Recent Developments in Forex Markets: Navigating Uncharted Waters

Image: bitrebels.com

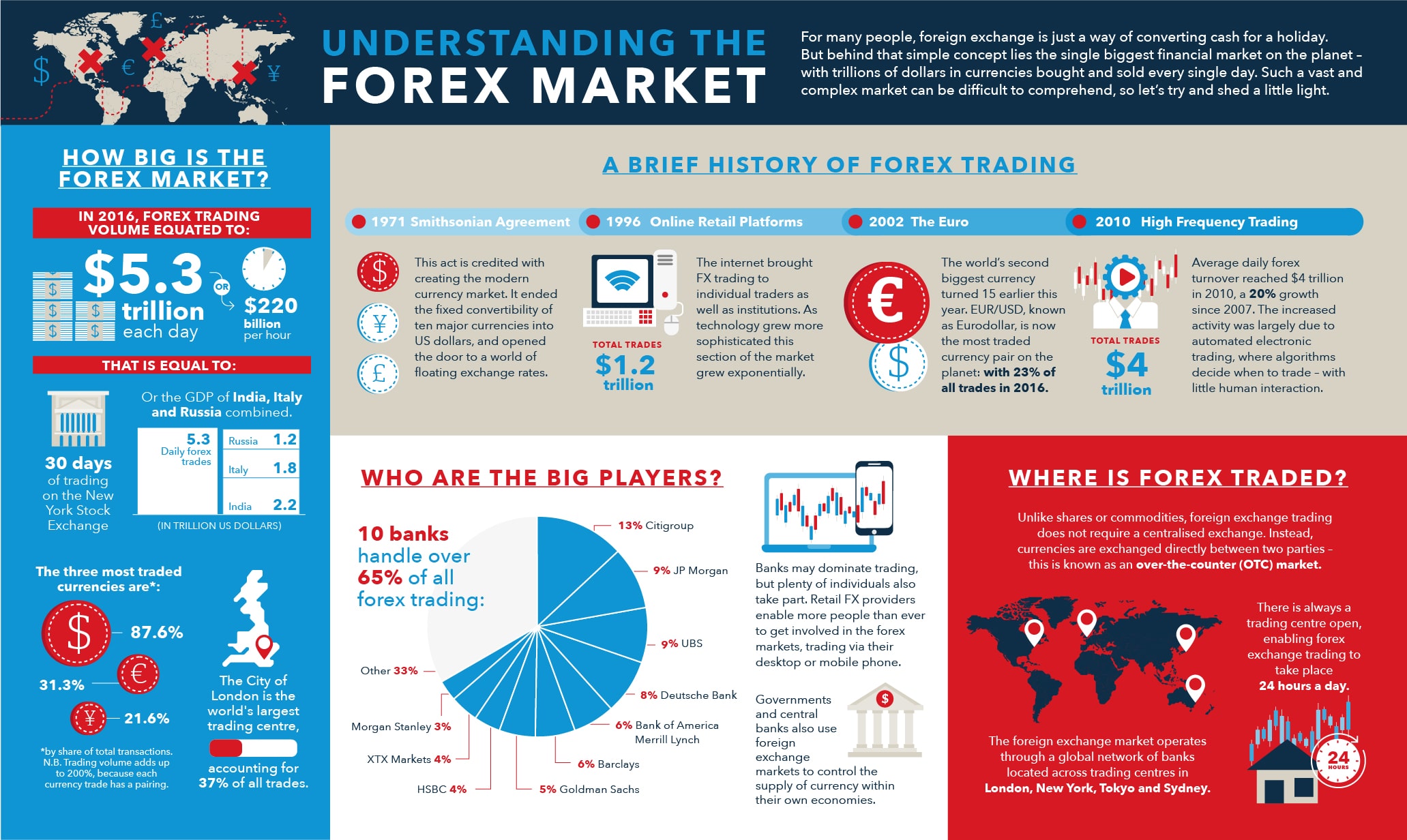

The foreign exchange (forex) market, an ever-evolving landscape where currencies trade hands around the globe, has witnessed a flurry of transformative advancements in recent times. These developments have not only reshaped the way currency trading is conducted but also opened up new opportunities and challenges for traders of all levels.

The Rise of Technology and Algorithmic Trading

The advent of sophisticated trading technologies has revolutionized the forex market. High-frequency algorithmic trading strategies, capable of executing hundreds of trades per second, have gained significant traction. While these algorithmic traders often operate on lightning-fast timescales, their rapid decision-making and ability to process vast amounts of data have been instrumental in increasing market efficiency.

The Growing Influence of Central Banks

Central banks, wielding significant monetary policy powers, have played a pivotal role in shaping forex market dynamics. Their decisions on interest rates and quantitative easing measures have had a profound impact on currency values. This elevated influence has heightened the need for traders to vigilantly monitor central bank announcements and market reactions.

The Rise of Cryptocurrencies

The surge in popularity of cryptocurrencies, such as Bitcoin and Ethereum, has introduced a new dynamic to the forex market. While cryptocurrencies are still in their nascent stages, their rapid growth and potential for integration with traditional fiat currencies have sparked considerable interest among investors and traders alike.

Increased Market Volatility and Uncertainty

The forex market is renowned for its inherent volatility, and recent events have only amplified this trait. Global economic uncertainties, geopolitical tensions, and natural disasters have heightened market fluctuations, presenting both opportunities and risks for traders. Navigating these turbulent waters requires a keen understanding of market dynamics and a prudent risk management approach.

Expert Insights and Actionable Tips

To maximize success in today’s complex forex market, aspiring traders would do well to heed the insights of seasoned professionals:

– Embrace Volatility: Recognize that volatility is an intrinsic characteristic of the forex market. Rather than seeking to avoid it altogether, traders should develop strategies that effectively manage risk and capitalize on market fluctuations.

– Stay Informed: Monitor market news, central bank announcements, and economic data closely. Staying informed about current events and market sentiment is crucial for making informed trading decisions.

– Diversify Your Portfolio: Spread your trades across multiple currency pairs and asset classes. Diversification reduces your risk exposure to any particular asset or market event.

– Practice Risk Management: Set clear stop-loss orders to limit your potential losses on each trade. Discipline and adherence to risk management principles are fundamental to long-term trading success.

Conclusion

The forex market, with its ever-evolving nature, presents both unparalleled opportunities and daunting challenges for traders. By embracing the constant evolution and leveraging the insights of experts, you can navigate the uncharted waters of the forex market with greater confidence and the potential to harness its transformative power. Remember, knowledge is your most formidable weapon in the high-stakes world of currency trading.

Image: www.cmcmarkets.com

Recent Developments In Forex Markets

https://youtube.com/watch?v=QWGzTfGw39Y