Introduction: The Golden Ratio’s Hidden Influence

Imagine embarking on a financial journey where you uncover the secrets of a time-honored trading tool that has guided traders for centuries. Embark on this exploration, and you will encounter the Fibonacci retracement, a remarkable concept rooted in the captivating Fibonacci sequence. Join me as I unveil the mysteries of Fibonacci retracement, empowering you to harness its formidable power for trading success.

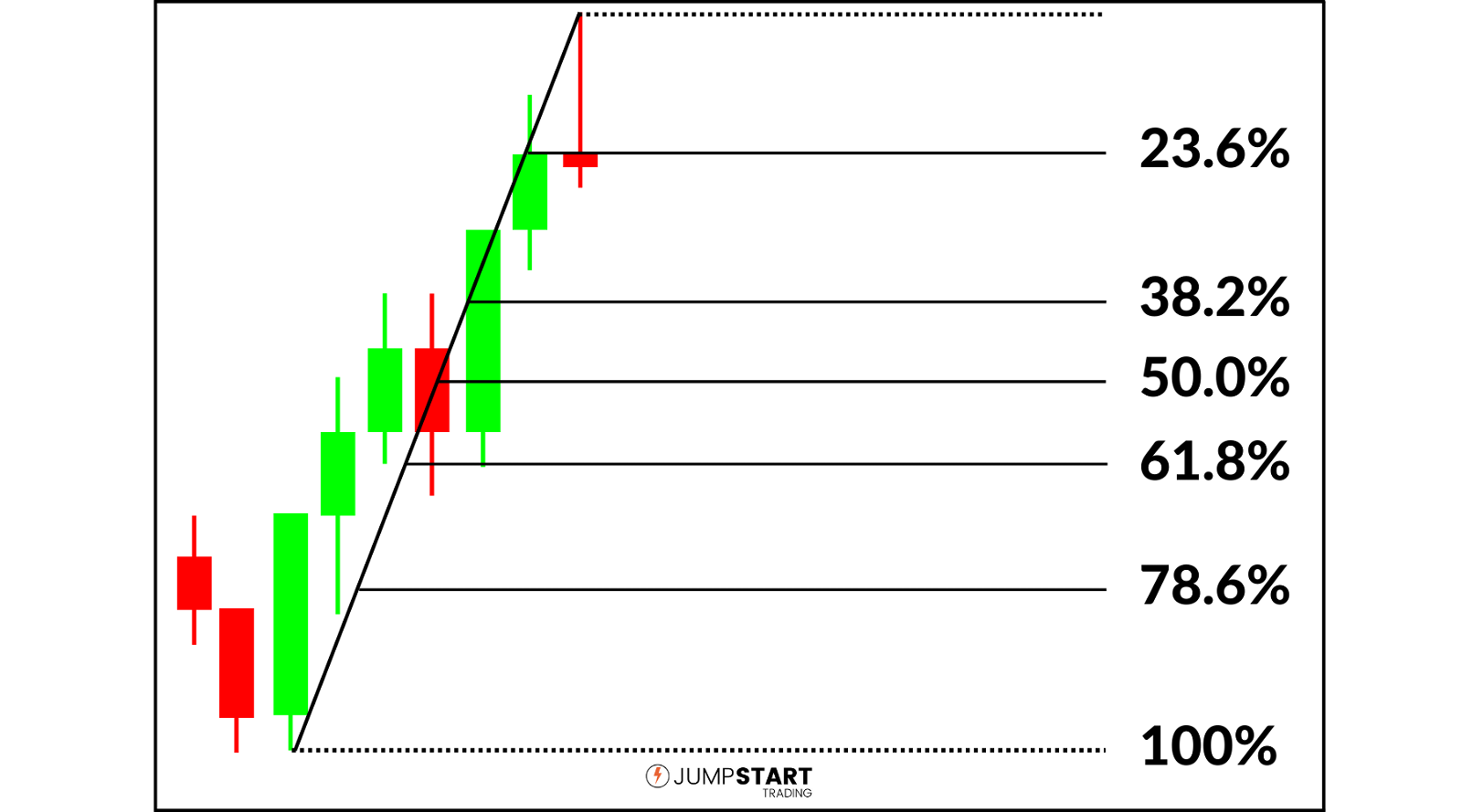

Image: www.jumpstarttrading.com

The Fibonacci sequence, a captivating string of numbers, emerges naturally in diverse realms of nature and our world. From the spiral patterns of galaxies to the arrangement of leaves on a stem, the Fibonacci sequence manifests its presence throughout creation. Within the financial markets, this sequence finds profound application in the form of Fibonacci retracement, a tool that has profoundly impacted traders’ decisions for generations.

