Imagine entering the bustling world of forex trading, where the stakes are high and the potential rewards are equally tantalizing. As you navigate through this labyrinthine landscape, you encounter an enigmatic concept known as leverage. It’s a force that can amplify your profits, but if wielded unwisely, it can also lead to substantial losses.

Image: howtotradeonforex.github.io

In this comprehensive guide, we will delve into the depths of leverage in forex, unraveling its benefits and pitfalls. We will equip you with the knowledge and understanding to harness the power of leverage while mitigating its risks. Get ready to embark on an enlightening journey that will empower you to make informed decisions in the dynamic realm of forex trading.

Unlocking the Power of Leverage: A Detailed Overview

Definition of Leverage

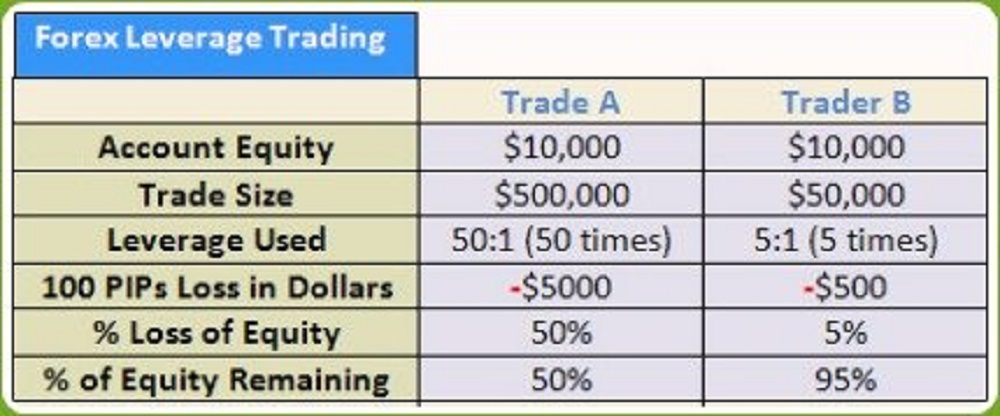

Leverage is a financial tool that empowers traders to magnify their potential profits by utilizing borrowed funds. In forex trading, leverage is typically expressed as a ratio, such as 100:1 or 500:1. This ratio indicates the amount of capital you can control relative to your deposited funds. For instance, with a leverage of 100:1, you can trade a position worth $100,000 with only $1,000 in your account.

Benefits of Leverage

Leverage offers several alluring benefits that can significantly enhance your trading experience. Firstly, it allows traders to trade larger positions with a modest capital investment. This can amplify their profits when the market moves favorably. Additionally, leverage enables traders to enter trades with smaller margins, which can be particularly advantageous during volatile market conditions.

Image: www.asktraders.com

Risks of Leverage

While leverage offers immense potential for profit maximization, it must be wielded with utmost caution. The higher the leverage, the greater the potential losses. If the market moves against your position, leverage can magnify your losses substantially, potentially leading to the depletion of your trading capital. Therefore, it’s crucial to understand the risks associated with leverage and use it prudently.

Mastering Leverage in Forex: A Step-by-Step Guide

To effectively harness the power of leverage in forex trading, it’s essential to adhere to a few fundamental principles:

- Start with Realistic Expectations: Don’t be lured by the allure of high leverage. Begin with a conservative approach and gradually increase the amount as you gain experience.

- Understand Risk Tolerance: Assess your risk appetite and determine the level of leverage that aligns with your comfort zone.

- Use Stop-Loss Orders: Implementing stop-loss orders is imperative to protect your trading capital from catastrophic losses.

- Practice Risk Management: Develop a robust risk management strategy that incorporates leverage as a crucial component.

Harnessing Leverage Intelligently: Tips and Expert Advice

To elevate your leverage utilization skills, consider incorporating the following tips and expert advice into your trading strategy:

- Use Leverage to Enhance Your Returns: Leverage can be an effective tool for magnifying your profits, allowing you to capitalize on small market movements.

- Diversify Your Portfolio: Spreading your funds across multiple trades can mitigate the risks associated with leverage.

- Educate Yourself Continuously: Stay abreast of the latest trends and developments in forex trading. Knowledge is power, especially when dealing with leverage.

Unveiling the Secrets of Leverage: FAQs

To enhance your understanding of leverage in forex, let’s delve into some frequently asked questions:

- Q: How does leverage work in forex?

A: Leverage allows you to trade larger positions with a smaller amount of capital, potentially magnifying your profits. - Q: What are the risks of using leverage?

A: Excessive leverage can lead to substantial losses if the market moves against your position. - Q: How do I calculate leverage?

A: Forex leverage is typically expressed as a ratio, such as 100:1. This ratio indicates the amount of capital you can control relative to your deposited funds.

What Is Leverage In Forex

Conclusion

Leverage in forex can be a double-edged sword. It can amplify your profits, but it can also lead to severe losses if not handled judiciously. By comprehending the risks and leveraging the power of leverage strategically, you can unlock its true potential and enhance your trading experience.

So, are you ready to delve into the enigmatic world of leverage in forex? Embrace its power, harness its benefits, and mitigate its risks. The path to Forex mastery lies in exploring new realms, unravelling secrets, and embracing the transformative potency of leverage.