Unveiling the Secrets of Pips: A Foundational Guide for Forex Traders

In the world of forex trading, understanding and interpreting pips, or percentage in points, is paramount to navigating the volatile currency markets. Pips are the fundamental unit of measurement for price fluctuations, enabling traders to quantify gains or losses and assess the profitability of their trades with precision. Embark on this comprehensive guide to demystify the significance of pips and empower yourself with knowledge essential for successful forex trading.

Image: www.youtube.com

The Essence of Pips: A Journey into Forex Dynamics

Imagine the forex market as a vast ocean, where currencies ebb and flow like waves. Pips represent the smallest measurable change in value between two currencies. Similar to inches or centimeters used to measure physical distances, pips serve as the yardstick for gauging currency movements. Just as inches allow us to accurately track the growth of a sapling, pips empower traders to discern even the most subtle shifts in currency values.

Decoding the Pips: Exploring the Anatomy of Currency Pairs

Currencies in the forex market are always traded in pairs, such as EUR/USD or GBP/JPY. The first currency in the pair is known as the ‘base currency,’ while the second is the ‘quote currency.’ Pips measure the change in value of the base currency against the quote currency. For instance, if the EUR/USD exchange rate moves from 1.1234 to 1.1235, the increase of 0.0001 represents a gain of 1 pip.

Pips in Action: Measuring Profit and Loss with Precision

Pips are not only crucial for measuring price fluctuations but also serve as the basis for calculating profit or loss in forex trades. Consider a trader who buys 10,000 units of EUR/USD at 1.1234. If the rate subsequently rises to 1.1236, they have profited 2 pips. Conversely, if the rate falls to 1.1232, they have incurred a loss of 2 pips. By understanding the value of pips, traders can accurately determine the profitability of their trades and make informed decisions.

Refining Your Forex Strategy: The Role of Pips in Risk Management

Pips also play a critical role in risk management. By calculating the potential pip value of a trade, traders can determine the maximum amount of money they are willing to risk. For instance, if the pip value of a trade is $10 and a trader is willing to risk 1%, their maximum loss would be $1. Understanding pips helps traders define clear stop-loss levels, ensuring they exit losing trades before significant losses accumulate.

Leverage and Pips: A Double-Edged Sword in Forex Trading

Leverage, a feature unique to forex trading, allows traders to control a larger position with a smaller deposit. While leverage can magnify profits, it can also amplify losses. Therefore, it is imperative for traders to calculate the pip value of a trade in conjunction with the leverage employed. This ensures they have a clear understanding of the potential risks and rewards involved.

Conclusion: Empowering Forex Traders with the Power of Pips

Pips, the lifeblood of forex trading, provide traders with the precise measurement needed to navigate market fluctuations, quantify profits or losses, and manage risk effectively. By mastering the intricacies of pips, traders gain a competitive edge, unlocking the potential for profitability in the ever-evolving currency markets.

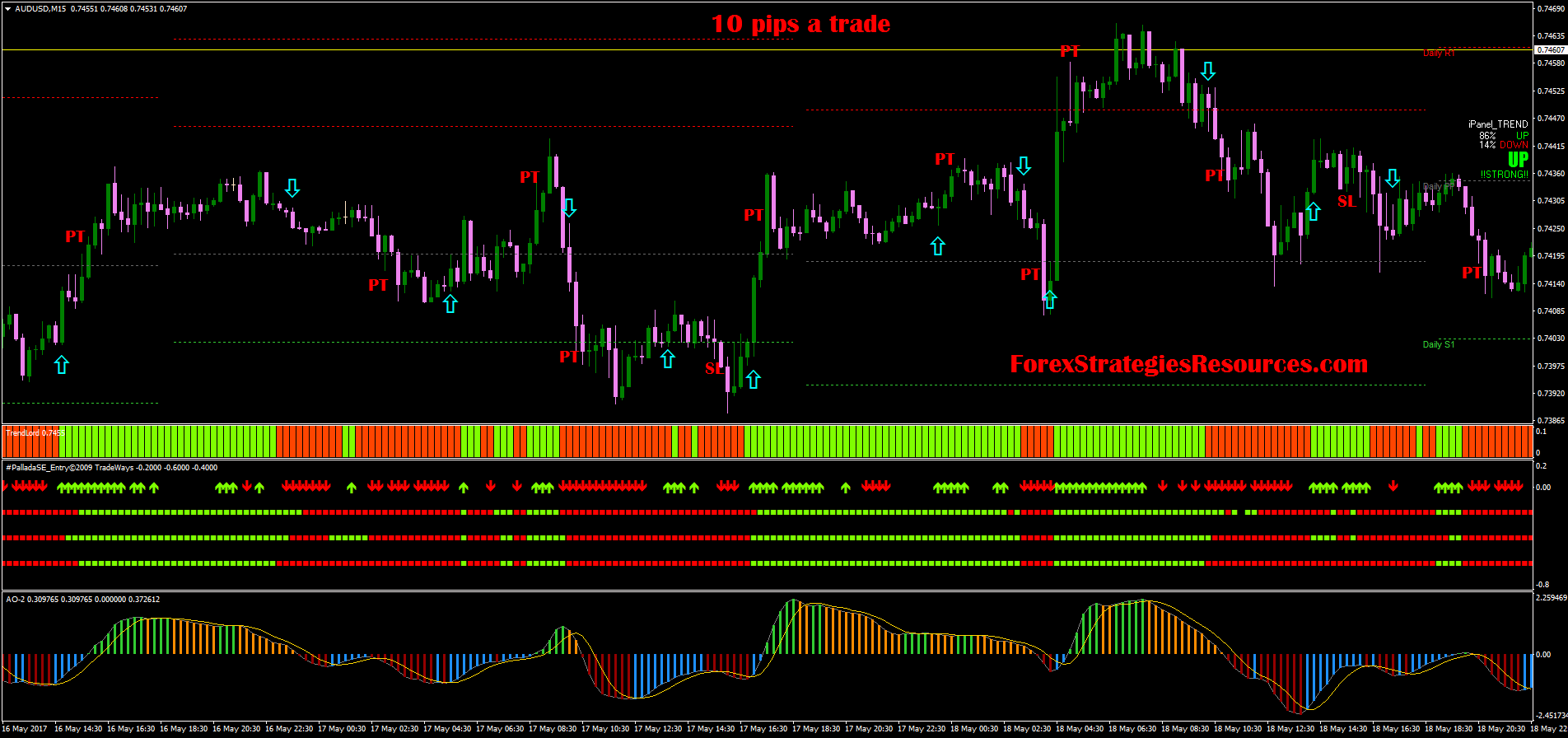

Image: www.forexstrategiesresources.com

What Is Pips In Forex Trading

https://youtube.com/watch?v=GIhYAwFn89Y