In the vibrant tapestry of global financial markets, where fortunes are made and dreams take flight, the Nikkei Index stands as a towering beacon of economic growth and prosperity. For investors, analysts, and business leaders alike, understanding the nuances of this influential index is paramount to navigating the complexities of investing in Japan and beyond.

Image: atelier-yuwa.ciao.jp

What is the Nikkei Index?

The Nikkei Index, also known as the Nikkei 225, is a stock market index that comprises the 225 most actively traded large-capitalization companies on the Tokyo Stock Exchange’s First Section. Established in 1950, it has become an indispensable barometer of the Japanese economy, reflecting the overall health and performance of the nation’s leading corporations.

History and Significance

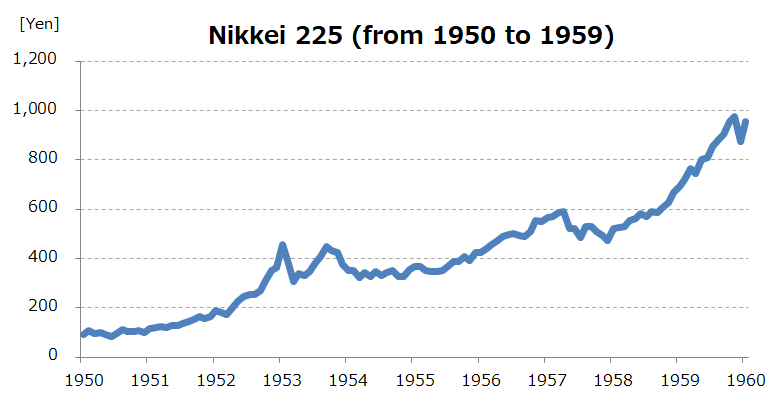

The origins of the Nikkei Index can be traced back to 1949, when the Nihon Keizai Shimbun (Nikkei) newspaper introduced a predecessor index known as the Dow Jones Industrial Average of Japan. In 1950, the index was reconfigured to include 225 companies and was renamed the Nikkei 225.

Since its inception, the Nikkei Index has witnessed extraordinary growth and become a symbol of Japan’s economic prowess. Its components span a wide range of industries, including electronics, automotive manufacturing, finance, consumer staples, and healthcare, providing a comprehensive representation of the nation’s diverse economy.

Measuring Economic Performance

As a barometer of the Japanese economy, the Nikkei Index offers invaluable insights into the country’s financial health, business climate, and growth prospects. When the index rises, it signifies increased investor confidence, economic activity, and corporate profitability. Conversely, a decline in the index can indicate economic challenges, market downturns, and reduced market sentiment.

Image: nkbb.nikkei.co.jp

Impact on Global Economy

The Nikkei Index has a significant influence not only on the Japanese economy but also on the global financial landscape. As a major market index, its movements can impact currency fluctuations, commodity prices, and investment decisions around the world.

Understanding Volatility

One of the salient characteristics of the Nikkei Index is its volatility, which means it is subject to price fluctuations. These fluctuations can be influenced by various factors, including economic data releases, central bank announcements, macroeconomic trends, and geopolitical events.

For investors, tracking the Nikkei Index’s volatility is crucial to managing risk and making informed investment decisions.

Diversification

The Nikkei Index provides investors with a compelling option for diversification in their investment portfolios. By investing in a single index fund or exchange-traded fund (ETF) that tracks the Nikkei Index, investors can gain exposure to the entire Japanese stock market.

Diversification helps spread risk across a broad portfolio, reducing the impact of potential losses from any single company or sector.

Challenges and Opportunities

While the Nikkei Index offers numerous benefits, it is not immune to challenges. Japan’s aging population, demographic shifts, and geopolitical uncertainties pose potential risks to the index’s long-term growth prospects.

However, these challenges also present opportunities. The Japanese government and businesses are actively working to address these challenges through economic reforms, technological advancements, and innovative solutions.

What Is The Nikkei Index

Conclusion

The Nikkei Index serves as a vital metric for understanding the economic pulse of Japan. Its historic trajectory and global significance make it an indispensable tool for investors, businesses, and individuals seeking to navigate the complexities of the financial markets.

By embracing the insights gleaned from the Nikkei Index, we can unlock the potential for informed decision-making, intelligent investment strategies, and economic growth on both a domestic and global scale.