Leverage is a critical concept in forex trading that empowers traders to control a larger position with a smaller amount of capital. It amplifies both potential gains and losses, making it crucial for traders to understand how leverage works before engaging in forex trading.

Image: forexeaadvisorcom.blogspot.com

Forex trading involves buying and selling currencies in pairs. For instance, the EUR/USD pair represents the exchange rate between the Euro (EUR) and the US Dollar (USD). Leverage allows traders to purchase a larger amount of a currency pair than they would be able to with their own capital alone. This enhanced purchasing power enables them to potentially increase their profits, as well as their risks.

Understanding Leverage in Forex Trading

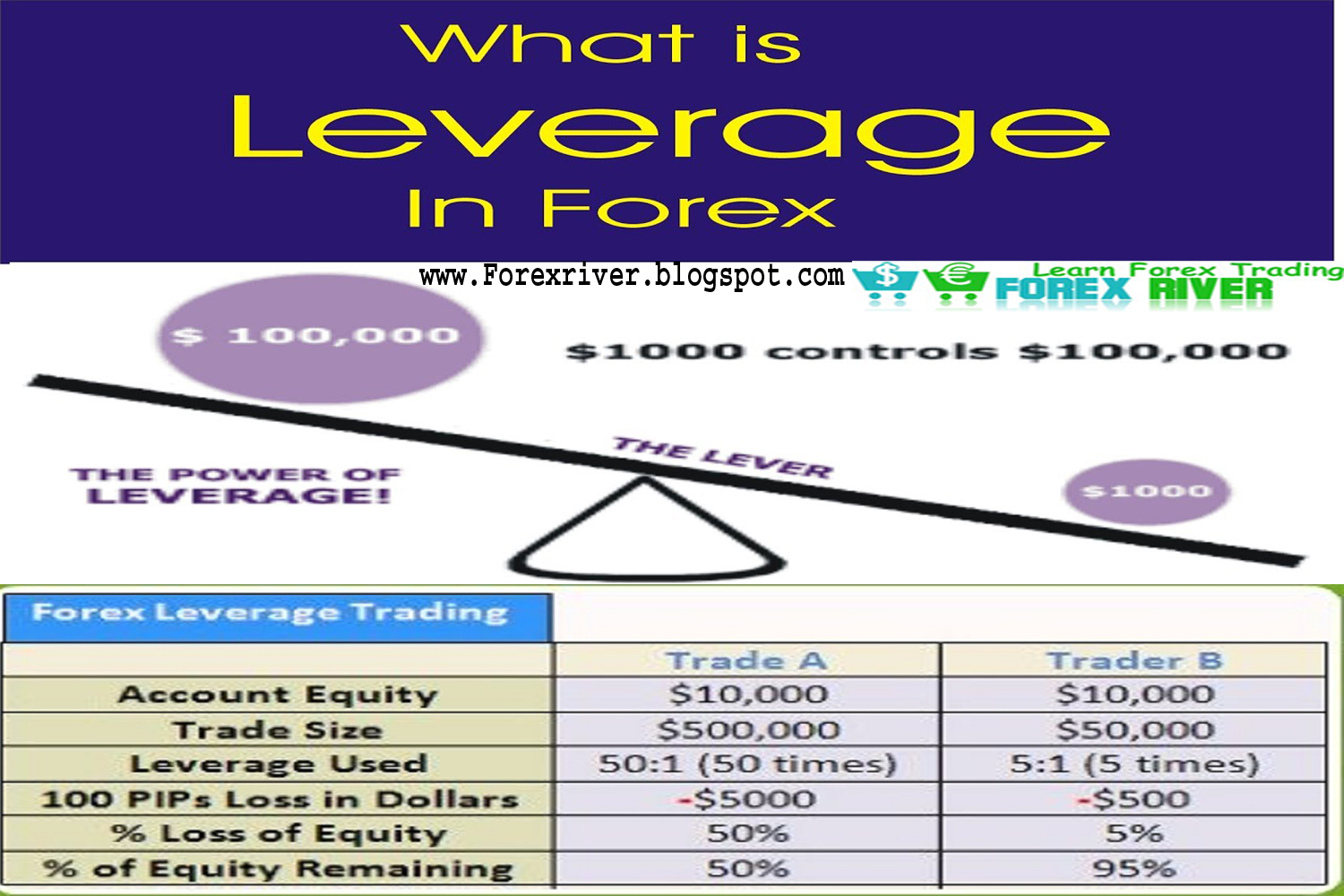

Leverage is expressed as a ratio, such as 50:1, 100:1, or 200:1. A leverage of 50:1 indicates that for every $1 of capital invested, the trader can control up to $50 worth of the currency pair. Similarly, leverage of 100:1 allows for control of up to $100, and leverage of 200:1 enables control of up to $200.

It’s important to note that leverage amplifies both profits and losses. While it offers the potential for higher returns, it also increases the risk of significant losses. For example, if a trader uses leverage of 50:1 and their $1 of capital experiences a 10% loss, their account balance would be -$5. Conversely, a 10% gain would result in a $5 profit.

Benefits and Risks of Using Leverage

Benefits:

- Increased purchasing power: Leverage allows traders to control a larger position size, potentially boosting their profits.

- Higher potential returns: With amplified positions, traders have the opportunity to generate larger gains on successful trades.

Image: forexriver.blogspot.com

Risks:

- Amplified losses: Leverage also magnifies potential losses, which can quickly deplete a trader’s capital if trades move against them.

- Margin calls: If losses from leveraged positions exceed the trader’s equity, the broker may issue a margin call, requiring them to deposit additional funds or risk being forced to sell their positions at a loss.

Expert Advice for Using Leverage Effectively

Experienced traders recommend employing leverage with caution and only after gaining a solid understanding of forex trading principles. Here are some tips for utilizing leverage effectively:

- Start with a low leverage ratio: Beginners should trade with modest leverage ratios, such as 10:1 or 20:1, to manage risk.

- Choose a reputable broker: Selecting a broker with transparent terms and fair leverage policies is crucial to avoid potential issues.

- Monitor risk levels: Traders should constantly assess their risk exposure and keep leveraged positions within their tolerance level.

- Use stop-loss orders: Implementing stop-loss orders helps mitigate potential losses by automatically closing positions at a predefined level.

FAQs on Leverage in Forex Trading

- What is the best leverage for beginners?

- Low leverage ratios, such as 10:1 or 20:1.

- Can I make quick profits using high leverage?

- While high leverage can increase potential profits, it also significantly amplifies losses. Quick profits are not guaranteed in forex trading.

- What happens if I exceed my margin requirement?

- If a trader’s leveraged positions exceed their available equity, the broker will issue a margin call and require them to deposit additional funds or face position liquidation.

- How can I manage risk when using leverage?

- By starting with low leverage, choosing a reputable broker, monitoring risk levels, and utilizing stop-loss orders.

What Does Leverage Mean In Forex Trading

Conclusion

Leverage in forex trading offers both opportunities and risks. It is a powerful tool that can enhance profits but must be used with caution. By understanding how leverage works and following recommended risk management strategies, traders can harness its potential benefits while mitigating potential pitfalls.

If you’re interested in forex trading and want to learn more about leverage, consult reputable sources, read books, and seek guidance from experienced traders. Knowledge and responsible risk management are key to success in forex trading.