Trading in South Africa presents an ocean of opportunities for investors seeking financial success. For those eager to ride the waves of economic growth, understanding the best time to trade is an invaluable skill. In this comprehensive guide, we’ll navigate the intricacies of South African trading, revealing the optimal conditions for maximum gains.

Image: forexbrokerslist.co.za

Decoding the Pulse of South African Trading

South Africa’s economy is a tapestry woven with diverse industries, from mining and agriculture to manufacturing and tourism. This dynamic landscape translates into a vibrant trading scene, where stocks, bonds, currencies, and commodities are actively traded on the Johannesburg Stock Exchange (JSE). The JSE is the 20th largest stock exchange globally, showcasing the country’s influential position in the African financial landscape.

Grasping the fundamental drivers of the South African economy is crucial for successful trading. Key economic indicators such as GDP growth, inflation, interest rates, and currency fluctuations should be closely monitored to gauge the overall health and direction of the market. Understanding the political and regulatory environment, along with global economic trends, completes the picture for informed trading decisions.

Timing the Perfect Trade: Unlocking Market Patterns

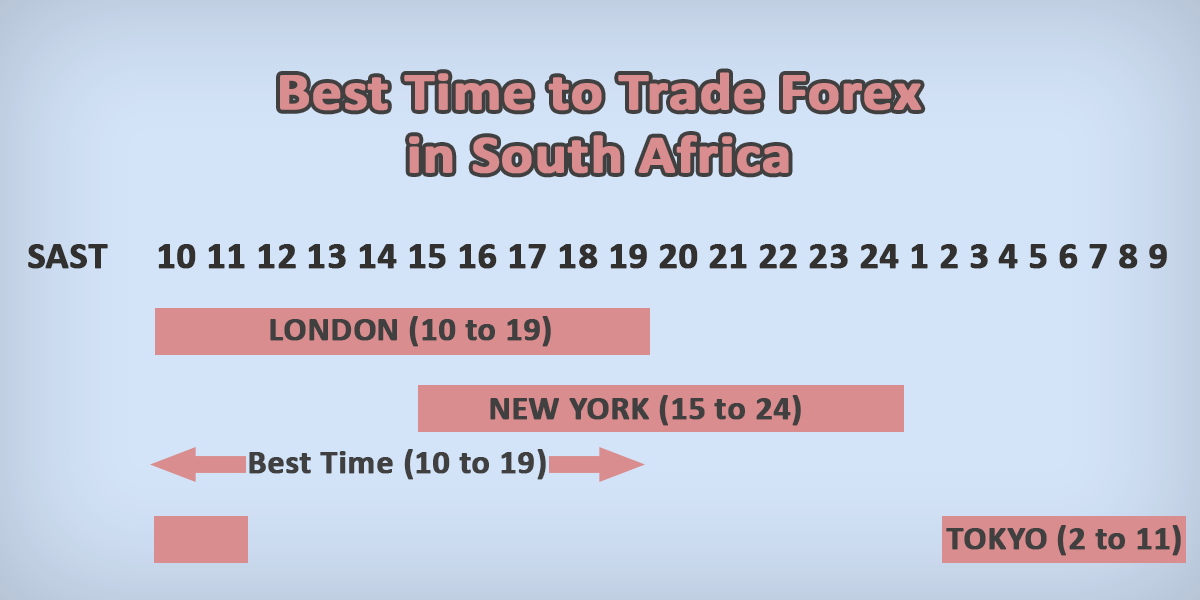

The best time to trade in South Africa, like most financial markets, is influenced by multiple factors. However, certain market patterns and historical data can provide valuable insights for investors.

Morning Momentum:

The early morning hours typically witness a surge in trading activity, as institutional investors and traders place their orders. This initial burst can offer ample opportunities to ride market momentum and capture favorable price movements.

Image: www.forexbeginner.com

Post-Lunch Dip:

In the afternoon, trading activity often slows down, creating a lull in price volatility. This period can be an ideal time to enter or exit positions with minimal slippage, minimizing the risk of unfavorable price fluctuations.

Weekly Trends:

Analyzing weekly trends can reveal patterns that assist in forecasting market direction. Historically, Mondays and Fridays have been identified as potentially lucrative trading days, with Mondays exhibiting bullish sentiment and Fridays showing signs of profit-taking.

Seasonality and Event-Driven Trading

Understanding seasonal influences and upcoming economic events can further refine trading strategies.

Seasonal Patterns:

Certain periods of the year tend to exhibit higher trading volumes and volatility. For instance, the end of financial quarters, such as March and September, often witness increased activity due to institutional fund managers rebalancing their portfolios.

Event-Driven Trading:

重大経済イベント、中央銀行の決定、政治的出来事は、市場に大きな影響を与える可能性があります。これらのイベントを特定して監視することで、トレーダーは潜在的な取引機会を特定し、市場の動きを先回りすることができます。

Harnessing Market Sentiment: A Psychological Edge

Psychology plays a significant role in market movements, and understanding investor sentiment can provide a valuable edge in trading.

Market Sentiment Indicators:

Market sentiment indicators, such as the Volatility Index (VIX), measure investor fear and uncertainty. High VIX readings typically indicate market volatility and potential selling pressure, while low VIX readings often reflect a more complacent market environment.

Social Media Sentiment Analysis:

ソーシャルメディアプラットフォームは、投資家の感情を監視するための宝庫です。ソーシャルメディアのデータ分析により、特定の株、産業、または経済情勢に対する市場の全体的なセンチメントを把握できます。

Crafting a Winning Trading Strategy: Timing Meets Analysis

Armed with insights into optimal trading time, economic factors, and market psychology, investors can develop a tailored trading strategy that aligns with their risk appetite and financial goals.

Technical Analysis:

Technical analysis involves studying price charts, indicators, and patterns to identify potential trading opportunities. Technical analysis can help traders pinpoint entry and exit points, identify trends, and anticipate market reversals.

Fundamental Analysis:

Fundamental analysis delves into the financial health and prospects of individual companies. By evaluating financial statements, industry trends, and company news, fundamental analysis helps investors determine the intrinsic value of a stock and make informed investment decisions.

Best Time To Trade South Africa

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion: Mastering the Art of Trading South Africa

Trading in South Africa offers a wealth of opportunities for profit, but navigating the complexities of the market requires a deep understanding of optimal trading time, economic drivers, market sentiment, and trading strategies. This comprehensive guide has equipped you with the tools and knowledge to unlock the secrets of South African trading. Remember to conduct thorough research, stay informed about market developments, and continuously refine your trading approach to ride the waves of financial success.