In the fast-paced world of forex trading, selecting the right platform is essential for success. With a plethora of options available, navigating the options can be an overwhelming task. To assist you in making an informed decision, this article will provide an in-depth analysis of the key factors to consider when choosing the best forex trading platform. Join us on this educational journey as we explore the intricacies of this important tool.

Image: www.koody.co

Understanding Forex Trading Platforms: The Gateway to Global Markets

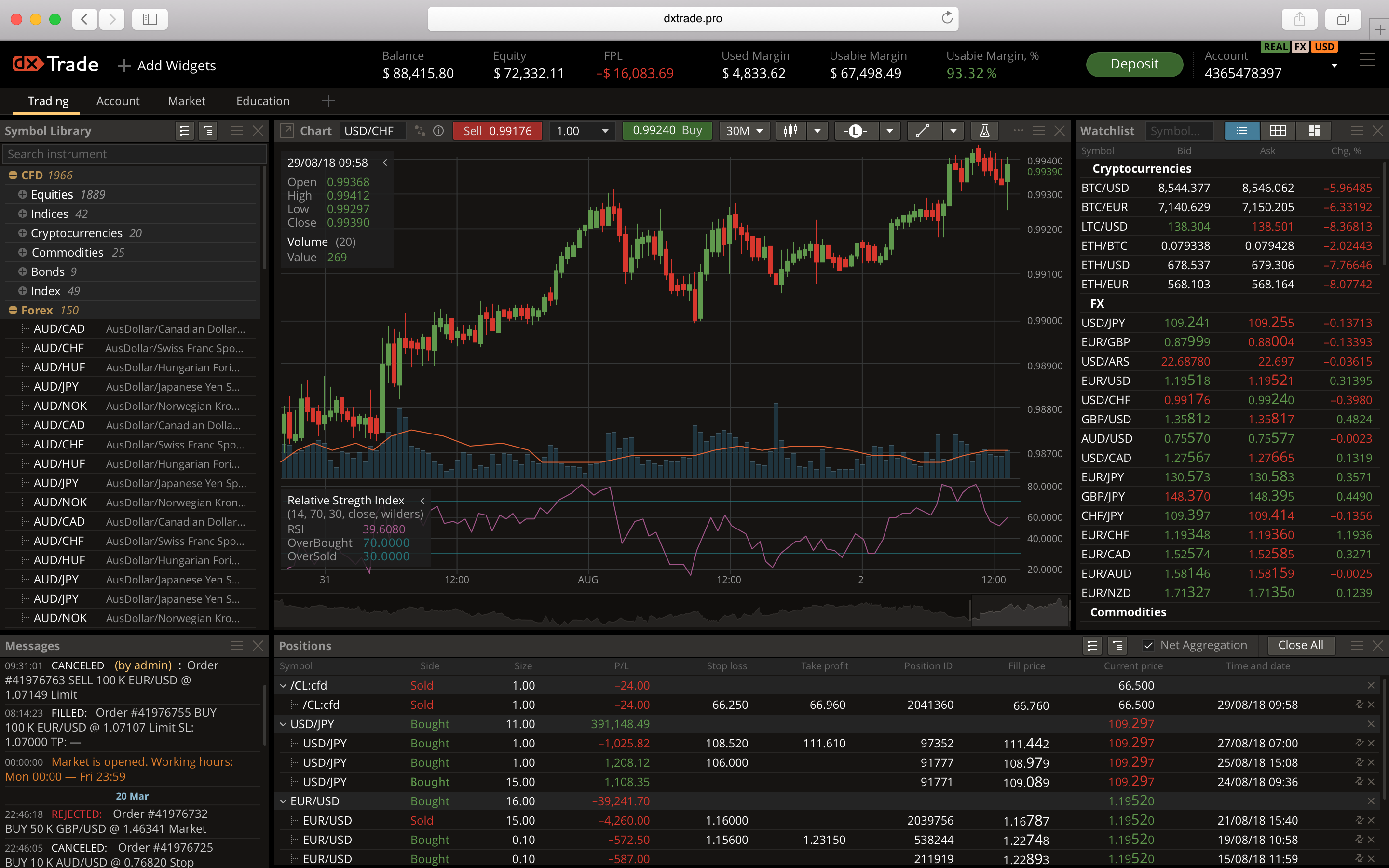

Forex trading platforms serve as the interface between traders and the global currency market, enabling them to buy, sell, and manage foreign currencies. These platforms provide a comprehensive suite of tools, including real-time quotes, technical analysis tools, and risk management features. They come in various forms, each with its distinct advantages and drawbacks. Choosing the platform that aligns with your specific trading style and preferences is crucial.

Evaluating Key Features: A Checklist for Success

When assessing forex trading platforms, consider the following features:

-

Functionality and User Interface: The platform should have an intuitive and user-friendly interface, allowing for seamless navigation and order execution.

-

Trading Instruments: Determine if the platform offers the currencies and instruments you intend to trade.

-

Execution Speed and Spreads: Choose a platform with fast execution speeds and competitive spreads to minimize slippage and maximize profitability.

-

Trading Tools and Indicators: Identify platforms that provide the technical analysis tools and indicators necessary for your trading strategy.

-

Account Types and Margin Requirements: Select a platform that offers account types and margin requirements suitable for your risk tolerance and financial situation.

-

Customer Support and Education: Opt for platforms with reliable and responsive customer support teams and educational resources to assist with queries and enhance your trading knowledge.

-

Regulation and Security: Verify that the platform is regulated by a reputable authority and employs robust security measures to protect your personal and financial information.

-

Third-Party Integrations: Consider compatibility with third-party trading tools and platforms to complement your trading experience.

Navigating the Landscape: Top Picks for Forex Traders

-

MetaTrader 4 (MT4): A widely used platform offering extensive customization options, advanced technical analysis tools, and a large community of traders.

-

MetaTrader 5 (MT5): An advanced version of MT4, providing additional features such as built-in charting, improved mobile trading, and hedging capabilities.

-

cTrader: A popular choice among automated and scalping traders, offering advanced order execution technologies and customizable user interfaces.

-

NinjaTrader: A high-performance platform renowned for its superior charting and order management capabilities, catering to advanced and professional traders.

-

FXCM Trading Station: A proprietary platform with robust trading tools, comprehensive market analysis, and educational resources designed for novice and experienced traders alike.

Image: howtotradeonforex.github.io

Which Platform Is Best For Forex Trading

Choosing the Best Platform: Tailor to Your Needs

Selecting the best forex trading platform is a personal decision based on your individual trading style and requirements. Consider the above factors carefully and evaluate which platform aligns best with your needs. Remember, the ideal platform empowers you with the tools, functionality, and support necessary to make informed trades and achieve your financial goals.