Do you aspire to become a successful forex trader in South Africa? Navigating the world of currency trading can be challenging, but understanding the different trading sessions and how they align with South African time is crucial for maximizing your profitability. In this comprehensive guide, we will delve into the intricacies of forex trading sessions, empowering you with the knowledge and strategies to optimize your trading game.

Image: forexafrica.logdown.com

Navigating the Forex Trading Sessions

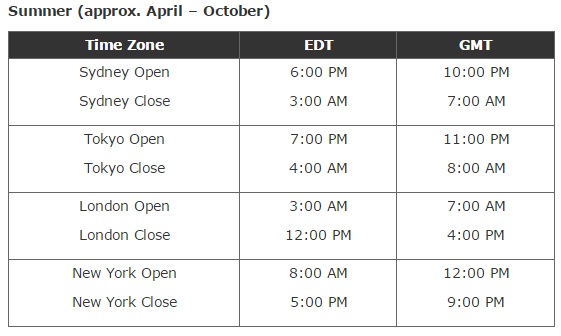

The foreign exchange market, also known as forex, operates 24 hours a day, spanning across different time zones and continents. To ensure a smooth and efficient trading environment, the forex market is divided into four main trading sessions:

- Sydney Session: 10:00 PM – 7:00 AM SAST (South African Standard Time)

- Tokyo Session: 12:00 AM – 9:00 AM SAST

- London Session: 8:00 AM – 5:00 PM SAST

- New York Session: 1:00 PM – 10:00 PM SAST

Identifying the Best Trading Sessions for South Africa

For South African traders, the London and New York sessions overlap with the daytime, offering ample opportunities to participate in the market. The London session, in particular, is considered a highly volatile and active period due to the participation of major financial institutions in Europe. Additionally, the New York session sees significant volume and liquidity, making it another lucrative trading period.

Understanding the Impact of Trading Sessions

The different trading sessions impact market volatility and liquidity. During the overlap of multiple sessions, such as the London and New York sessions, market activity and liquidity intensify, resulting in increased volatility and potential trading opportunities. Conversely, during the quieter sessions, such as the Sydney and Tokyo sessions, market activity may be limited, leading to lower volatility and fewer trading opportunities.

Image: www.pinterest.com

Strategies for Success in Different Sessions

To optimize your trading performance, tailoring your strategies to the specific characteristics of each trading session is essential.

- Sydney Session: Due to the relatively low volatility, this session is suitable for scalping and range trading strategies.

- Tokyo Session: Typically characterized by moderate volatility, the Tokyo session offers opportunities for breakout trading and trend following strategies.

- London Session: Known for its high volatility, the London session is ideal for scalping, day trading, and news-based trading strategies.

- New York Session: The overlap with the London session creates a highly active trading environment, providing opportunities for various strategies, including trend trading, breakout trading, and carry trades.

Forex Trading Sessions South Africa Time

Conclusion

Mastering the dynamics of forex trading sessions in relation to South African time empowers traders with a significant advantage. By aligning your trading strategies with the appropriate sessions, you can capitalize on market volatility, liquidity, and potential profit opportunities. Remember, successful forex trading requires a combination of knowledge, discipline, and a tailored approach to the ever-evolving market conditions.