Introduction

Image: kinesis.money

In the fast-paced and exhilarating world of forex trading, scalping stands as an intriguing strategy that captures the attention of both novice and experienced traders alike. This lightning-fast trading approach involves opening and closing multiple positions within minutes, even seconds, aiming to capitalize on tiny price movements. But not all currency pairs are created equal when it comes to scalping. To maximize your potential for success, it’s crucial to select the best currency pairs for scalping forex.

Identifying the Ideal Currency Pairs for Scalping

The key characteristics of a suitable currency pair for scalping include high liquidity, tight spreads, and predictable price action. Liquidity refers to the volume of trades executed in a particular currency pair, ensuring that you can enter and exit positions quickly and efficiently. Tight spreads, on the other hand, minimize transaction costs, which is crucial in scalping where profits are often small. Finally, predictable price action allows you to identify patterns and trends that can be exploited for profitable trades.

Top Currency Pairs for Scalping Forex

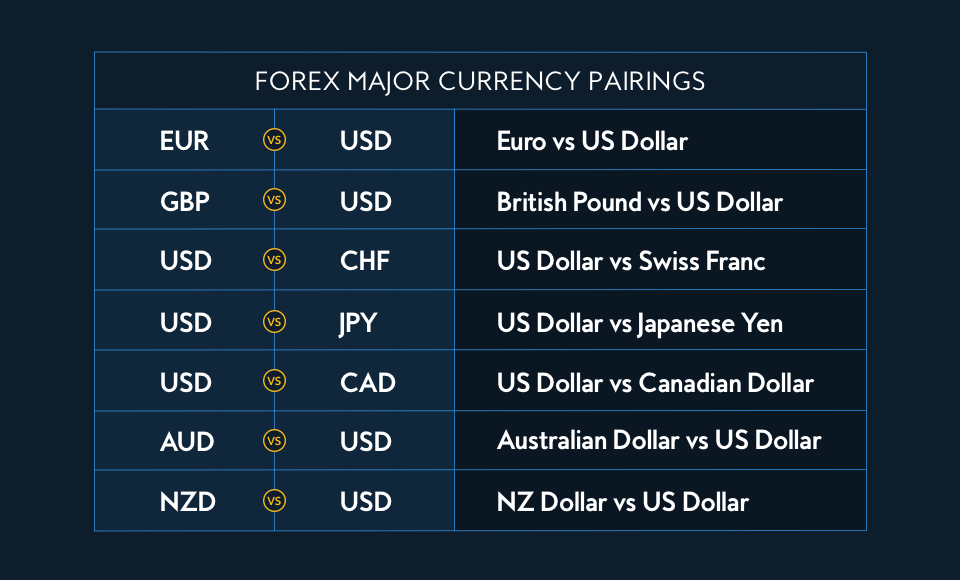

Based on these criteria, the following currency pairs consistently rank among the most popular choices for scalpers:

- EUR/USD: The most liquid currency pair in the world, offering high liquidity, tight spreads, and a relatively stable price action.

- GBP/USD: A major currency pair with a moderate spread, known for its volatility and frequent trend reversals.

- USD/JPY: The third most traded currency pair, known for its high liquidity and periodic periods of low volatility suitable for scalping.

- USD/CAD: A currency pair influenced by both economic and geopolitical factors, offering potential for short-term gains.

- AUD/USD: A relatively volatile currency pair with a trending nature during certain market conditions, presenting scalping opportunities.

Technical Analysis Techniques for Scalping

Scalping success hinges on your ability to identify and exploit short-term price movements accurately. Several technical analysis techniques can assist you in this endeavor:

- Moving Averages: Moving averages smooth out price data, helping you identify trends and potential reversal points.

- Bollinger Bands: Bollinger Bands depict the boundaries of price action, giving insights into potential overbought or oversold conditions.

- Relative Strength Index (RSI): The RSI measures market momentum, indicating when a currency pair is oversold or overbought.

- Stochastic Oscillator: Similar to the RSI, the Stochastic Oscillator provides insights into overbought and oversold conditions.

- Ichimoku Kinko Hyo: A comprehensive technical indicator that combines several trend and momentum indicators into a single chart.

Tips for Successful Scalping

- Use a demo account: Practice your scalping strategies in a risk-free environment before venturing into live trading.

- Manage your risk: Determine your risk appetite and trade only with a fraction of your capital.

- Follow a trading plan: Develop a set of trading rules and stick to them during each trading session.

- Stay disciplined: Consistency is key in scalping. Avoid emotional decision-making and trade only when favorable conditions arise.

- Monitor the news and economic events: Stay informed about market-moving events that can impact the performance of currency pairs.

Conclusion

Scalping forex can be a lucrative and exciting trading strategy, but it requires skill, discipline, and selecting the best currency pairs to maximize your potential for success. By embracing the tips and techniques outlined in this guide, you can enhance your scalping prowess and explore the world of high-frequency trading with increased confidence and profitability. Remember, the journey to scalping success is an ongoing pursuit of knowledge and refinement, and the rewards can be truly extraordinary for those who master this dynamic and exhilarating trading approach.

Image: www.dailyfx.com

Best Currency Pairs Scalping Forex