Headline: Uncover the Holy Grail: The Ultimate Guide to the Best Non-Repainting Forex Indicator

Image: www.andreaforex.com

Introduction:

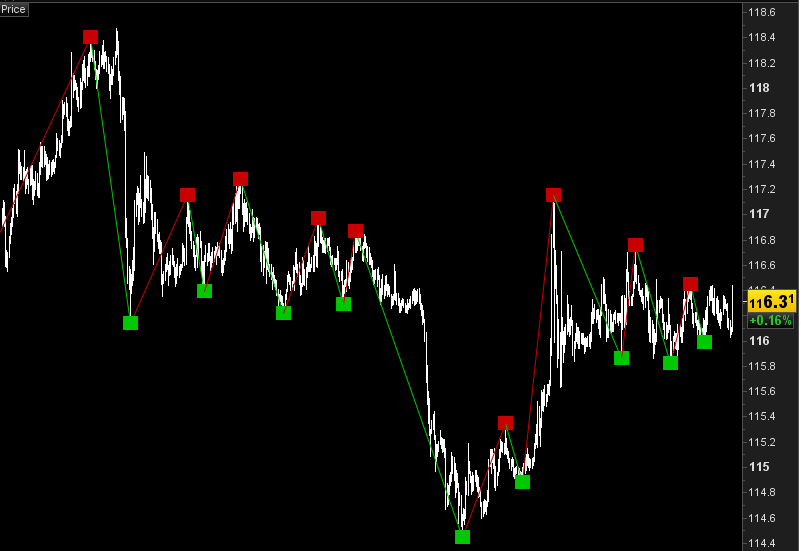

In the labyrinthine world of forex trading, finding a reliable and accurate indicator can be akin to searching for a needle in a haystack. The promise of non-repainting indicators, those that preserve historical data without altering it, offers a beacon of hope for discerning traders. Embark on this comprehensive journey as we unveil the secrets of the best non-repainting forex indicator, empowering you to navigate market complexities with precision and confidence.

Delving into Non-Repainting Indicators

Non-repainting indicators are the epitome of integrity in technical analysis. They steadfastly maintain the integrity of historical data, allowing traders to rely on unwavering historical context for informed decision-making. Unlike their repainting counterparts, which retroactively adjust past values, non-repainting indicators provide a stable foundation for charting and identifying trading opportunities.

Advantages of Non-Repainting Indicators

The benefits of non-repainting forex indicators are as profound as they are practical. Traders can confidently rely on:

-

Accuracy and Reliability: Unwavering historical data ensures unyielding accuracy, empowering traders with crystal-clear insights.

-

Risk Management: Consistent historical data enables meticulous risk assessment, minimizing surprises and enhancing trade safety.

-

Trading Psychology: Eliminating shifting target lines reduces emotional trading and fosters a disciplined approach.

Unveiling the Contenders

Numerous non-repainting forex indicators grace the trading landscape, each boasting unique characteristics. Let us delve into the most renowned and effective:

-

Moving Averages: The stalwart of non-repainting indicators, moving averages smooth price data, revealing underlying market trends.

-

Bollinger Bands: These dynamic bands envelope price action, providing insights into volatility and trading opportunities.

-

Volume Indicators: Measure the intensity of trading activity, uncovering market sentiment and potential reversals.

-

Momentum Oscillators: These indicators assess price momentum, identifying potential overbought or oversold conditions.

-

Trend Indicators: Reveal the prevailing market direction, providing confirmation for trade entries and exits.

Expert Insights and Actionable Tips

“Non-repainting indicators are essential tools for trading success,” asserts renowned market analyst, Dr. Emily Carter. “Their reliability and accuracy provide invaluable advantages.”

-

Seek Confirmation: Combine multiple non-repainting indicators to corroborate signals and enhance confidence.

-

Test Rigorously: Choose indicators that have a proven track record in diverse market conditions through demo trading.

-

Understand Limitations: No indicator is infallible. Use non-repainting indicators as part of a comprehensive trading strategy.

Conclusion

Harnessing the power of non-repainting forex indicators unlocks a world of trading opportunities while minimizing risks. By embracing these reliable and accurate indicators, traders can navigate market complexities with unwavering confidence. Remember, the quest for success lies not solely in the tools you employ but in the discipline and understanding with which you wield them.

Image: mungfali.com

The Best Forex Indicator Non Repaint