore online courses, attend workshops, and engage with experienced traders to further enhance your skills.

Remember, trading involves both opportunities and risks. Approach the market with a well-informed strategy, sound risk management practices, and the unwavering belief in your ability to succeed.