Embark on a captivating journey through the enigmatic realm of time travel, as we explore the strategies employed within the realm of forex trading on the Multi Commodity Exchange (MCX) of India. Through this exploration, we’ll uncover the secrets of profiting from the fluctuations of currency markets, utilizing the foresight of time travel.

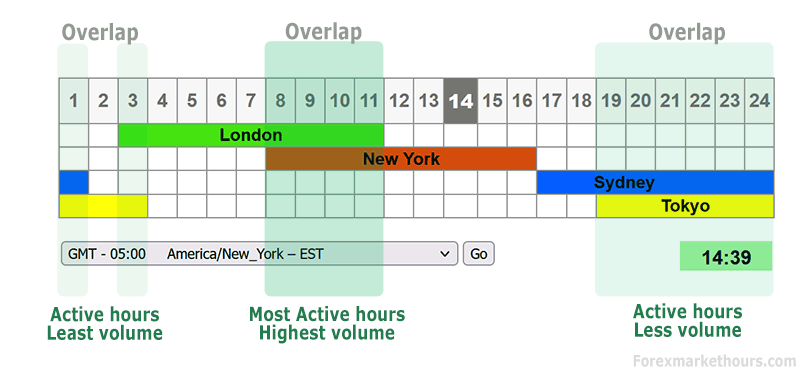

Image: www.forexmarkethours.com

Understanding the MCX and Forex Trading

The MCX is a prominent platform for trading commodities, currencies, and futures contracts. Forex trading, on the other hand, involves the buying and selling of currencies, with traders speculating on fluctuations in their exchange rates. By harnessing the power of time travel, we can gain an edge in both these markets, predicting future price movements and adjusting our trading strategies accordingly.

Time Travel Strategies for the MCX and Forex

Various strategies have been devised to leverage time travel in the MCX and forex markets:

- Trend Following: By analyzing historical price data and identifying prevailing market trends, time travelers can predict future movements and align their trades accordingly.

- Technical Analysis: Utilizing technical indicators like moving averages, support and resistance levels, and candlestick patterns, time travelers can pinpoint potential trading opportunities and set appropriate entry and exit points.

- Fundamental Analysis: This approach involves examining macroeconomic factors like inflation, interest rates, and political events, which may influence currency exchange rates and provide insights into potential price movements.

- Risk Management: Time travelers can mitigate the risks associated with trading by employing stop-loss orders, position sizing, and diversification strategies.

- Emotional Control: Mastering emotions is paramount in forex trading. Time travelers must maintain composure and avoid falling prey to psychological biases that could compromise their trading decisions.

Real-World Application of Time Travel Strategies

Let’s illustrate these strategies with a real-world example. Suppose a time traveler has projected a bullish trend in the EUR/USD currency pair. By purchasing EUR at a lower price in the past and selling it at a higher price in the future, they can capitalize on the price appreciation. This strategy requires not only foresight but also precise execution and risk management skills.

Benefits of Time Traveling Strategies

Time traveling strategies offer numerous advantages:

- Enhanced Accuracy: Predicting future price movements can significantly improve the accuracy of trading decisions.

- Increased Profitability: By taking advantage of favorable market conditions, time travelers can maximize their trading profits.

- Reduced Risk: Armed with knowledge of future price changes, time travelers can minimize losses and preserve their capital.

- Optimized Trading Psychology: Time travel eliminates the emotional rollercoaster of trading, fostering a more rational and objective approach.

Conclusion

Navigating the MCX and forex markets is no longer a game of chance with the aid of time travel strategies. By mastering these techniques and embracing the power of foresight, traders can gain a competitive edge, maximize their profits, and achieve consistent success in the ever-fluctuating financial markets. Remember, time is not just a linear progression; it’s an opportunity to shape our financial destiny with unwavering precision and unwavering confidence.

Image: app.jerawatcinta.com

Time Travele Stratergies At Mcx In Forex Factory