Welcome to our in-depth analysis of the USD/CAD currency pair. Forex traders, buckle up for a comprehensive exploration of the latest news, trends, and expert insights shaping the USD/CAD market.

Image: www.exchangerates.org.uk

USD/CAD: A Brief Overview

The USD/CAD exchange rate gauges the value of the United States dollar (USD) versus the Canadian dollar (CAD). This currency pair is heavily influenced by factors such as economic data, interest rates, and political events that impact both countries. The USD/CAD is known for its relatively low volatility compared to other major currency pairs.

Understanding the USD/CAD Fundamentals

The USD/CAD exchange rate is primarily driven by the economic strength of the United States and Canada. Favorable interest rate differentials, strong economic data, and a stable political climate in the US generally strengthen the USD against the CAD. Conversely, when the Canadian economy outperforms the US economy or global markets grow pessimistic, the CAD gains ground against the USD.

Current Market Dynamics and Outlook

The recent USD/CAD trend has been characterized by sideways movement within a narrow range between 1.25 and 1.30. The lack of clear market direction can be attributed to several factors, including:

- Uncertainty surrounding the pace of interest rate hikes by the US Federal Reserve and the Bank of Canada

- Economic headwinds related to the COVID-19 pandemic

- Geopolitical risks, such as the ongoing conflict in Ukraine

- Resistance: 1.30

- Support: 1.25

In the short term, the USD/CAD is likely to remain rangebound. However, a breakout above 1.30 or below 1.25 could signal a sustained trend reversal.

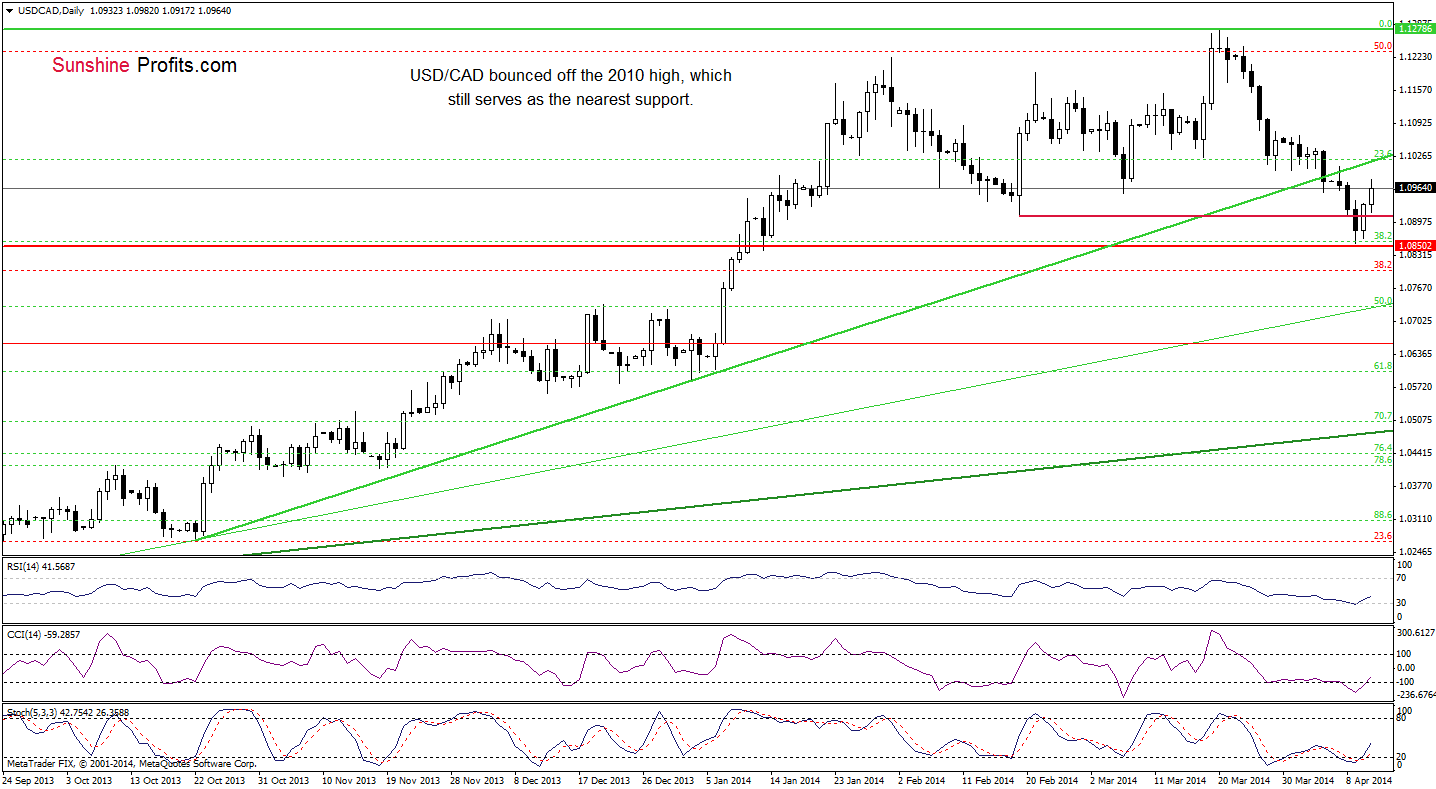

Image: www.sunshineprofits.com

Technical Analysis of USD/CAD

From a technical standpoint, the USD/CAD has been consolidating above its 200-day moving average, indicating potential support at current levels. Key technical levels to watch include:

Traders may consider long positions if the USD/CAD breaks above 1.30 with volume, targeting potential resistance at 1.32 and 1.35. Alternatively, short positions can be considered if the pair breaks below 1.25 with volume, with potential targets at 1.23 and 1.20.

Expert Advice and Tips for Traders

Diversify your portfolio: Spread your trading capital across various currency pairs to mitigate risk and enhance returns.

Manage your risk: Implement stop-loss and take-profit orders to limit potential losses and secure profits.

Stay updated with market news: Regularly monitor economic data, central bank announcements, and political developments to stay informed and make informed trading decisions.

Frequently Asked Questions on USD/CAD Trading

Q: What is the current USD/CAD exchange rate?

A: As of writing, the USD/CAD exchange rate is trading around 1.28.

Q: What is the long-term forecast for the USD/CAD?

A: The USD/CAD is expected to trend towards 1.30 in the long term as the US economy recovers from the pandemic.

Q: How do I trade the USD/CAD?

A: Traders can trade the USD/CAD using various methods, including spot market trading, futures contracts, and options.

Usd Cad Forecast Forex News

Conclusion

The USD/CAD currency pair offers opportunities for traders seeking both short-term and long-term gains. By staying abreast of market trends, following expert advice, and managing risk, you can position yourself for success in the USD/CAD market.

So, are you ready to embark on a profitable trading journey with the USD/CAD? Join us in the vibrant world of forex trading and start exploring the USD/CAD market today!