As a savvy Forex trader, understanding the intricacies of trading times in different global markets is crucial for success. In this comprehensive guide, we delve into the time zones that govern Forex trading in China, empowering you with the knowledge to navigate the market effectively.

Image: phantomtradingfx.com

China’s financial hub, Shanghai, operates in the China Standard Time (CST) zone, which is eight hours ahead of Coordinated Universal Time (UTC). This means that when it’s noon in London (UTC), it’s 8:00 PM in Shanghai (CST).

Trading Sessions in China

The Forex market in China operates during the following sessions:

- Morning session: 9:00 AM – 11:30 AM CST

- Afternoon session: 1:00 PM – 3:30 PM CST

- Evening session: 7:00 PM – 9:00 PM CST

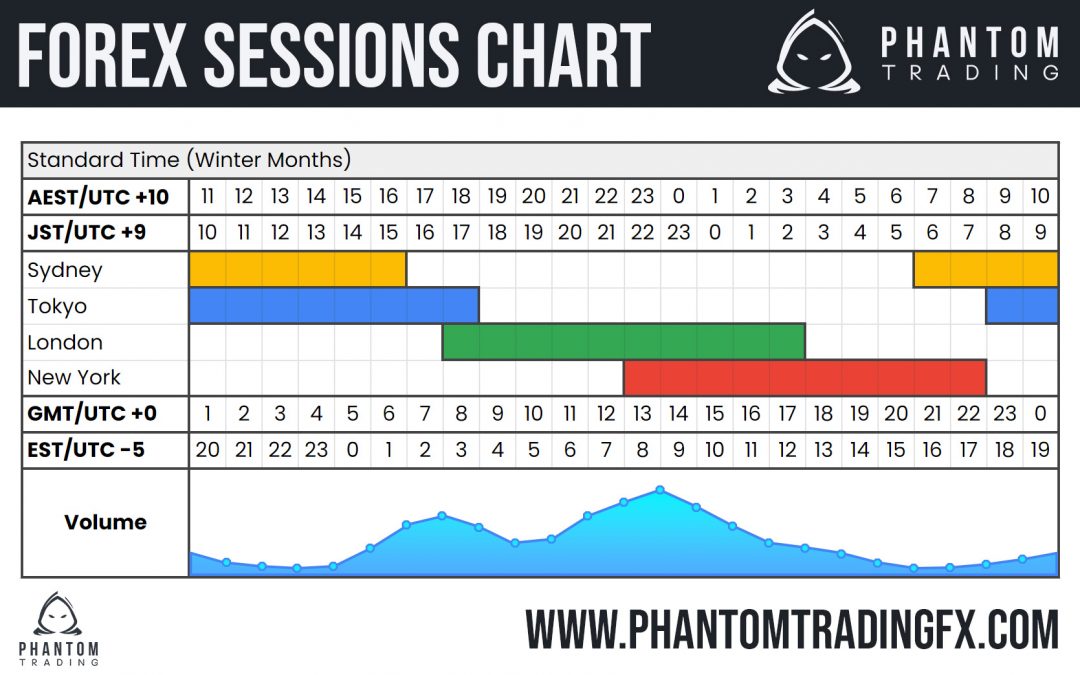

These sessions coincide with the primary trading hours in other major financial centers such as London, New York, and Tokyo, creating ample opportunities for traders to participate in the global Forex market.

Market Activity During Chinese Trading Hours

The Chinese Forex market is known for its high volatility and liquidity during its trading sessions. The morning session tends to be relatively calm, with moderate trading activity. As the afternoon session progresses, volatility increases as major institutions and banks enter the market. The evening session often boasts the highest trading volume, providing traders with ample opportunities for profit.

The Chinese Yuan (CNY) is a major currency pair that traders actively trade against other currencies, including the US Dollar (USD), Euro (EUR), and Japanese Yen (JPY). Understanding market conditions and technical analysis techniques is essential for successful trading during Chinese trading hours.

Tips and Expert Advice

To optimize your Forex trading strategies during Chinese trading hours, consider the following tips:

- Monitor major economic events: Stay informed about news releases and economic data from China that can impact currency values.

- Choose liquid currency pairs: Trade currency pairs with high liquidity, such as USD/CNY or EUR/CNY, to ensure efficient execution of trades.

- Manage risk effectively: Use stop-loss and take-profit orders to limit potential losses and protect your trading account.

By adhering to sound trading principles and leveraging the aforementioned tips, you can enhance your chances of success in the Chinese Forex market.

Image: derivbinary.com

FAQ on Time Zones for Forex Trading in China

Q: What is the time difference between China and London?

A: China (CST) is eight hours ahead of London (UTC).

Q: What is the busiest Forex trading session in China?

A: The evening session (7:00 PM – 9:00 PM CST) generally experiences the highest trading volume.

Q: Can I trade Forex in China during the weekend?

A: No, the Chinese Forex market is closed on weekends.

Time In China Forex Trading Times

Conclusion

Understanding the time zones and market dynamics of Forex trading in China is a fundamental aspect of successful global trading. By leveraging the information provided in this guide and incorporating effective trading strategies, you can unlock the opportunities presented by the Chinese Forex market.

Have you found the information in this article insightful? Join our discussion by sharing your trading experiences and valuable insights in the comment section below.