In the intricate realm of global finance, time plays a pivotal role in shaping market dynamics and facilitating seamless transactions. Witness the convergence of the world’s two largest financial hubs, London and New York, where the overlap of their trading sessions creates a unique symphony of market activity.

Image: community.ig.com

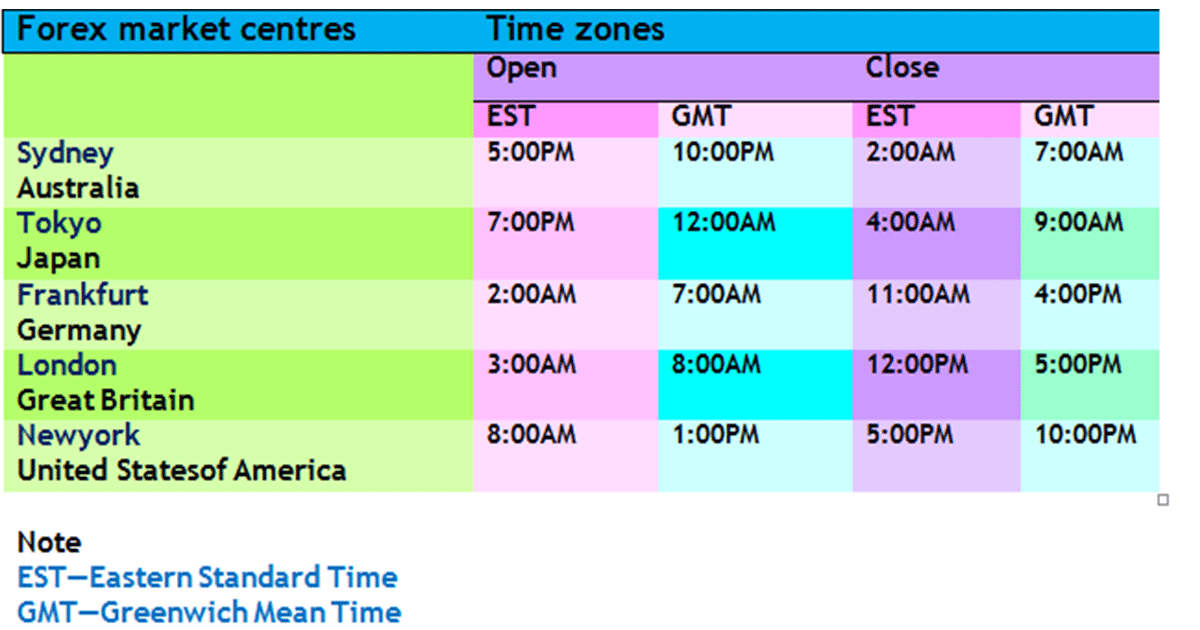

The London Stock Exchange and the New York Stock Exchange, colossal bastions of financial power, open their doors at distinct times, giving rise to a harmonized market rhythm that spans the Atlantic. London’s trading session commences at 8:00 am GMT, while New York’s day begins at 9:30 am EST. This overlap, lasting for four hours, forms a fertile trading ground for currency traders worldwide, offering unparalleled liquidity and opportunity.

An Overlap of Opportunities

The New York session, notorious for its dynamic price movements, kick-starts the day, setting the tone for global forex markets. As New York traders settle into their rhythm, the tempo gradually increases, inviting participation from the powerhouse financial institutions and central banks that call the city home. The overlap with London’s session amplifies the activity, as traders from both sides of the pond interact, exchanging currency pairs and shaping market trends.

During this shared trading period, liquidity surges, making it easier for traders to enter and exit positions with minimal slippage. Volume swells, providing tighter spreads and more competitive pricing, enticing traders of all levels. The symphony reaches its crescendo at noon EST, a time when traders from both regions converge in a frenetic dance of buy and sell orders, pushing market volatility to its peak.

A Time-Sensitive Advantage

The overlap of London and New York trading sessions not only provides ample liquidity and reduced trading costs but also offers a key advantage: time-sensitive trading opportunities. As the day progresses, economic news and events from both sides of the Atlantic are released, potentially triggering swift market reactions. Traders who are attuned to these time-sensitive events can capitalize on volatility, potentially reaping significant rewards.

Experienced traders monitor economic calendars, eagerly awaiting key releases that can influence currency pair prices. For instance, the release of the Non-Farm Payroll numbers in the US or the Bank of England’s interest rate decision can send shockwaves through the forex markets. Being present during these opportune moments can empower traders to make informed decisions and ride the waves of market sentiment.

A Microcosm of Global Finance

The overlapping trading sessions of London and New York serve as a microcosm of the interconnectedness of global finance. Traders from diverse cultures, speaking different languages, yet united by a shared pursuit of profit, converge in this virtual marketplace. The symphony of market activity transcends geographical boundaries, creating a tapestry of financial interaction that mirrors the ebb and flow of the world’s economies.

As the London session winds down, passing the baton to New York, the trading day continues, uninterrupted by the setting sun. The flow of capital shifts across the Atlantic, but the intensity of the market never truly wanes. The overlap of these two financial giants ensures that the forex markets are always alive, always in motion, a perpetual symphony of currency exchange.

Image: freeforexcoach.com

London New York Overlap Forex Time

https://youtube.com/watch?v=pyUk-cEZpXA

Conclusion

The overlapping forex markets of London and New York are a testament to the power of collaboration and the interconnectedness of the global financial landscape. This harmonious overlap provides traders with unparalleled liquidity, competitive pricing, and time-sensitive trading opportunities. Whether you’re a seasoned veteran or a novice dipping your toes in the forex waters, the London-New York overlap beckons you to embrace its rhythmic dance and seek your fortune amidst the ebb and flow of the currency tides.