Introduction

The dynamic exchange rates between currencies are a cornerstone of global commerce, facilitating the seamless flow of goods and services across borders. Among the myriad currency pairs traded worldwide, the conversion of Canadian dollars (CAD) to Indian rupees (INR) holds significant importance for individuals and businesses alike. HDFC Bank, a leading financial institution in India, offers competitive CAD to INR forex rates, catering to the diverse needs of its customers. In this comprehensive guide, we delve into the intricate dynamics of CAD to INR forex rates at HDFC Bank, exploring their significance, key factors, and strategies for maximizing value.

Delving into CAD to INR Currency Dynamics

The CAD to INR forex rate represents the value of the Canadian dollar relative to the Indian rupee. This rate fluctuates constantly, influenced by a plethora of macroeconomic factors, including economic growth, inflation rates, interest rates, political stability, and global market sentiment. Understanding the underlying drivers behind these fluctuations is crucial for navigating the complexities of currency exchange.

For instance, a period of strong economic growth in Canada, accompanied by higher interest rates compared to India, can lead to an appreciation of the CAD against the INR. Conversely, political instability or unfavorable economic conditions in either country can trigger a depreciation of the respective currency.

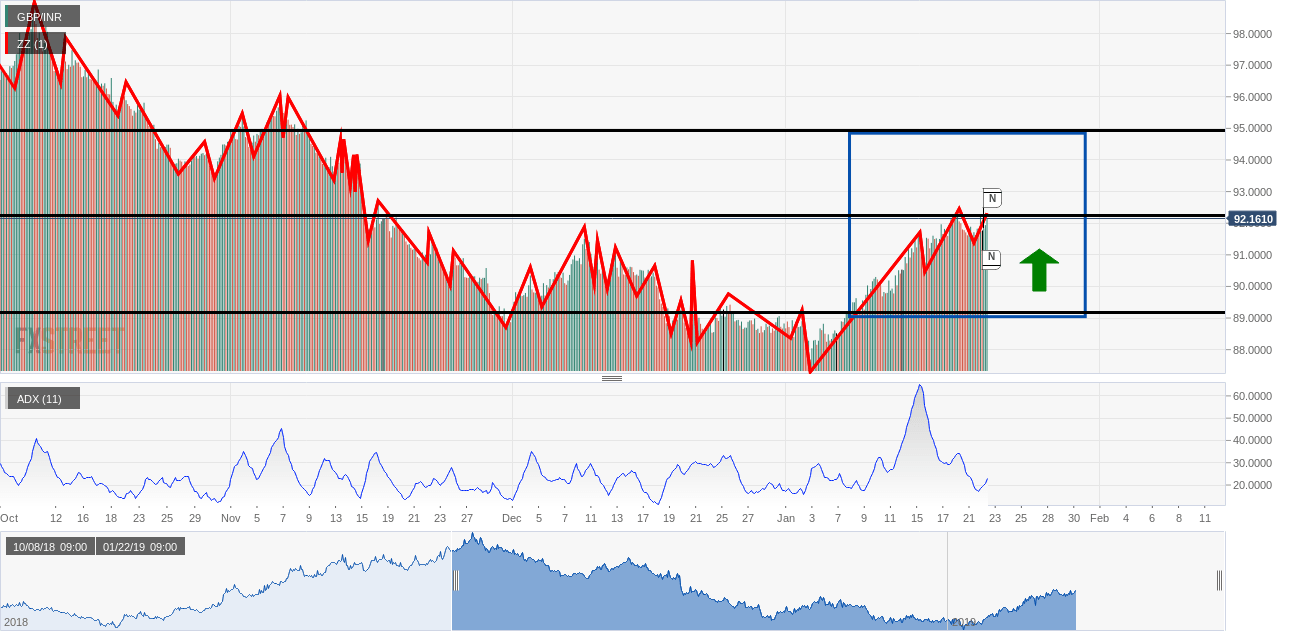

Image: forexrobotcryptocurrency.blogspot.com

Factors Influencing CAD to INR Forex Rates at HDFC Bank

HDFC Bank’s CAD to INR forex rates are determined by various factors, including:

• Real-time Market Conditions:

HDFC Bank closely monitors global currency markets, adjusting its rates in line with prevailing market rates. The bank’s forex desk employs advanced analytical tools and expertise to ensure competitive pricing.

• Bank Spread:

HDFC Bank applies a small spread, or markup, to its forex rates to cover operational costs and generate revenue. The spread varies depending on market conditions and the volume of currency being exchanged.

Image: brasiliacc.blogspot.com

• Service Fees:

In addition to the spread, HDFC Bank may charge a nominal service fee for currency exchange transactions. These fees typically apply to smaller transaction amounts and may vary depending on the method of exchange (online, branch, etc.).

Maximizing Value on CAD to INR Forex Transactions

To get the most favorable CAD to INR forex rates at HDFC Bank, consider the following strategies:

• Monitor Currency Trends:

Stay abreast of economic news and market analysis to understand the factors that may influence CAD to INR fluctuations. This knowledge can help you make informed decisions about when to exchange currencies.

• Compare Rates:

Obtain quotes from multiple banks and online currency exchange platforms to ensure you’re getting the best possible rate. HDFC Bank’s online forex portal provides real-time rate comparisons for various currencies.

• Utilize Online Platforms:

HDFC Bank’s online banking and mobile app allow you to exchange currencies conveniently and potentially secure better rates compared to physical branches.

• Consider Forward Contracts:

If you anticipate a future need for currency exchange, consider locking in a rate today using a forward contract. This can protect you against adverse currency movements in the future.

Cad To Inr Hdfc Forex Rate

Conclusion

Navigating the ever-changing CAD to INR forex rates at HDFC Bank requires a thorough understanding of the underlying factors and strategic decision-making. By monitoring currency trends, comparing rates, utilizing online platforms, and considering forward contracts, individuals and businesses can maximize the value of their currency exchange transactions. HDFC Bank’s commitment to competitive pricing, coupled with its expertise and customer-centric approach, makes it an ideal choice for all your CAD to INR forex needs.