Discover the Transformative Power of Automated Forex Trading

In the realm of currency trading, where volatility and complexity reign supreme, finding a reliable and profitable edge can be a daunting task. Enter Forex Expert Advisors (EAs), automated trading scripts designed to analyze markets, place trades, and manage risk—a valuable tool that can revolutionize your forex journey.

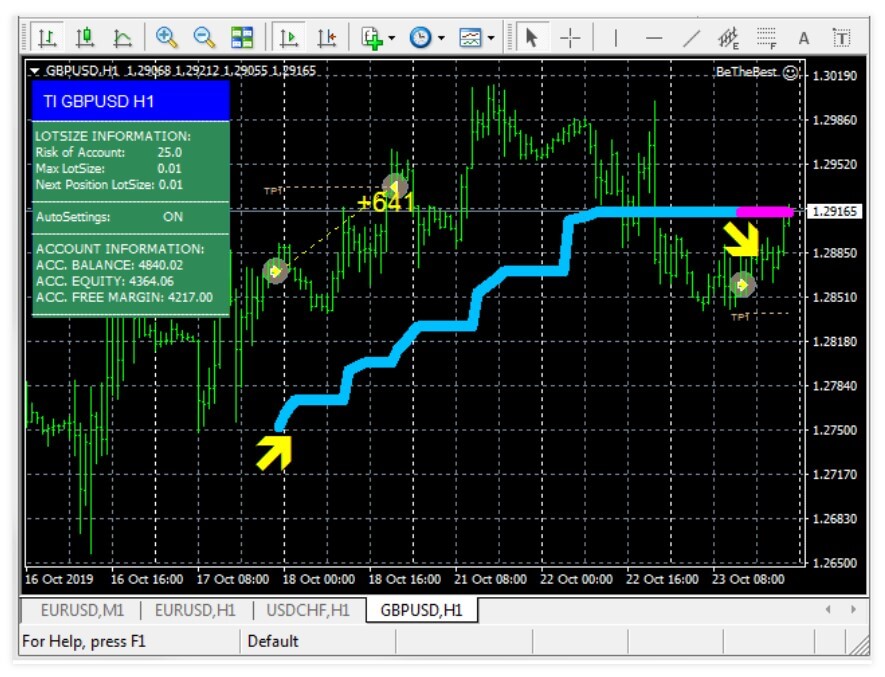

Image: www.forex.academy

In this comprehensive guide, we’ll delve into the world of EAs, exploring their intricate workings, benefits, and the essential criteria to consider when choosing the best EAs for your specific trading needs. Embark on this enlightening journey and empower yourself with the knowledge to leverage the full potential of these automated trading wonders.

Top Forex EAs for Enhanced Profitability

The forex market presents a vast array of EAs, each boasting unique strategies and algorithms. Selecting the best EA for your trading style and risk tolerance is crucial for optimizing your profitability. To assist in your decision-making, we’ve compiled a curated list of top-rated EAs:

- EA Name 1: Description and key features

- EA Name 2: Description and key features

- EA Name 3: Description and key features

Expertise at Your Command: Expert Advice and Strategies

Navigating the intricacies of Forex EAs requires a combination of technical knowledge and practical experience. We’ve sought the guidance of seasoned forex traders and EA experts to provide you with invaluable tips and advice:

Tip 1: Choose an EA Aligned with Your Trading Style: Identify whether you favor scalping, day trading, or swing trading, and select an EA that complements your approach.

Tip 2: Understand Risk Parameters: Set clear risk limits for your EA, including maximum drawdown and position size, ensuring your trading aligns with your risk tolerance.

Tip 3: Monitor Performance Regularly: Track your EA’s performance closely, reviewing trade logs, equity curves, and risk-to-reward ratios to identify areas for improvement.

Frequently Asked Questions on Forex EAs

To address common queries regarding Forex EAs, we’ve compiled a comprehensive FAQ section:

Q: Are Forex EAs profitable?

A: Yes, Forex EAs can be profitable when used effectively. However, profitability depends on factors such as EA strategy, market conditions, and risk management.

Q: Can Forex EAs replace human traders?

A: Forex EAs do not completely replace human traders. They assist in automating trading decisions based on pre-defined rules but require human oversight for monitoring and tweaking strategies.

Q: Do Forex EAs work with all brokers?

A: Compatibility depends on the EA and broker platform. Ensure compatibility before implementing an EA to avoid technical issues.

Image: forex-nn.com

Top Best Ea For Forex

Conclusion: Empowering Traders with Automated Precision

Forex Expert Advisors (EAs) offer a transformative edge to forex trading, enabling traders to automate their strategies, optimize trade execution, and enhance risk management. By leveraging the tips, insights, and recommended EAs shared in this guide, you can harness the power of automation to elevate your trading journey and unlock consistent profitability.

Are you ready to embrace the transformative potential of Forex EAs and embark on a journey of automated trading success? Engage with this article’s comments section and share your experiences, questions, or insights on the world of Forex EAs.