Introduction:

Image: forexlucrativo.com

Pips play a pivotal role in the foreign exchange (forex) market, the world’s largest and most liquid financial arena. Understanding the concept of pips is crucial for forex traders, as it helps them gauge the profit or loss potential for a trade, manage risk, and make informed trading decisions. In this comprehensive beginner’s guide, we’ll delve into the intricacies of pips, demonstrating how to calculate pip values and empowering traders with the knowledge they need to navigate the dynamic forex market.

What are Pips in Forex?:

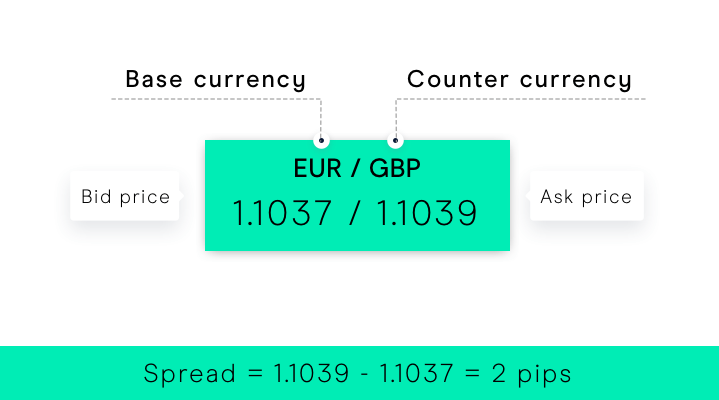

Pips (Percentage in Points or Points in Percentage) are standardized unit measurements that quantify the minimal price movement of a currency pair in forex trading. Pips represent the fine increment in which a currency pair fluctuates, with one pip typically equaling 0.0001 or 1/100th of 1% of a quote.

Calculating Pip Values Understand Clearly:

Determining the pip value for a currency pair differs based on the second currency’s denomination. For major currency pairs like EUR/USD, USD/JPY, and GBP/USD, one pip is equivalent to $10. This holds true because for these pairs, the USD is always quoted as the second currency.

For other less frequently traded pairs, also known as cross currency pairs, the calculation involves converting the pip value to the trader’s account currency. For example, in the EUR/GBP pair, if the EUR is the base currency in the trader’s account, one pip would be worth €0.0001.

Impact of Pip Values on Profits and Losses:

In order to attain a comprehensive perspective of the significance of pips, it’s imperative to understand their impact on potential profits or losses. A favorable or adverse movement in a currency pair relative to the trader’s forecast can directly impact the financial outcome of their trade. Each pip of movement represents a proportional change in the trader’s equity.

With a sound understanding of how pip values work, traders are better equipped to determine the potential risk and reward of a trade before committing to it. In this way, they can adjust their positions and leverage appropriately, laying a solid foundation for successful forex trading.

Utilizing Pip Values in Risk Management:

Risk management is a cornerstone of successful forex trading, and this is where pip values demonstrate their critical importance. In essence, risk management refers to the process of minimizing potential losses when executing trades. By interpreting the relationship between pips and account equity, traders can define the ideal levels for placing stop-loss orders.

Stop-loss orders are valuable tools that safeguard traders from enduring substantial losses on unfavorable trades. Pips provide a granular mechanism for managing risk, enabling traders to set specific pip-based limits beyond which a trade will be automatically closed, thus limiting the potential financial damage.

Conclusion:

Pips are the fundamental unit of measurement in forex trading, providing insights into price movements, profit potential, loss potential, and effective risk management. By comprehending the nature of pips and their significance, traders gain the foundation to confidently navigate the forex market and make informed trading decisions aimed at maximizing profits while judiciously managing risk.

Image: www.cmcmarkets.com

How Much Is 10 Pips In Forex