In the dynamic world of forex trading, timing is everything. The New York session, stretching from 8 AM to 5 PM ET, holds immense significance for traders across the globe, including those in India. This bustling trading period offers a unique confluence of liquidity, volatility, and opportunity, making it a prime time for Indian traders to tap into the forex market’s potential.

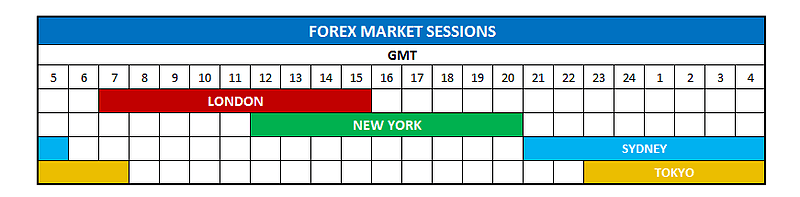

Image: dailypriceaction.com

Navigating the New York Session from India

For traders based in India, the New York session overlaps with the late afternoon and evening hours (5:30 PM to 12:30 AM IST). This overlap provides ample time for traders to engage in active trading or monitor the market’s movements closely. However, understanding the nuances of the New York session is essential to maximize trading opportunities and mitigate risks.

During the New York session, the US dollar, the world’s reserve currency, plays a dominant role. Its value against other major currencies, such as the Euro, Japanese Yen, and British Pound, experiences significant fluctuations. This volatility stems from a plethora of economic data releases, news events, and central bank announcements originating from the US. Consequently, traders can capitalize on these price movements by taking strategic positions aligned with the prevailing market sentiment.

Trading Strategies for the New York Session

Harnessing the New York session’s potential requires a well-defined trading strategy. Here are some effective approaches that Indian traders can consider:

-

Trend Following: During the New York session, the forex market exhibits well-defined trends. By identifying these trends using technical indicators such as moving averages and Bollinger Bands, traders can align their trades in the direction of the prevailing momentum.

-

Scalping: Scalping involves executing multiple small trades over a short period to capitalize on tiny price movements. The high liquidity of the New York session makes it an ideal environment for scalpers to profit from fleeting opportunities.

-

Day Trading: Day traders enter and exit positions within a single trading day, often taking advantage of intraday price swings. The New York session provides ample volatility for day traders to implement their strategies successfully.

Tips for Success in the New York Session

While the New York session presents lucrative opportunities, it also poses challenges. Here are some tips to help Indian traders navigate this dynamic period:

-

Stay Informed: Economic data releases, news events, and geopolitical developments can significantly impact currency values. Regularly monitoring these factors through financial news sources and economic calendars is crucial.

-

Manage Risk Effectively: Using stop-loss orders and money management techniques is essential to limit potential losses and protect your capital.

-

Optimize Time Management: For traders in India, the New York session coincides with evening hours. Allocating dedicated time for trading and sticking to a disciplined schedule is recommended.

-

Seek Education and Support: Continuously expand your trading knowledge by studying books, articles, and attending webinars. Joining trading communities or online forums can also provide valuable insights and support.

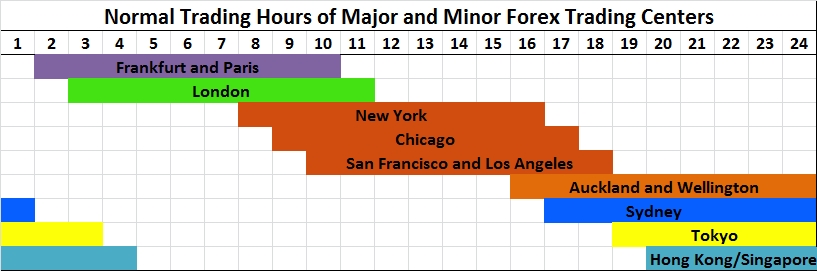

Image: homecare24.id

New York Session Forex Time In India

Conclusion

The New York session forex time holds immense potential for Indian traders. By understanding the unique dynamics of this trading period, adopting sound strategies, and implementing risk management techniques, traders can unlock profitable opportunities while navigating the challenges associated with this dynamic market. Embracing a knowledgeable and calculated approach can pave the way for success in the exciting world of New York session forex trading.