Unlock the Secrets of Forex Currency Timings in India

Image: nurtasapra.blogspot.com

Introduction:

In today’s interconnected global economy, mastering the timings of currency exchange has become crucial for businesses and individuals alike. Forex trading, the vibrant marketplace where currencies are bought and sold, operates around the clock, but certain time zones offer unique advantages. Understanding the timings of forex currency in India can empower you to make informed decisions and maximize your profits.

Forex Market: A Global Tapestry of Currencies

The forex market, a decentralized marketplace where currencies are traded, ranks as the largest financial market globally, surpassing the sheer volume of stocks, bonds, and commodities combined. This perpetual electronic exchange connects traders, banks, corporations, and governments worldwide, enabling them to buy, sell, or trade currencies on an unprecedented scale.

The Indian Forex Market: A Regional Powerhouse

Within the global forex ecosystem, the Indian forex market has emerged as a significant player, owing to the country’s growing economic prowess. Regulated by the Reserve Bank of India (RBI), the Indian forex market plays a pivotal role in facilitating international trade, attracting foreign investment, and managing the value of the Indian Rupee against other major currencies.

Navigating the Forex Market: Timing is Everything

The currencies traded in the forex market are highly volatile, meaning their values can fluctuate significantly over short periods. Savvy traders leverage the timings of forex currency to capitalize on these fluctuations. Different time zones experience peaks and troughs in trading activity, reflecting the unique operating hours of financial institutions and economic centers.

India’s Forex Market Timings: An Optimal Window

The Indian forex market typically operates from Monday to Friday, with trading hours spanning from 9:00 AM to 5:00 PM Indian Standard Time (IST). However, most retail forex traders in India prefer to trade between 10:00 AM and 2:00 PM IST, overlapping with the London session, when liquidity and volatility reach their zenith.

Key Factors Influencing Currency Timings

The timings of forex currency in India are influenced by several key factors:

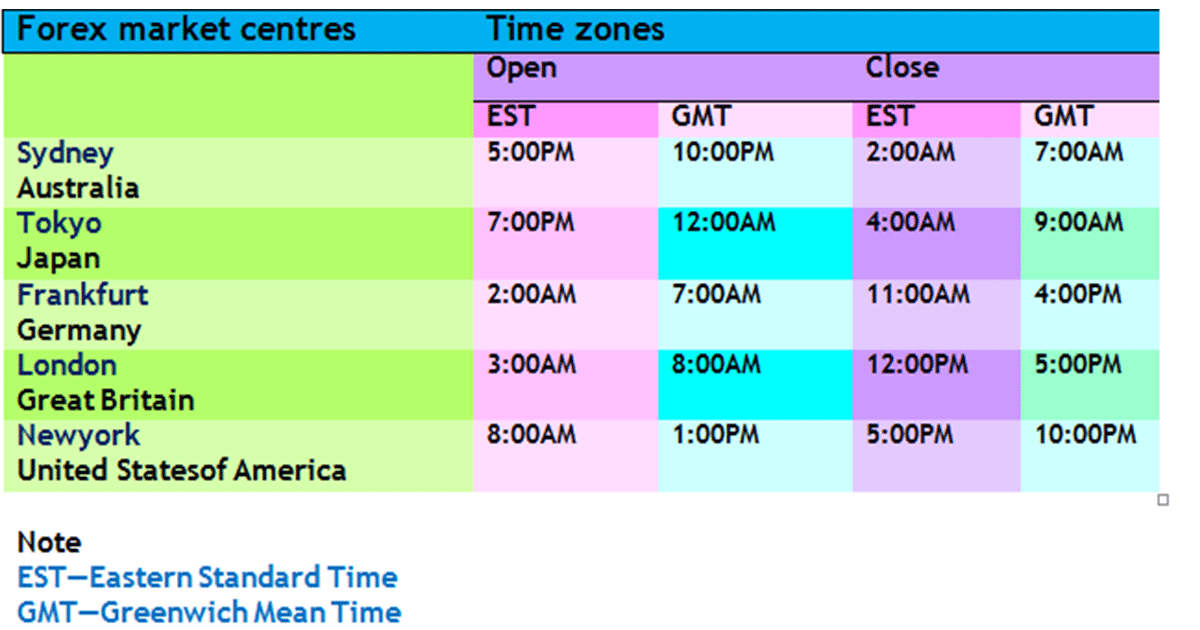

- London Session (07:00 – 15:00 GMT): The London session, the most liquid trading period, sets the tone for the global forex market. Its impact extends to currencies such as the GBP, EUR, and JPY.

- New York Session (13:00 – 21:00 GMT): The New York session, also highly liquid, influences the values of the USD, CAD, and MXN.

- Sydney Session (21:00 – 07:00 GMT): The Sydney session opens the Asian trading day and plays a role in the dynamics of the AUD, NZD, and JPY.

- Tokyo Session (00:00 – 08:00 GMT): The Tokyo session overlaps with the London session’s close and establishes the trading rhythm for the Japanese Yen (JPY).

Choosing the Right Time to Trade

The optimal time to trade forex in India depends on individual trading strategies and the currencies involved. However, certain time periods offer advantages for specific trades:

- High Liquidity (10:00 AM – 12:00 PM IST): This period overlaps with the London and Tokyo sessions, providing ample liquidity and reduced volatility.

- Lower Volatility (2:00 PM – 4:00 PM IST): As the New York session winds down, volatility tends to decrease, allowing traders to execute trades with greater precision.

- News and Events: Breaking news and economic events can significantly impact currency values. Monitoring these events and trading during their announcement times can yield profitable opportunities.

Capturing Market Insights: Expert Perspectives

Industry experts emphasize the importance of understanding forex currency timings in India:

- “The London and New York sessions present prime opportunities for traders in India. These sessions offer unparalleled liquidity and volatility,” says renowned forex analyst, Ms. Anjali Gupta.

- “Leveraging economic calendars that highlight important news and event times can give traders an edge in anticipating market movements,” advises Mr. Rahul Sharma, a seasoned professional trader.

Actionable Tips for Trading Success

Follow these tips to enhance your forex currency trading in India:

- Study the key timings and determine the best time to trade based on your strategy.

- Monitor economic calendars to stay abreast of market-moving events.

- Choose a reliable forex broker that offers competitive spreads and trading platforms.

- Practice risk management techniques to mitigate potential losses.

- Seek professional guidance from experienced traders or financial advisors.

Conclusion:

Mastering the timings of forex currency in India is integral to successful trading. By aligning your trading activities with the optimal windows, you can capitalize on market fluctuations and maximize your returns. Remember, knowledge, patience, and a disciplined approach are the cornerstones of forex trading success.

Image: www.tradingfuel.com

Timings Of All Forex Currency In India