Introduction:

Image: www.jotform.com

In today’s fast-paced digital landscape, seamless and secure online payments are essential. Enter Skrill, a globally renowned e-wallet platform that has revolutionized the way we transact funds online. Whether you’re a savvy shopper, an e-commerce entrepreneur, or a freelancer seeking cross-border payments, Skrill offers a comprehensive solution to meet your financial needs.

This comprehensive guide delves into the multifaceted world of Skrill accounts, exploring their genesis, functionality, and the myriad benefits they offer. Get ready to unlock a world of financial freedom and convenience as we embark on this journey of discovery.

What is a Skrill Account?

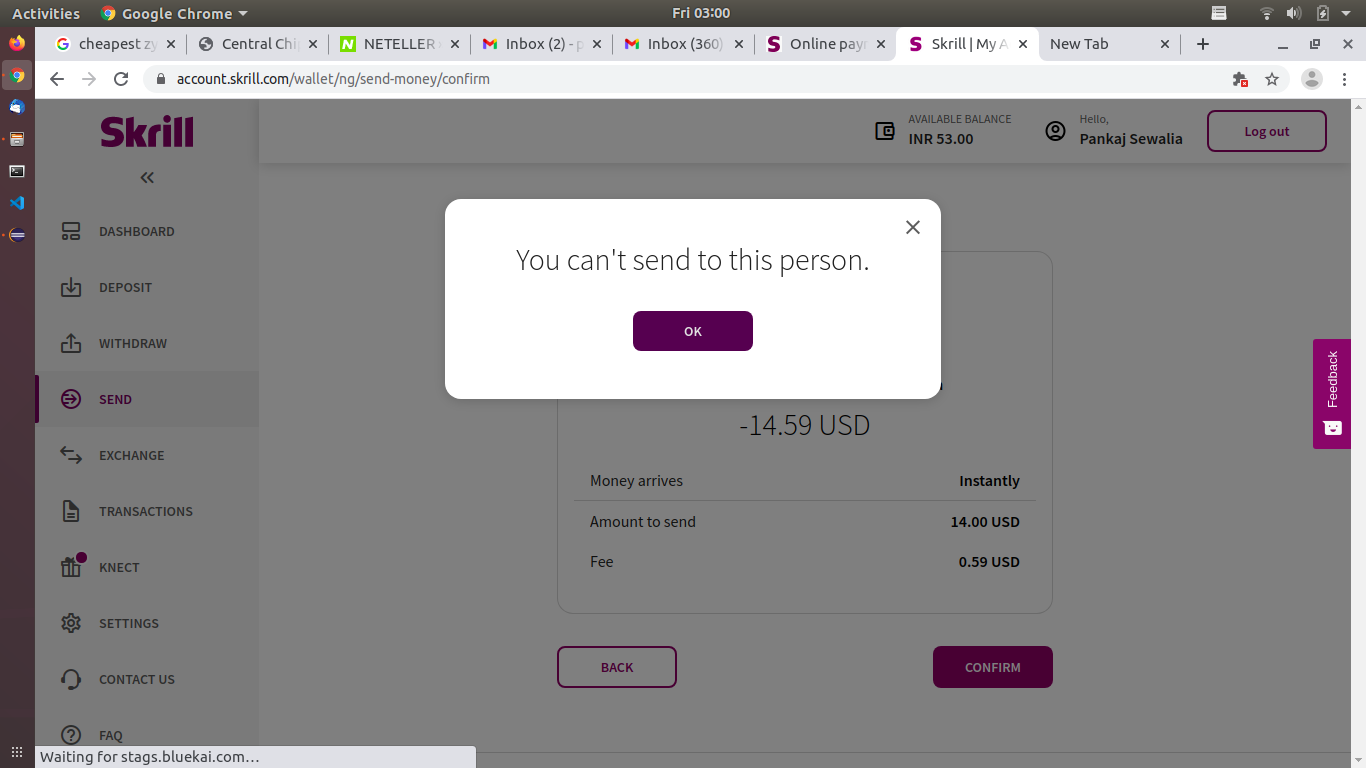

A Skrill account is a secure, online financial hub that allows you to send, receive, and store funds instantly and securely. It’s like having your own digital bank account, but with the added flexibility of managing your money from anywhere in the world, anytime you need to. Whether you’re making purchases online, transferring money to friends or family, or receiving payments for goods or services, Skrill streamlines the process with its user-friendly interface and robust security features.

Versatile Functionality: A Multitude of Applications

The applications of a Skrill account are as diverse as the financial needs of its users. Here’s a glimpse into its versatility:

-

E-commerce Payments Made Easy:** Skrill is a preferred payment gateway for countless online merchants, making it a seamless option for your online shopping endeavors. Say goodbye to cumbersome checkout processes and embrace the convenience of swift, secure transactions.

-

Effortless Money Transfers:** Sending money to friends, family, or business associates both domestically and internationally is a breeze with Skrill. Its fast transfer times and competitive exchange rates will save you time and money.

-

Freelance Payments Simplified:** Freelancers and remote workers can bid farewell to payment delays and embrace a streamlined income system. Skrill enables you to receive payments from clients worldwide, simplifying your financial management.

-

User-friendly Mobile App:** Manage your finances on the go with Skrill’s intuitive mobile app. Send and receive payments, view account balances, and stay in control wherever you are.

-

Additional Features:** Skrill also offers additional features such as currency conversion, a prepaid Mastercard, and cryptocurrency trading, enhancing its functionality as a comprehensive financial tool.

Unveiling the Benefits: Why Choose Skrill?

Skrill doesn’t just provide an e-wallet; it offers a suite of benefits that empower users in multiple ways:

-

Lightning-fast Transactions:** Experience instant transfers, both domestically and internationally, without the agonizing wait times associated with traditional banking systems.

-

Bulletproof Security:** Skrill utilizes cutting-edge encryption technology and adheres to stringent security measures to keep your funds and personal data safeguarded.

-

Competitive Fees:** Skrill’s competitive fees ensure that you can transact more while keeping more of your hard-earned money in your pocket.

-

Global Reach:** Skrill’s global presence enables you to transact in over 40 currencies, connecting you with a worldwide marketplace.

-

Unmatched Convenience:** Manage your finances anytime, anywhere, from your laptop, smartphone, or tablet. Skrill goes where you go, offering unparalleled flexibility.

Image: fxpedia.info

Historical Origins: Tracing Skrill’s Journey

Skrill’s journey commenced in 2001 as Moneybookers, a humble e-wallet service. Over the years, through strategic acquisitions and continuous innovation, it evolved into the global financial powerhouse we know today, rebranding as Skrill in 2011. Today, Skrill, owned by the Paysafe Group, serves millions of users worldwide, empowering them to navigate the digital financial landscape.

What Is Skrill Account

Conclusion: Embracing Financial Empowerment

In conclusion, a Skrill account is an indispensable tool for anyone seeking financial freedom and seamless online transactions. Its versatility, coupled with its robust security features and competitive fees, makes it an attractive option for individuals and businesses alike. Whether you’re a seasoned e-commerce shopper, a freelance professional, or an entrepreneur seeking to expand your global reach, a Skrill account is the key to unlocking a world of financial empowerment. Join the millions of satisfied users who have embraced Skrill and experience the transformative power of digital payments.