The Forex Revolution: Empowering Traders and Shaping the Global Economy

The foreign exchange (forex) market stands as the world’s largest and most liquid financial market, facilitating the conversion of one currency into another. With over $6.6 trillion traded daily, the forex market plays a pivotal role in international trade and investment. In recent times, the forex market has been buzzing with excitement as groundbreaking developments and promising news have emerged. Here, we delve into the best news for the forex market, highlighting opportunities, advancements, and insights that will shape its future.

Image: paxforex.org

Unlocking New Horizons: Technological Advancements Transform Forex Trading

Technological innovation has forever changed the forex trading landscape. The advent of algorithmic trading, artificial intelligence (AI), and cloud-based platforms has revolutionized trade execution, risk management, and market analysis. Algorithmic trading employs sophisticated algorithms to automate trading strategies, capitalizing on market inefficiencies and responding to price fluctuations with lightning speed. AI-powered solutions analyze vast amounts of data, generating insights and predictions that empower traders to make informed decisions. Cloud-based platforms offer remote access to trading platforms, enabling traders to execute trades from anywhere with an internet connection. These technological advancements not only enhance trade efficiency but also democratize access to the forex market, leveling the playing field for traders of all levels.

Regulation and Transparency: Fostering Trust and Integrity in Forex Trading

The forex market has witnessed a wave of regulation in recent years, aimed at enhancing transparency, protecting traders, and mitigating financial crime. Governments and regulatory bodies worldwide have implemented strict measures to combat fraud, ensure market stability, and promote fair practices. Leading forex brokers have adopted rigorous compliance frameworks, adhering to best practices and meeting stringent regulatory requirements. This heightened regulation has bolstered trader confidence and fostered a more transparent and trustworthy trading environment. As a result, traders can trade with greater peace of mind, knowing that their interests are safeguarded.

Rise of Retail Trading: Empowering Individuals in the Forex Market

The forex market has traditionally been dominated by institutional investors and large corporations. However, the advent of user-friendly trading platforms and accessible educational resources has opened the door to retail traders. This surge in retail participation has brought fresh perspectives and strategies to the market. Retail traders can now engage in forex trading with fractional amounts, making it accessible to a wider audience. Brokerages and online resources have dedicated themselves to educating retail traders, equipping them with the knowledge and skills they need to succeed in the forex market. This democratization of the forex market is a testament to the growing inclusivity and adaptability of the financial industry.

Image: forexpronews.com

Economic Recovery and Global Events: Shaping Market Dynamics

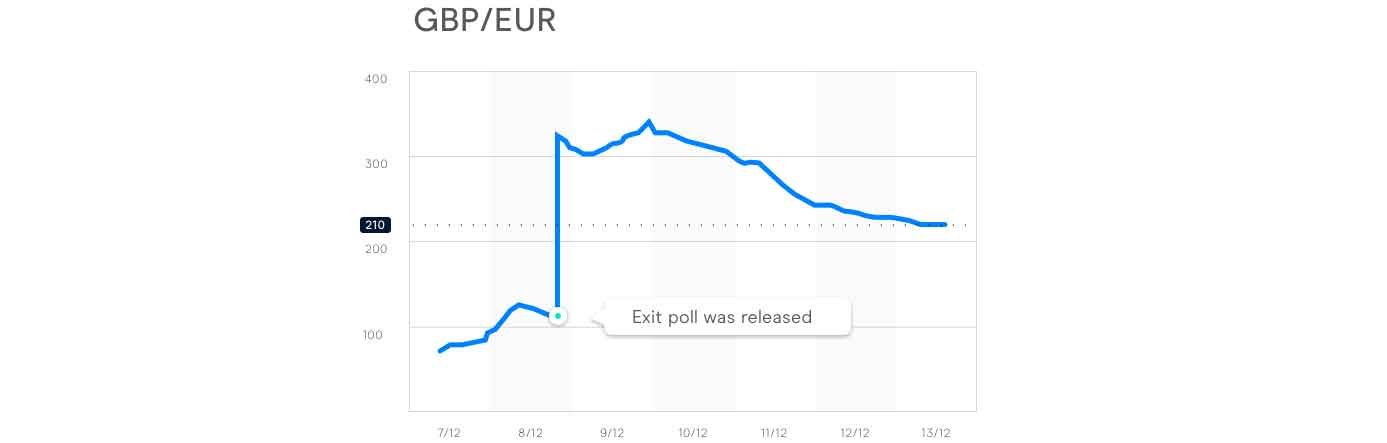

The global economic recovery following the COVID-19 pandemic has had a profound impact on the forex market. Factors such as inflation, interest rate fluctuations, and geopolitical events have contributed to market volatility, creating both opportunities and challenges for traders. The ongoing conflict in Ukraine has influenced currency dynamics, particularly those involving the Euro, Russian Ruble, and Ukrainian Hryvnia. Traders must stay abreast of these macroeconomic developments and geopolitical events to make informed decisions and adapt their strategies accordingly. By monitoring economic indicators and analyzing the potential impact of global events, traders can better navigate market uncertainties and identify profitable trading opportunities.

Innovation in Forex Instruments: Expanding Trading Possibilities

The forex market is constantly evolving, with the introduction of new instruments providing traders with additional ways to speculate on currency movements. Contract for differences (CFDs) and options have gained popularity, offering flexible and sophisticated trading strategies. CFDs allow traders to speculate on price movements without owning the underlying asset, while options provide a way to manage risk and hedge against market volatility. These instruments have expanded the range of trading opportunities available to traders, allowing them to tailor their portfolios to their specific risk appetites and trading preferences.

Best News For Forex Market

Conclusion

The forex market is brimming with optimism and brimming with promising developments. Technological advancements are revolutionizing trading practices, while regulatory measures are enhancing transparency and trust. The surge in retail trading is democratizing the market, making it more accessible than ever before. Economic recovery and global events continue to shape market dynamics, creating opportunities for savvy traders to profit from volatility. With ongoing innovation in forex instruments, the future of the forex market looks bright, presenting traders with a wealth of opportunities to succeed. Embrace the best