In the intricate labyrinth of financial markets, astute investors relentlessly seek opportunities to increase their wealth. Amidst this competitive landscape, arbitrage stands forth as a formidable strategy, providing traders with the means to capitalize upon price discrepancies across disparate markets. Enter the realm of forex, where currencies dance in a symphony of exchange rates, and arbitrage emerges as a potent force. Discover the multifaceted nature of arbitrage in the forex market and harness its power to amplify your trading profits.

Image: fxtrendo.com

A Primer on Arbitrage: Navigating Market Inefficiencies

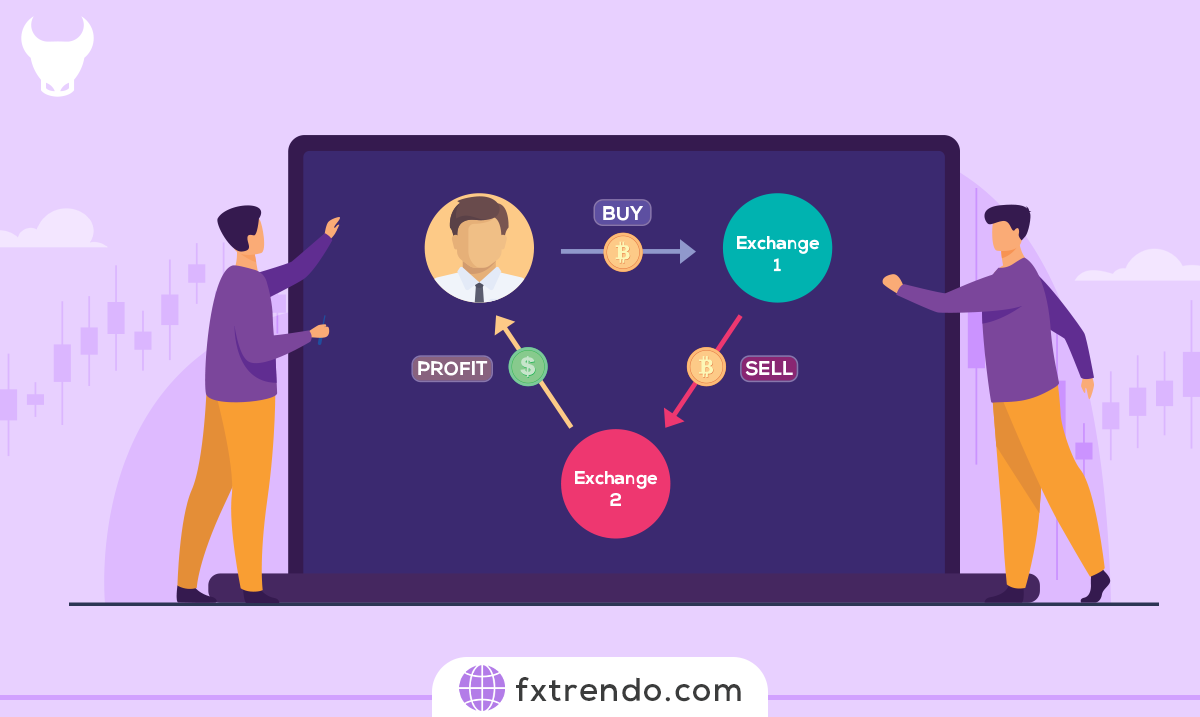

Arbitrage, derived from the Latin term “arbitrum,” meaning “third party,” hinges upon the astute identification of price differentials. Traders seize upon discrepancies between identical assets traded simultaneously on distinct platforms or exchanges. By exploiting these disparities, investors execute simultaneous transactions, effectively locking in risk-free profits. The allure of arbitrage lies in its ability to capitalize upon inefficiencies within the market, ensuring profitability irrespective of broader market fluctuations.

Types of Arbitrage: Mastering the Spectrum of Opportunities

The world of forex arbitrage holds a kaleidoscope of opportunities, each tailored to specific market conditions and trader preferences. Delve into the diverse spectrum of arbitrage techniques, ranging from simple to complex, unlocking the full potential of this lucrative strategy:

1. Closed Arbitrage: Unlocking Risk-Free Profits

Closed arbitrage, the epitome of risk-free trading, involves simultaneous transactions of the same asset across different markets, exploiting minor price differentials. Transactions are completed expeditiously, minimizing the risk of price fluctuations.

