Forex trading in South Africa, the economic powerhouse of sub-Saharan Africa, is a lucrative yet challenging endeavor. To succeed, you must be well-versed in the intricate nuances of the forex market, including its trading sessions. This blog will delve into the depths of forex trading sessions in South Africa, providing you with invaluable insights, tips, and expert advice to bolster your trading strategies.

Image: www.cashbackforex.com

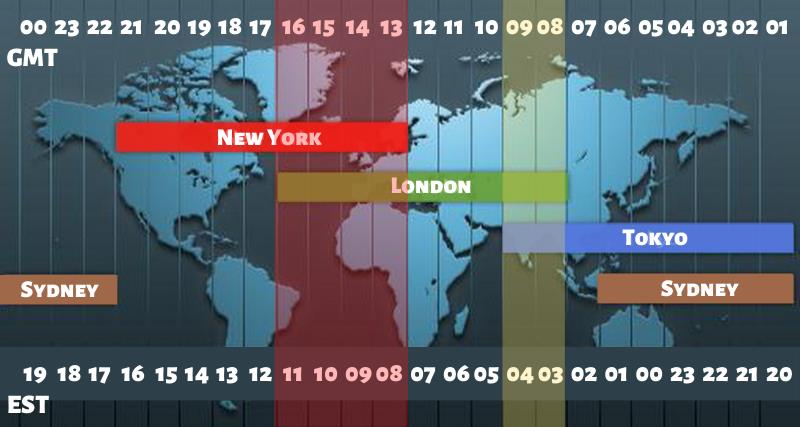

Forex Trading Sessions: A Global Market Never Sleeps

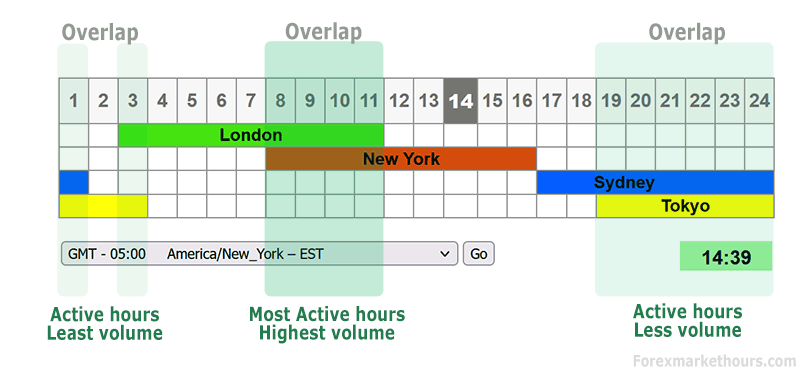

The foreign exchange market operates 24 hours a day, spanning across different time zones and continents. Consequently, trading sessions are divided into four primary periods: the Sydney session, Tokyo session, London session, and New York session. Each trading session is characterized by unique market conditions, with varying levels of volatility, liquidity, and trading activity.

Navigating Forex Trading Sessions in South Africa

South Africa falls within the Eastern Cape Time (ECT) Zone, which runs three hours after Coordinated Universal Time (UTC). Forex trading in South Africa typically commences during the Tokyo session and overlaps with the London and New York sessions. The following table presents the specific hours for each trading session in South African Standard Time (SAST):

| Trading Session | Start Time (SAST) | End Time (SAST) | Key Features |

|---|---|---|---|

| Sydney | 11:00 PM | 3:00 AM | Low volatility, low liquidity |

| Tokyo | 12:00 AM | 8:00 AM | Moderate volatility, increasing liquidity |

| London | 7:00 AM | 3:00 PM | High volatility, high liquidity |

| New York | 12:00 PM | 8:00 PM | High volatility, highest liquidity |

Maximizing Trading Opportunities in South Africa

Strategic trading during specific forex trading sessions can significantly enhance your profitability. The London session, characterized by high volatility and liquidity, aligns with South Africa’s morning hours and is often favored by scalpers and active traders. Conversely, the New York session, encompassing South Africa’s afternoon, offers the greatest liquidity and is suitable for traders seeking larger, longer-term trades.

Additionally, understanding the impact of South African economic indicators on currency valuations is crucial. Major economic data releases, such as interest rate announcements and GDP reports, can have profound effects on the rand’s value and overall market sentiment. Staying informed about these events and incorporating them into your trading strategy will empower you to make better informed decisions.

Image: www.forexmarkethours.com

Tips and Expert Advice

- Identify Your Trading Style: Determine whether you prefer scalping, day trading, or longer-term strategies to match your time availability and risk tolerance.

- Choose Trading Sessions Wisely: Based on your strategy, select the trading sessions that best suit your needs. For instance, if you prefer high-volatility trades, the London or New York sessions offer ample opportunities.

- Stay Updated on Economic Events: Regularly monitor economic calendars to stay abreast of upcoming South African and global economic announcements that can influence market movements.

- Control Risk Exposure: Implement prudent risk management techniques such as setting stop-loss orders and limiting your leverage to mitigate potential losses.

- Seek Professional Guidance: Consider consulting with a reputable forex broker or financial advisor to gain personalized guidance and tailor your trading approach to the unique dynamics of South Africa.

Frequently Asked Questions

-

What is the ideal trading session for beginners?

The London session is generally recommended for beginners due to its high volatility and liquidity, enabling traders to enter and exit positions quickly with minimal slippage.

-

How do I stay informed about forex market news?

Subscribe to reputable forex news websites, economic calendars, and social media platforms to receive real-time updates and analysis from market experts.

-

Is it possible to trade forex full-time in South Africa?

Yes, forex trading can be pursued as a full-time occupation in South Africa, but it requires a comprehensive understanding of the market and a disciplined approach to risk management.

Forex Trading Sessions South Africa

Conclusion

Mastering forex trading sessions in South Africa is pivotal for successful trading. By carefully selecting trading sessions that match your strategy and staying abreast of market conditions, you can make informed decisions, maximize profits, and minimize risks. Remember, the forex market is an ever-evolving landscape, so continuous learning and adaptation are essential for sustained success. Engage in further discussions, consult with experts, and be open to exploring different trading strategies to enhance your forex trading journey in South Africa.

Are you ready to embark on an exciting forex trading adventure in South Africa? Let us know your thoughts and inquiries in the comments section below!