Introduction

In the dynamic world of foreign exchange (forex), leverage plays a pivotal role in maximizing profits and amplifying returns. Imagine yourself as a trader with limited capital seeking to make substantial gains. This is where the concept of leverage comes into play, a double-edged sword that can either significantly augment your profits or, conversely, magnify your losses.

Image: jesuschester.blogspot.com

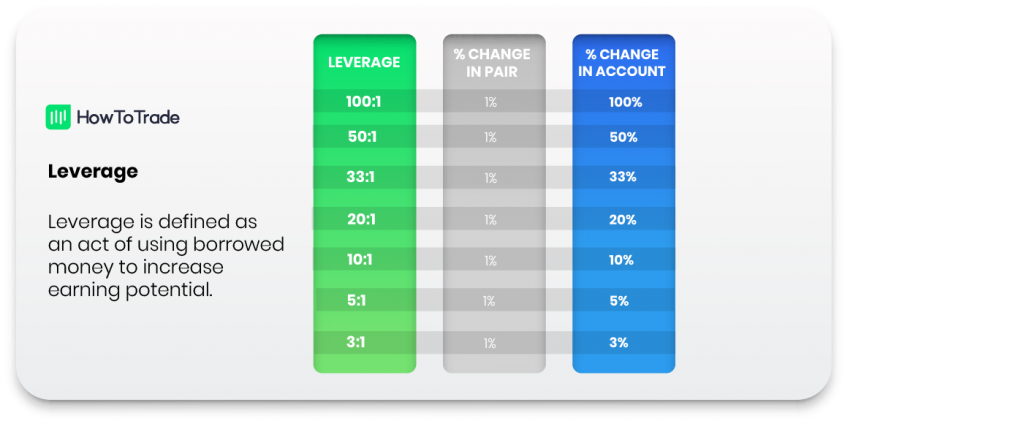

Leverage in forex refers to the practice of borrowing funds from a broker to increase your trading power. It essentially allows you to control a larger position with a smaller initial investment. This amplifies both your potential gains and potential losses. However, it’s crucial to understand the underlying mechanisms and risks associated with leverage to harness its potential effectively.

Understanding Leverage: A Balancing Conundrum

Leverage is expressed as a ratio, such as 1:10, 1:50, or even higher. A ratio of 1:10 implies that for every dollar you contribute, you can control $10 worth of currency in the market. This magnification effect empowers you to trade larger positions and potentially reap greater profits. However, it’s imperative to recognize that higher leverage also amplifies potential losses.

To illustrate, if you buy $10,000 worth of EUR/USD with a leverage of 1:10 and the euro appreciates by 1%, you would make a profit of $100. Conversely, if the euro depreciates by 1%, your loss would also be $100. However, with a leverage of 1:50, the same price movement would result in a profit of $500 or a loss of $500, respectively.

Mastering the Techniques

Leverage can be a powerful tool in the hands of experienced traders who understand its nuances and apply it strategically. If you’re considering using leverage, follow these tips to mitigate risks:

- Start Small: Begin with a conservative leverage ratio and gradually increase it as you gain experience and confidence.

- Manage Risk: Set appropriate stop-loss orders to limit potential losses. Use a take-profit level to lock in profits and protect your gains.

- Monitor the Market: Stay informed about economic events, news, and market movements that may impact your trades.

- Control Your Emotions: Trading with leverage can amplify emotions. Avoid making impulsive decisions and stick to your trading plan.

- Seek Knowledge: Educate yourself about different trading strategies, technical analysis, and risk management techniques.

Expert Insights: Leverage as a Double-Edged Sword

“Leverage can be an incredibly useful tool for experienced traders who understand its risks and manage them effectively,” advises veteran trader John Carter. “However, it’s not suitable for everyone, especially beginners. It’s essential to start small, gradually increase leverage, and always have a risk management strategy in place.”

Another expert, Sarah Jenkins, adds, “Leverage can amplify both profits and losses, so it’s crucial to have a clear understanding of your risk tolerance. Use leverage sparingly and only when you have a well-defined trading plan and sound risk management strategies.”

Image: howtotrade.com

FAQs: Unraveling the Leverage Enigma

Q: What is the ideal leverage ratio?

A: The optimal leverage ratio depends on your individual risk tolerance, trading experience, and market conditions. Start with a conservative ratio and adjust it gradually.

Q: Is leverage necessary for successful forex trading?

A: Leverage is not a prerequisite for success in forex trading. You can still achieve profitability without using leverage, albeit with smaller potential returns.

Q: How can I mitigate the risks associated with leverage?

A: Implement proper risk management techniques such as stop-loss orders, position sizing, and having a well-defined trading plan.

How Leverage Works In Forex

https://youtube.com/watch?v=c27691r7vTY

Conclusion

Leverage in forex trading can be a powerful tool or a liability, depending on how it’s used. By understanding its mechanisms, managing risks effectively, and utilizing expert advice, you can harness the potential of leverage to maximize profits while safeguarding your capital. Remember, leverage is not for the faint of heart, and trading with excessive leverage can lead to significant losses.

So, are you ready to embrace the transformative power of leverage? If so, tread cautiously, educate yourself, and use this knowledge wisely. The world of forex trading awaits your strategic application of leverage, where immense rewards can be reaped with astute risk management.