In today’s interconnected world, traversing borders for business or leisure is more common than ever. Navigating foreign currencies can become a hassle, incurring hefty exchange fees and hidden charges. Enter the UK multi-currency forex card, a revolutionary financial solution that eliminates these obstacles and empowers you with financial freedom worldwide.

Image: www.indusind.com

A UK multi-currency forex card is a prepaid card that allows you to store and transact in multiple currencies, akin to a financial passport. It connects to a multi-currency account, enabling you to make payments in various countries while avoiding the pitfalls of traditional methods like cash or credit cards. By utilizing wholesale exchange rates and eliminating exorbitant transaction fees, these cards offer significant savings and convenience, transforming your international financial experience.

Benefits of UK Multi-Currency Forex Cards

1. Avoidance of Dynamic Currency Conversion:

Dynamic currency conversion, or DCC, is a sneaky practice employed by merchants to exchange currencies on your behalf, charging exorbitant conversion rates. Multi-currency forex cards bypass DCC, ensuring you always receive the most favorable exchange rates.

2. Exclusion of Cash Withdrawal Fees:

Withdrawing money from ATMs abroad incurs hefty charges with conventional methods. Multi-currency forex cards offer fee-free or significantly reduced cash withdrawals, allowing you to access your funds easily and affordably.

3. Access to Interbank Exchange Rates:

Multi-currency forex cards grant access to wholesale interbank exchange rates, typically reserved for large financial institutions. This advantage saves you money on every transaction, minimizing the impact of currency fluctuations.

4. Real-Time Transaction Tracking:

Most multi-currency forex cards come with online or mobile apps that provide real-time transaction tracking. Monitor your spending, track your balances, and manage your account effortlessly from anywhere, enhancing financial transparency.

How to Choose the Best UK Multi-Currency Forex Card

Choosing the optimal UK multi-currency forex card depends on your individual needs. Consider these factors:

- Currency Compatibility: Ensure the card supports the currencies you will use.

- Fees and Exchange Rates: Compare fees and exchange rates between different providers to maximize savings.

- Transaction Limits: Be aware of daily or monthly transaction limits to avoid potential restrictions.

- Security Features: Choose a card with robust security features like chip and PIN protection and fraud monitoring.

- Customer Support: Consider the availability and responsiveness of customer support in case of queries or emergencies.

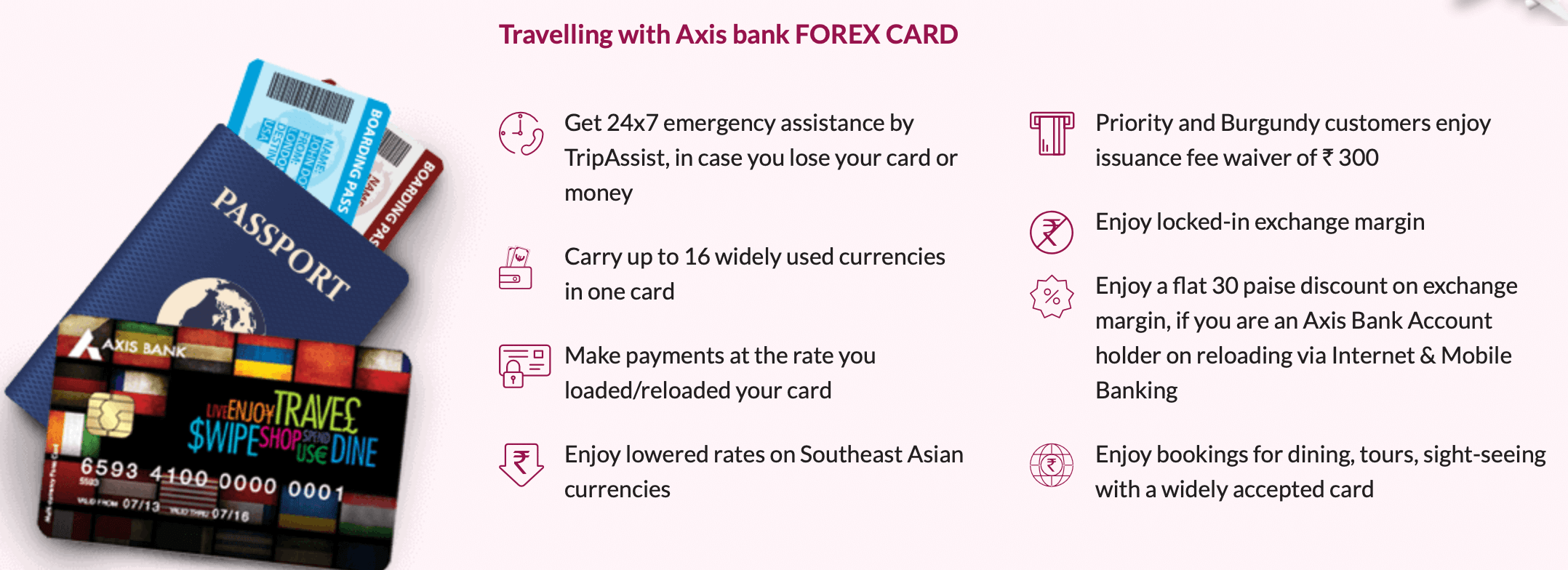

Image: windsorwhock2002.blogspot.com

Uk Multi Currency Forex Card

Conclusion

A UK multi-currency forex card is an indispensable tool for savvy travelers and global citizens. By minimizing currency exchange fees, eliminating hidden charges, and providing real-time transaction tracking, these cards empower you with financial freedom and peace of mind. Embrace the convenience and cost-effectiveness of multi-currency forex cards, unlock the world’s currencies, and elevate your international financial experience.