Harness the Power of Forex Trend Trading with a Dashboard Indicator

Image: www.youtube.com

In the labyrinthine world of forex trading, identifying trends can be akin to navigating a tempestuous sea. However, the advent of trend trading dashboard indicators has transformed this pursuit into a more manageable endeavor, empowering traders to make informed decisions that maximize their profit potential. Delving into this comprehensive guide, we’ll uncover the intricacies of trend trading, equip ourselves with the indispensable forex trend trading dashboard indicator, and emerge as more astute traders.

Understanding Forex Trend Trading

Forex trend trading revolves around the art of recognizing and riding the waves of currency market movements. Trends are classified as either uptrends (where the value of a currency pair rises steadily) or downtrends (where the value falls consistently). Successful trend traders reap substantial rewards by capitalizing on these prolonged price fluctuations.

The Forex Trend Trading Dashboard Indicator: A Guiding Light

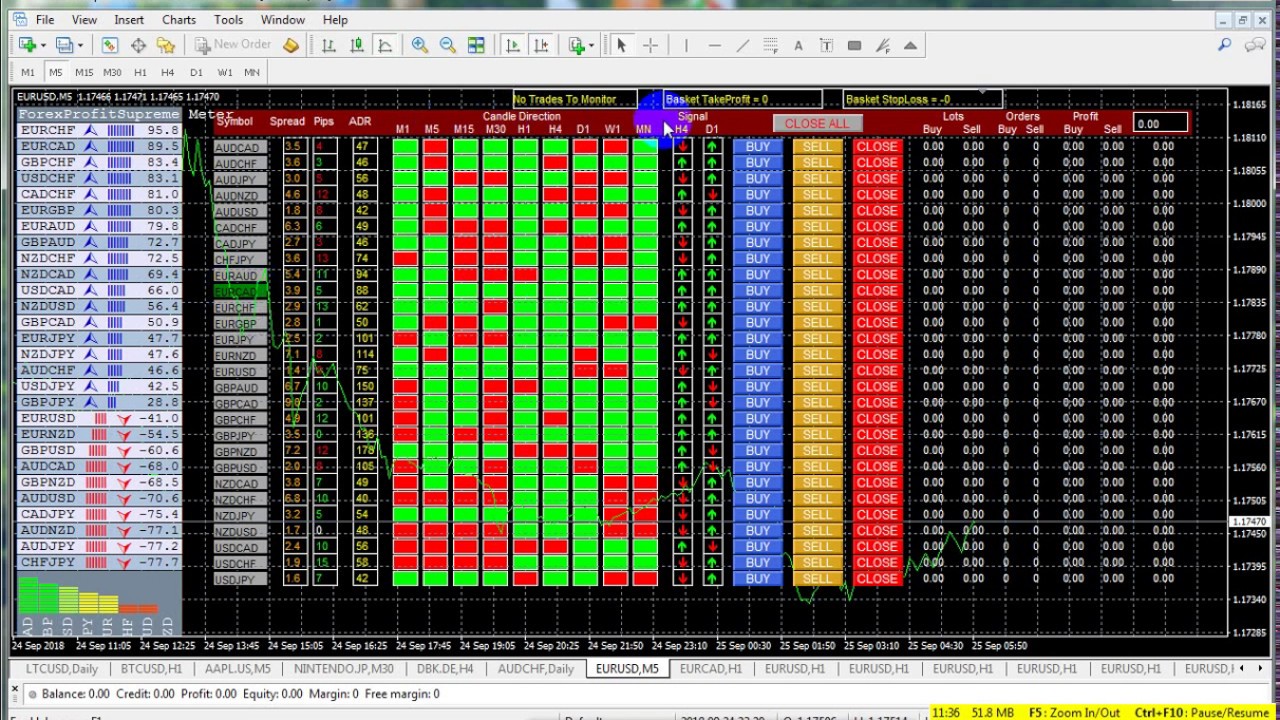

Imagine having a personal compass that guides you through the currency markets, seamlessly identifying prevailing trends. Enter the forex trend trading dashboard indicator, a dynamic tool that empowers traders with real-time data and intuitive visualizations to discern market direction quickly and accurately.

Navigating the Dashboard

The forex trend trading dashboard indicator typically includes the following components:

-

Moving Average Indicator: Plots moving averages of different periods, highlighting potential trend reversals or confirmations.

-

Stochastic Oscillator: Assesses market momentum and overbought/oversold conditions, providing insights into potential trend exhaustion or continuation.

-

Relative Strength Index (RSI): Similar to the Stochastic Oscillator, the RSI measures market momentum but on a scale of 0 to 100, further enhancing trend analysis.

-

Trend Line Tool: Enables traders to manually draw trend lines that connect price peaks and troughs, visualizing underlying trend patterns.

-

Correlation Matrix: Reveals the relationship between different currency pairs, aiding in identifying potential trading opportunities.

Leveraging the Indicator for Trading Success

By meticulously analyzing these various indicators, traders can gather invaluable insights into market behavior and position themselves for profitable trades aligned with the prevailing trend. For instance, a rising moving average coupled with a high RSI suggests a bullish trend, while an RSI below 30 may indicate an oversold condition and potential trend reversal.

Empowering Traders with Actionable Insights

Expert traders emphasize the following tips for effective utilization of the forex trend trading dashboard indicator:

-

Follow the Trend: Side with the dominant trend, as it often leads to more lucrative trades.

-

Confirm the Trend: Seek confirmation from multiple indicators before initiating a trade to minimize risk.

-

Wait for Pullbacks: Enter trades during pullbacks within the trend to optimize entry price points.

-

Manage Risk: Employ appropriate risk management strategies like stop-loss orders to safeguard your capital.

Embracing the Future of Forex Trend Trading

The forex trend trading dashboard indicator has revolutionized the world of forex trading, providing traders with an unprecedented level of insight and market understanding. Armed with this powerful tool, traders can navigate the currency markets with newfound confidence and strive towards financial success. Remember, the path to mastery lies in continual learning, so embrace the opportunities to refine your skills and capitalize on the boundless potential of forex trend trading.

Image: www.etsy.com

Forex Trend Trading Dashboard Indicator