Introduction

Navigating the world of international travel can be thrilling yet daunting. One essential aspect that often adds complexity is acquiring a forex card. Axis Bank, a prominent financial institution in India, offers a wide range of forex card options tailored to cater to diverse travel needs. Understanding the documentation required for an Axis Bank forex card is pivotal for a smooth and hassle-free application process.

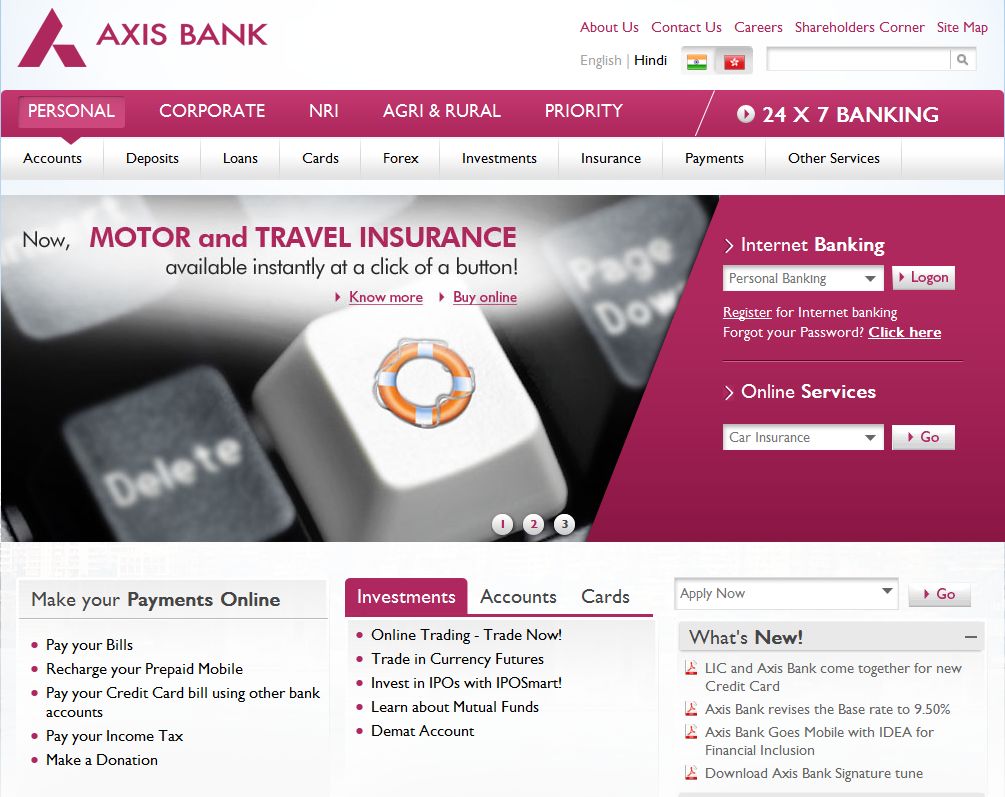

Image: allaboutforexs.blogspot.com

Required Documents for Axis Bank Forex Card Application

To apply for an Axis Bank forex card, the following documents are typically required:

- Original passport with a minimum validity of 6 months from the intended date of return

- Visa or travel authorization, if applicable, for the intended destination

- Residence proof, such as a utility bill, phone bill, or property tax receipt, reflecting the current and permanent address

- Income proof, such as salary slips, bank statements, or FORM 16

- Two passport-size photographs

Additional Documents for Specific Purposes

In certain cases, additional documents may be required for specific purposes:

- For students studying abroad: Proof of admission to an educational institution

- For business travelers: Business-related documentation, such as a letter from the employer

- For medical travel: Medical documents, such as a doctor’s prescription or hospital invoice

Benefits of Using an Axis Bank Forex Card

- Convenience: Axis Bank forex cards allow travelers to carry multiple currencies on a single card, eliminating the need for exchanging currency multiple times.

- Security: Forex cards provide an added layer of security compared to carrying cash, as they can be easily deactivated in case of theft or loss.

- Competitive exchange rates: Axis Bank offers competitive exchange rates, allowing travelers to get the best value for their money.

- Global acceptance: Axis Bank forex cards are widely accepted at ATMs, POS terminals, and online merchants worldwide.

- 24/7 customer support: Axis Bank provides 24/7 customer support to assist travelers with any queries or emergencies.

Image: www.forex.academy

FAQs on Axis Bank Forex Card

- Q: What is the maximum amount that can be loaded onto an Axis Bank forex card?

A: The maximum amount that can be loaded depends on the variant of the forex card and ranges from INR 25,000 to INR 2,00,000.

- Q: Are there any fees associated with using an Axis Bank forex card?

A: Yes, there may be certain fees like issuance fee, reloading fee, and currency conversion fee.

- Q: Can I use my Axis Bank forex card to withdraw cash?

A: Yes, you can withdraw cash from ATMs using your Axis Bank forex card, but a fee may be applicable.

- Q: How do I activate my Axis Bank forex card?

A: You can activate your Axis Bank forex card by calling the customer care number or through the Axis Bank mobile application.

Axis Bank Forex Card Documents Required

Conclusion: Journey Smart with Axis Bank Forex Card

Navigating international travel can be effortless with the Axis Bank forex card. By providing the necessary documentation and understanding the card’s benefits and usage, you can ensure a seamless journey abroad, exploring the world with peace of mind and financial convenience.

Are you ready to embark on your global adventures empowered with an Axis Bank forex card?