Introduction: Unveiling the Secrets of Forex Success

Embark on an enriching journey through the world of forex trading, where fortunes can be forged and financial acumen honed. Forex, short for foreign exchange, encompasses the buying and selling of currencies, serving as a global marketplace where traders from all corners of the earth converge to capitalize on currency fluctuations. This comprehensive guide is your compass, navigating you through the labyrinthine intricacies of forex trading with expert tips and proven strategies that empower you to optimize your returns and outsmart the market.

Image: networkshamachi.com

Delve into the intricacies of forex, comprehending the fundamental concepts that govern currency valuation and the factors that influence their ebb and flow. By grasping the intricacies of supply and demand, economic indicators, geopolitical events, and central bank policies, you gain a competitive edge, forecasting market trends with greater precision and positioning yourself to seize lucrative opportunities. Harnessing this knowledge, you transform from a novice trader into a seasoned market navigator, adept at exploiting market inefficiencies and turning market volatility to your advantage.

Section 1: Market Analysis – Unraveling the Enigma of Currency Movements

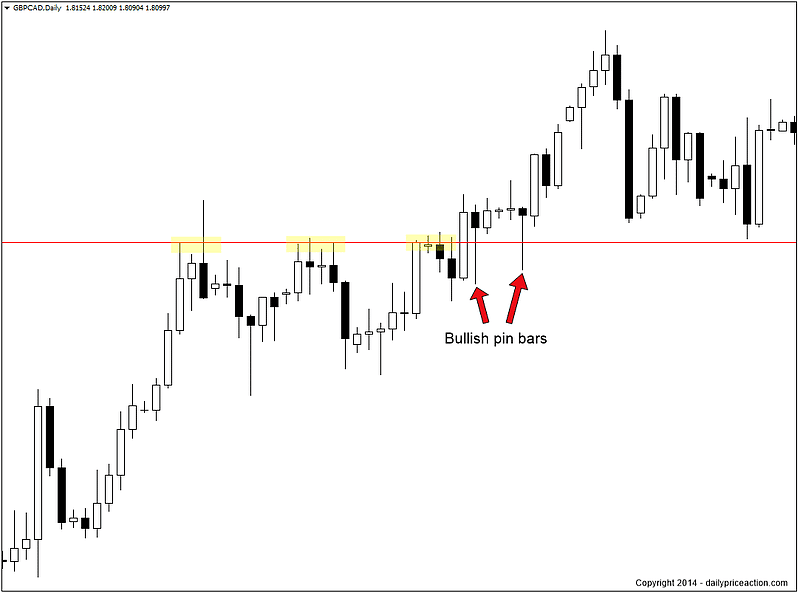

Technical analysis, the art of interpreting historical price data to predict future price movements, is your first line of defense in the tumultuous forex market. Master the art of spotting chart patterns, weaving together trends, support and resistance levels, and applying technical indicators to gain insights into market behavior. By deciphering these intricate price patterns, you illuminate the path ahead, discerning the probable direction of currency pairs and anticipating market reversals before they materialize.

Fundamental analysis, the meticulous study of economic and geopolitical factors that shape currency valuations, complements technical analysis beautifully. By understanding the global economic landscape, you uncover the underlying forces that drive currency fluctuations. Employment figures, interest rate decisions, inflation reports, and political developments all hold sway over currency markets. Armed with this profound knowledge, you can anticipate market reactions, making informed trading decisions rooted in a comprehensive understanding of the market’s underlying dynamics.

Section 2: Risk Management – The Bedrock of Trading Success

In the turbulent seas of forex trading, risk management is your stalwart companion, safeguarding your capital against unforeseen market swings. Employ prudent risk management strategies to limit your exposure and protect your hard-earned profits. Determine your risk tolerance, the amount of potential loss you’re willing to accept, and tailor your trading strategy accordingly. Implement stop-loss orders, risk-reward ratios, and position sizing techniques to mitigate risk and maintain a level of comfort as you navigate the volatile market landscape.

Diversification, the age-old adage of “don’t put all your eggs in one basket,” applies with equal force to forex trading. Spread your trades across multiple currency pairs, asset classes, or even different markets to minimize your exposure to any single event or market downturn. By diversifying your portfolio, you create a more resilient trading strategy, reducing the impact of adverse price movements on your overall returns.

Section 3: Trading Strategies – Unlocking the Gates of Profitability

Forex trading offers a smorgasbord of trading strategies, each with its unique strengths and weaknesses. Scalping, day trading, swing trading, and position trading represent a spectrum of approaches, catering to different risk appetites and time horizons. Explore the nuances of each strategy, understanding the underlying principles and execution techniques. Discover the optimal time frames, entry and exit points, and risk management parameters that align with your trading style and risk tolerance.

Trend trading, a cornerstone of forex trading, involves identifying and capitalizing on prevailing market trends. By riding the waves of market momentum, trend traders aim to capture significant profits as currencies appreciate or depreciate over time. Contrarian trading, on the other hand, challenges conventional wisdom, seeking profits by trading against the prevailing trend. Contrarian traders believe that market sentiment often overshoots, creating opportunities to profit by betting against the crowd.

Image: dailypriceaction.com

Section 4: Psychology of Trading – Mastering the Mind Game

In the high-stakes world of forex trading, psychology plays a pivotal role, often determining the difference between success and failure. Understand the psychological biases and emotional traps that can cloud your judgment and lead to poor trading decisions. Learn to control your emotions, trade with discipline, and avoid the perils of overconfidence or fear. By mastering the psychology of trading, you gain a significant advantage, making rational decisions based on sound analysis rather than impulsive reactions.

Develop a robust trading plan, outlining your trading strategy, risk management rules, and psychological triggers. By adhering to your trading plan with unwavering discipline, you inject structure and consistency into your trading routine, reducing the likelihood of impulsive decisions driven by fear or greed. Maintaining a trading journal, meticulously documenting your trades, helps you identify patterns, evaluate your performance, and continuously refine your trading approach, fostering a path toward sustained profitability.

Tips And Tricks In Forex Trading

Conclusion: Embracing the Path to Forex Trading Mastery

Forex trading, a captivating blend of art and science, empowers you to reap the rewards of currency fluctuations and achieve financial independence. By mastering technical and fundamental analysis, implementing prudent risk management strategies, exploring diverse trading strategies, and honing your trading psychology, you equip yourself with the tools to navigate the turbulent forex market with confidence and finesse.

Embrace this guide as your constant companion, referring to it often as you embark on your forex trading journey. Seek knowledge, stay abreast of market trends, and continually refine your skills. Forex trading is a marathon, not a sprint, and consistent effort coupled with unwavering determination will propel you toward your financial aspirations.