When it comes to forex trading, the spread is one of the most important factors to consider. It can affect your profitability, as well as your overall trading strategy. In this article, we will take a look at what spread is, how it works, and how it can affect your forex trading.

Image: www.cmcmarkets.com

What is Spread in Forex?

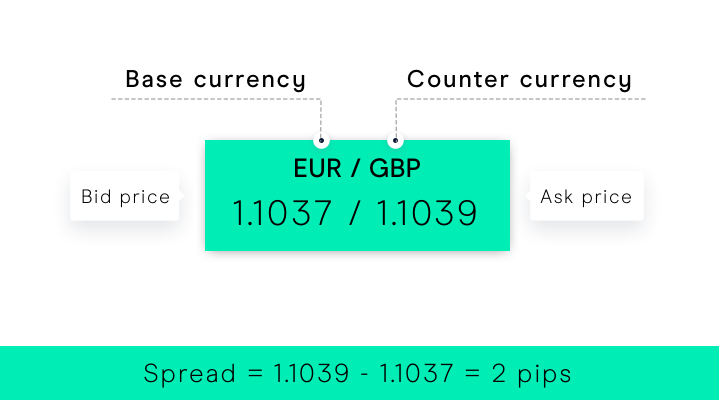

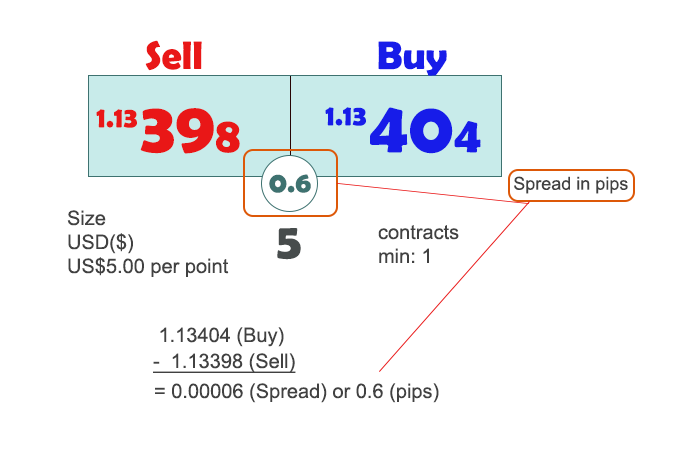

The spread in forex is the difference between the bid price and the ask price. The bid price is the price at which you can sell a currency pair to your broker, while the ask price is the price at which you can buy a currency pair from your broker. The spread is usually expressed in pips, which are the smallest unit of measurement in forex.

For example, if the bid price for the EUR/USD currency pair is 1.1110 and the ask price is 1.1115, then the spread would be 5 pips. This means that for every $100,000 worth of EUR/USD that you trade, you will pay $5 in spread.

How Does Spread Affect Forex Trading?

The spread can affect your forex trading in a number of ways. First, it can affect your profitability. The wider the spread, the more you will pay in trading costs. This can reduce your overall profits, especially if you are a scalper or day trader who makes many trades in a short period of time.

Second, the spread can affect your trading strategy. If you are using a strategy that relies on tight spreads, then you may need to adjust your strategy if the spreads are wider than you expected. For example, if you are using a scalping strategy that relies on entering and exiting trades quickly, then you may need to adjust your trading strategy if the spreads are too wide.

How to Minimize the Impact of Spread in Forex

There are a number of things that you can do to minimize the impact of spread in forex. First, you can choose a broker with tight spreads. There are a number of brokers that offer tight spreads, so it is important to shop around to find the best deal.

Second, you can avoid trading during times of high volatility. The spread is usually wider during times of high volatility, so it is best to avoid trading during these times if possible.

Third, you can use a trading strategy that does not rely on tight spreads. If you are using a strategy that relies on tight spreads, then you may need to adjust your strategy if the spreads are wider than you expected.

Image: www.dailyforex.com

How Does Spread Affect Forex

Conclusion

The spread is an important factor to consider when trading forex. It can affect your profitability, as well as your overall trading strategy. By understanding how the spread works and how to minimize its impact, you can improve your overall forex trading experience.