Decoding Fibonacci Retracement: A Geometrical Masterpiece

Understanding the Fundamentals

Fibonacci retracement stems from the idea that after a significant price move, the markets tend to retrace a specific percentage of that move before continuing in the original direction. These retracement levels are calculated using the Fibonacci ratios, which are derived from the Fibonacci sequence: 23.6%, 38.2%, 50%, 61.8%, and 76.4%. These levels represent potential support and resistance zones where price action may encounter obstacles or find impetus for further movement.

History and Significance

The concept of Fibonacci retracement dates back to the 13th century when Italian mathematician Leonardo Fibonacci introduced the Fibonacci sequence in his famous work, “Liber Abaci.” Since then, this mathematical concept has gained widespread acceptance and application in the financial markets. Over the years, traders have discovered the remarkable ability of Fibonacci retracement to identify potential price reversal points and forecast market behavior.

Image: www.protradingschool.com

Practical Application: Harnessing Fibonacci Retracement for Trading

Trend Identification: Unveiling the Underlying Market Direction

One key application of Fibonacci retracement lies in identifying the dominant trend in the market. By plotting Fibonacci retracement levels on a price chart, traders can gauge the extent of a pullback or rally within the larger trend. If the market bounces off a Fibonacci retracement level, it often signals a continuation of the underlying trend. Conversely, a breakout through a retracement level may indicate a potential trend reversal.

Support and Resistance Identification: Pinpointing Price Action Pivots

Fibonacci retracement levels serve as crucial support and resistance levels in the market. Support levels indicate areas where buyers may step in to prevent further price declines, while resistance levels represent zones where sellers may exert pressure to halt price advances. Traders can use Fibonacci retracement to anticipate potential price reactions at these critical levels.

Target Setting: Estimating Optimal Profit Zones

Fibonacci retracement can aid traders in setting realistic profit targets. After identifying a potential trading opportunity, traders can use Fibonacci retracement levels to determine potential profit zones. For example, if a trader buys a stock at a Fibonacci retracement level of 38.2%, they may consider taking profits at a target of 61.8%.

Expert Insights: Enhancing Your Trading Strategy

Timely Execution: Capitalizing on Price Action

For effective Fibonacci retracement trading, timing is of the essence. Traders should monitor price action closely and enter trades only when the market exhibits clear signals of a reversal or breakout at Fibonacci retracement levels. Waiting for confirmation before executing trades helps reduce risk and improves the likelihood of success.

Risk Management: Safeguarding Your Trading Capital

Risk management is paramount in Fibonacci retracement trading. Traders should always establish clear stop-loss levels to minimize potential losses. Stop-loss orders should be placed below (for long positions) or above (for short positions) critical support or resistance levels, ensuring the trade is closed automatically if the market moves against the trader’s expectations. Additionally, traders should adhere to sound position sizing principles to avoid excessive risk exposure.

Frequently Asked Questions: Demystifying Fibonacci Retracement

Q: How do I calculate Fibonacci retracement levels?

A: Fibonacci retracement levels are calculated based on the Fibonacci ratios (23.6%, 38.2%, 50%, 61.8%, and 76.4%). To calculate these levels, you need to identify a significant price move and apply the ratios to determine the potential retracement zones.

Q: Is Fibonacci retracement a reliable trading tool?

A: While Fibonacci retracement is a widely used trading tool, it is not foolproof. It should be combined with other technical analysis techniques to improve trading decisions. Additionally, traders should exercise caution when using Fibonacci retracement during volatile market conditions.

Q: What are some common mistakes to avoid when using Fibonacci retracement?

A: Common mistakes to avoid include overfitting (adding too many Fibonacci retracement levels to a chart), trading against the trend, and ignoring other technical indicators. Traders should also be aware of the potential for false signals and should always manage their risk accordingly.

How To Use Fib Retracement

Conclusion: Embracing the Power of Fibonacci Retracement

As you delve into the world of Fibonacci retracement, you will discover a time-tested tool that has empowered traders for generations. By understanding the principles of Fibonacci retracement, you can gain insights into market behavior, identify potential trading opportunities, and enhance your trading strategy. Embrace the wisdom of the Fibonacci sequence and unlock the gateway to trading profits.

Join the ranks of successful traders who have harnessed the power of Fibonacci retracement. Are you ready to embark on this transformative journey and unlock the secrets of market mastery?