Introduction

Image: livefromalounge.com

When planning an international trip, deciding how to manage your finances abroad can be daunting. Should you exchange cash, get a traveler’s check, or use a debit card? Each option has its own advantages and disadvantages. In this article, we will compare two popular choices: forex cards and international debit cards to help you determine the best option for your needs.

Forex Card

A forex card is a prepaid card that is loaded with the currency of your destination. Once loaded, you can use it to make purchases, withdraw cash from ATMs, and pay for services in the local currency. Forex cards offer several benefits:

- Competitive Exchange Rates: Forex card providers typically offer competitive exchange rates.

- No Hidden Fees: Forex cards often have low or no fees for transactions.

- Security: Forex cards are more secure than carrying cash and can be easily canceled or replaced if lost or stolen.

- Convenience: Forex cards are widely accepted at businesses and ATMs around the world.

International Debit Card

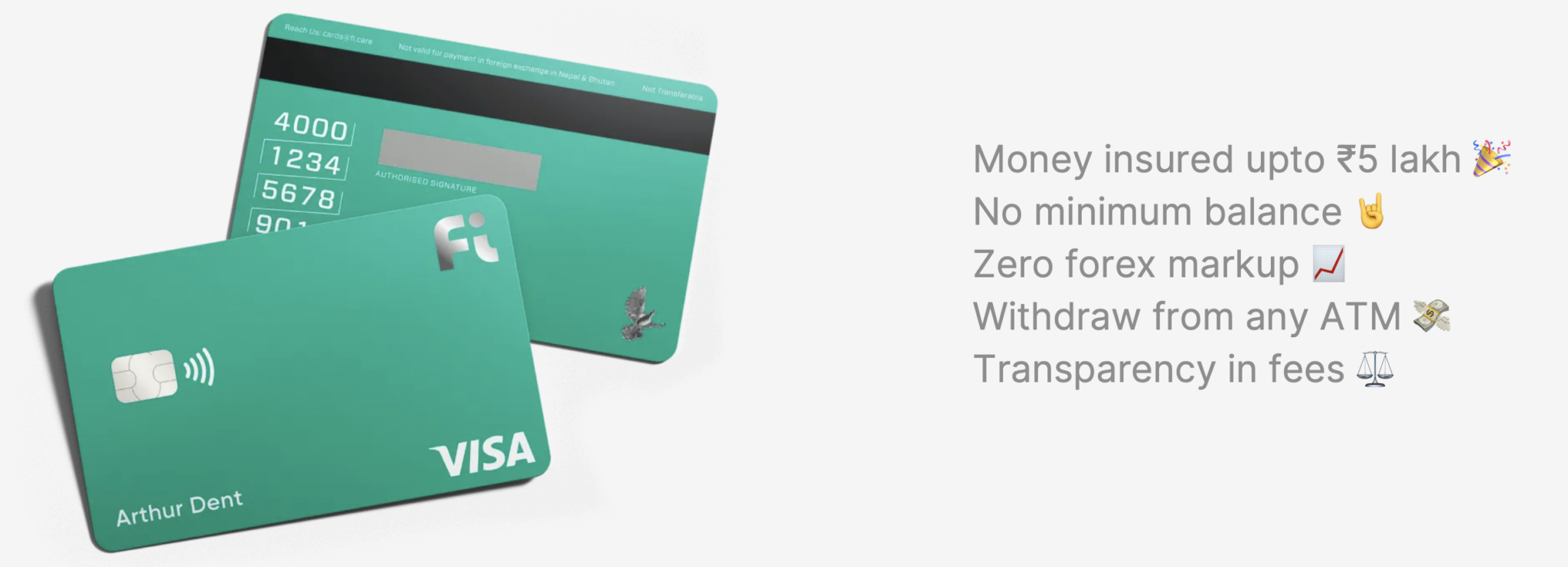

An international debit card is a debit card that can be used to make purchases and withdraw cash in countries outside your home country. International debit cards offer similar benefits to forex cards, such as:

- Security: Debit cards are protected by advanced fraud prevention measures.

- Convenience: Debit cards can be used at most businesses and ATMs that accept debit cards.

- Instant Access to Funds: Debit cards provide direct access to your bank account, allowing you to withdraw funds as needed.

- Widely Accepted: International debit cards are widely accepted in many countries around the world.

Key Differences

- Exchange Rates: Forex cards generally offer more competitive exchange rates than international debit cards.

- Fees: Forex cards often have lower or no fees for transactions, while international debit cards may have foreign transaction fees.

- Loadability: Forex cards can be loaded with multiple currencies, while international debit cards can only be loaded with a single currency.

- Access to Funds: Forex cards are preloaded, while international debit cards are linked to your bank account.

Which One Is Right for You?

The best choice depends on your individual needs and preferences. If you plan on spending a significant amount of time abroad and want the best exchange rates and flexibility in currency options, a forex card may be the better option. If you prefer the convenience of accessing your own bank account, a low-cost international debit card may be a more suitable choice.

Conclusion

Both forex cards and international debit cards offer convenient and secure options for managing your finances abroad. However, the ideal choice for you will depend on factors such as your budget, travel plans, and currency management needs. By carefully considering the key differences between the two options, you can make an informed decision that will meet your needs while ensuring a safe and enjoyable international travel experience.

Image: www.goniyo.com

Difference Between Forex Card And International Debit Card