Image: www.forexgdp.com

2. Simple Arbitrage: Capitalizing on Currency Pair Mispricings

Simple arbitrage targets currency pairs with mispriced exchange rates across distinct platforms. By buying the undervalued currency on the cheaper exchange and simultaneously selling it on the pricier exchange, traders capture the profit differential.

3. Carry Trade Arbitrage: Marrying Currency Swaps with Interest Rates

Carry trade arbitrage capitalizes upon discrepancies between interest rates on currency pairs. Traders borrow a currency with a low interest rate, purchasing a currency with a higher interest rate. The interest rate differential yields a consistent profit stream, subject to fluctuations in the exchange rate.

4. Cross-Market Arbitrage: Bridging Geographical Differences

Cross-market arbitrage involves exploiting price disparities between currencies on different exchanges located in geographically distinct regions. Capitalizing upon time zone differences and exchange regulations, traders execute simultaneous transactions, pocketing the profit differential.

5. Statistical Arbitrage: Unleashing Machine Learning for Profit Mining

Statistical arbitrage leverages sophisticated mathematical models and machine learning algorithms to identify trading opportunities based on historical price patterns and statistical anomalies. This advanced technique requires a deep understanding of data analysis and statistical modeling.

Mastering the Nuances: The Art of Successful Arbitrage

Navigating the complexities of forex arbitrage demands a comprehensive understanding of market intricacies. Here are some invaluable tips to enhance your arbitrage strategy:

-

Preemptive Preparation: Lay the groundwork for success by diligently studying currency pairings, spread analysis, and market conditions. This meticulous preparation ensures you’re well-equipped to seize opportunities swiftly.

-

Speed and Execution: Arbitrage thrives on lightning-fast execution. Leverage advanced trading platforms and technologies to initiate and complete transactions instantaneously, capitalizing upon fleeting price discrepancies.

-

Risk Management Precaution: Despite the inherent low-risk nature of arbitrage, prudent risk management remains paramount. Implement robust risk management protocols to safeguard your capital against unforeseen market fluctuations.

-

Market Intelligence and Surveillance: Vigilantly monitor market movements and stay abreast of global economic and political events that may influence currency valuations. Continuous market intelligence empowers you with the agility to adapt your strategies accordingly.

-

Finding the Ideal Broker: Choose a forex broker that provides competitive spreads, swift execution, and a platform tailored to arbitrage traders’ unique needs. A reliable and capable broker forms the backbone of successful arbitrage endeavors.

The Future of Arbitrage: Unlocking Untapped Opportunities

The future of forex arbitrage holds immense promise, with the advent of advanced technologies and evolving market dynamics creating a fertile ground for innovation. Here’s a glimpse into the exciting developments reshaping the arbitrage landscape:

Quantum Computing: The dawn of quantum computing heralds the potential for lightning-fast arbitrage transactions, enabling traders to seize opportunities that may otherwise be missed.

Artificial Intelligence: AI-powered trading algorithms are poised to revolutionize arbitrage by automating trade execution, risk management, and pattern recognition, enhancing efficiency and profitability.

Blockchain Integration: Blockchain technology introduces immutable and transparent record-keeping, simplifying the verification and settlement of arbitrage transactions, fostering confidence among market participants.

RegTech for Compliance: RegTech solutions streamline regulatory compliance, enabling arbitrage traders to navigate the complexities of global financial regulations, ensuring adherence to ethical and legal standards.

Types Of Arbitrage In Forex Market

Unlocking the Power of Arbitrage: Conclusion

Arbitrage, a cornerstone of the forex market, offers traders the means to amplify their profits by capitalizing upon price discrepancies. Through its various forms, from simple arbitrage to advanced statistical modeling, arbitrage empowers investors to navigate market inefficiencies, generating consistent returns irrespective of broader market fluctuations.

By embracing the principles of arbitrage, mastering its nuances, and staying abreast of emerging technologies, you’ll ascend the ranks of successful traders. May the power of arbitrage fuel your financial success, paving the way for a profitable journey amidst the dynamic tides of the forex market.