Introduction

In the realm of international finance, foreign exchange (forex) trading plays a pivotal role. Whether you’re an entrepreneur navigating global markets or a traveler embarking on an adventure abroad, understanding the intricacies of forex charges is paramount. In this comprehensive article, we will delve into the landscape of HDFC Bank’s forex trading charges, empowering you with the knowledge to make informed financial decisions.

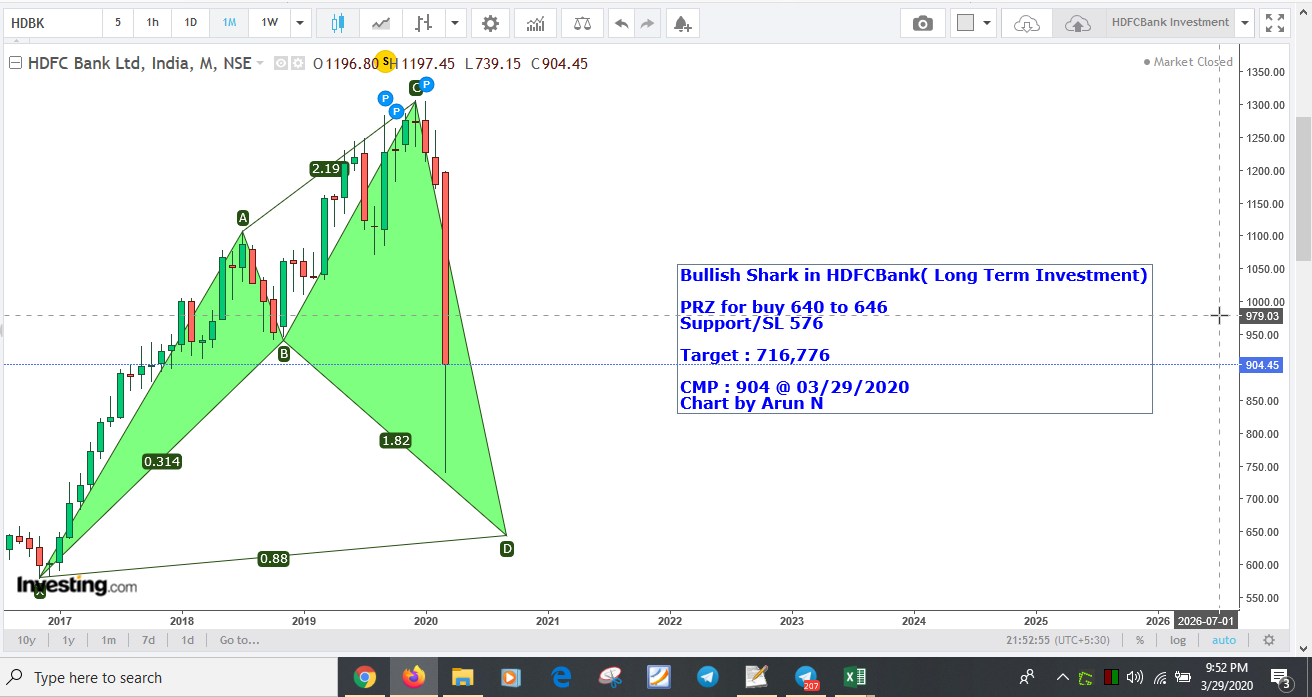

Image: www.tradingview.com

Understanding HDFC Bank’s Forex Trading Charges

HDFC Bank, India’s leading private sector bank, offers a wide range of forex services, including currency exchange, foreign travel cards, and international remittances. For individuals and businesses engaging in forex transactions, the bank levies certain charges to cover operational costs and maintain exchange rate margins.

The charges associated with HDFC Bank’s forex trading primarily comprise service fees, spreads, and transaction fees. Service fees are a fixed amount charged for specific services, such as demand drafts or inward remittances. Spreads refer to the difference between the buying and selling rates offered by the bank, enabling it to generate profit. Transaction fees are applicable to international wire transfers and may vary depending on the destination and transaction amount.

Factors Influencing HDFC Bank’s Forex Trading Charges

Several factors influence the forex trading charges set by HDFC Bank, including:

-

Market Volatility: Currency fluctuations in the global forex market can impact the bank’s pricing strategy. Higher volatility may lead to wider spreads.

-

Transaction Volume: Larger transaction amounts may qualify for negotiated rates or reduced fees.

-

Regulatory Environment: HDFC Bank’s charges are subject to regulations and compliance requirements set by the Reserve Bank of India (RBI).

Making Informed Forex Trading Decisions

Navigating the world of forex trading requires a keen understanding of the charges involved. Here are a few tips to make informed decisions when dealing with HDFC Bank’s forex services:

-

Compare Spreads: Compare the spreads offered by HDFC Bank with those of other banks or currency exchange providers to secure the most competitive rates.

-

Negotiate Fees: For high-volume transactions, consider negotiating with HDFC Bank to obtain reduced service fees or favorable exchange rates.

-

Utilize Online Platforms: HDFC Bank’s online forex trading platform allows for real-time tracking of currency rates and transaction execution, providing transparency and convenience.

Image: www.harmonicstraders.com

Benefits and Drawbacks of Using HDFC Bank for Forex Trading

Benefits:

-

Extensive Network: HDFC Bank’s vast network of branches and ATMs worldwide ensures easy access to forex services.

-

Competitive Rates: The bank offers competitive spreads and exchange rates, particularly for large transactions.

-

Reliable Customer Support: HDFC Bank’s dedicated customer support team assists with inquiries and troubleshooting, providing peace of mind.

Drawbacks:

-

Service Fees: Some forex services, such as demand drafts, incur a fixed service fee.

-

Transaction Fees: International wire transfers may attract transaction fees, which can add up for frequent transactions.

-

Limited Foreign Currencies: HDFC Bank may not offer all foreign currencies, limiting exchange options for certain destinations.

Hdfc Bank Trade Forex Charges

https://youtube.com/watch?v=nC1NZtzL4bo

Conclusion

Understanding the dynamics of HDFC Bank’s forex trading charges empowers individuals and businesses to make well-informed financial decisions. By carefully considering factors such as market volatility, transaction volume, and regulatory requirements, you can optimize your forex transactions and maximize the value of your foreign exchange operations. For further guidance, consult with financial advisors or explore HDFC Bank’s online resources to stay abreast of the latest forex trends and market movements.