Navigating foreign lands often requires a trusted financial companion. Enter Axis Bank’s Forex Card, a traveler’s haven that empowers you to explore the world with financial flexibility and peace of mind. In this comprehensive guide, we will delve deep into the Axis Bank Forex Card limit, unraveling its transformative benefits, discerning its significance, and exploring the latest updates and expert tips to maximize your overseas adventures.

Image: robotforexkaskus.blogspot.com

Global Currency at Your Fingertips

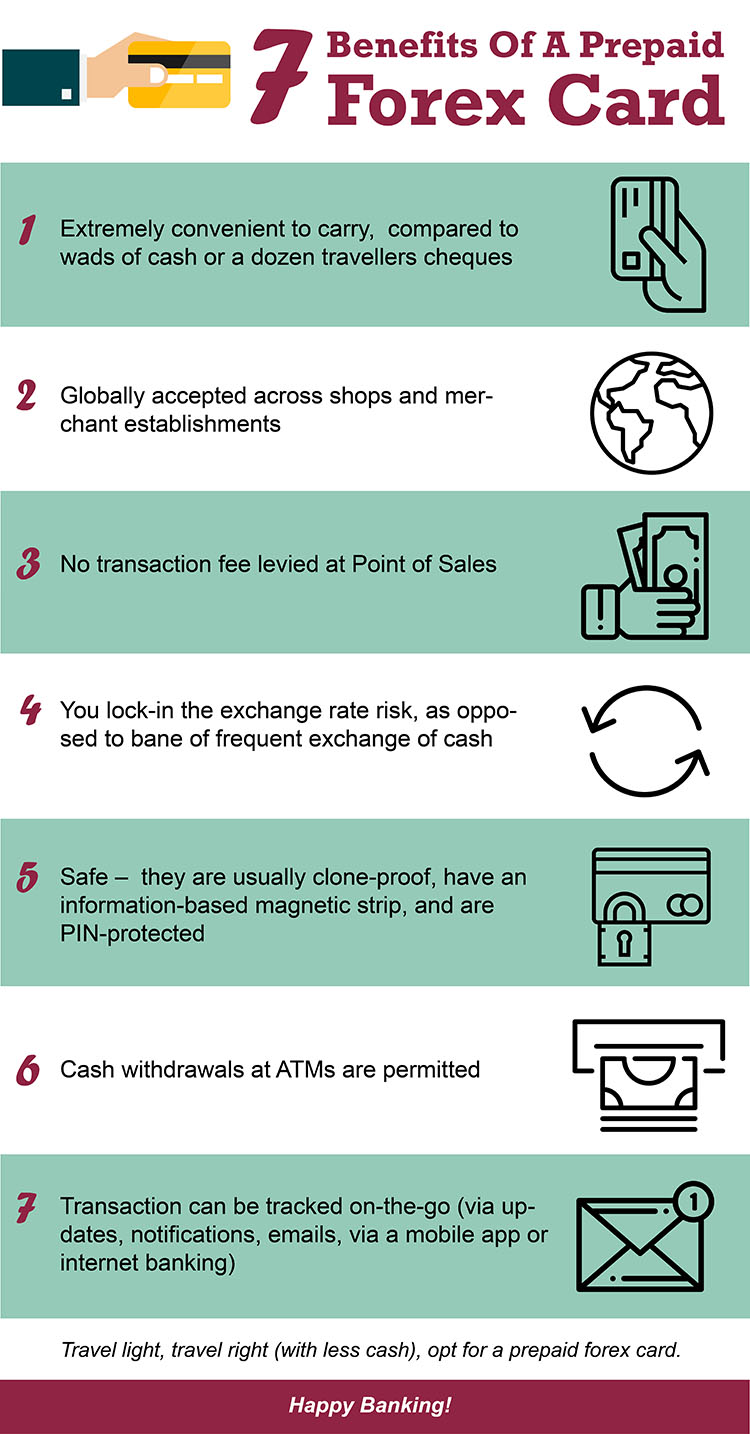

An Axis Bank Forex Card is akin to a financial passport, granting you seamless access to foreign currencies anytime, anywhere. This prepaid card is a cornerstone of international travel, allowing you to make purchases, withdraw cash, and exchange currencies at competitive rates. With its widespread acceptance at millions of ATMs and merchants globally, the Axis Bank Forex Card empowers you to traverse diverse destinations with unparalleled financial convenience.

Unveiling Axis Bank’s Forex Card Limit

The Axis Bank Forex Card limit plays a pivotal role in shaping your travel experience. It determines the maximum amount you can load onto your card and subsequently spend during your trip. Understanding the limit is crucial for prudent financial planning and avoiding any unforeseen surprises.

Factors Influencing the Forex Card Limit

The Forex Card limit can vary depending on several factors:

- Customer Profile: Your income, creditworthiness, and travel history impact the limit assigned to you.

- Destination: The limit may vary based on the country you’re visiting due to currency regulations and market dynamics.

- Currency: Different currencies may have varying load limits based on their exchange rates and market availability.

Image: www.ankuraggarwal.in

Types of Forex Card Limits

Axis Bank offers two primary Forex Card limits:

- Daily Limit: This refers to the maximum amount you can spend per day on your card.

- Overall Limit: This signifies the total amount you can load onto your card for the duration of your trip.

Empowering Your Forex Card Experience

Maximizing your Axis Bank Forex Card experience entails strategic planning and astute usage. Here are some expert tips:

- Ascertain Your Limit: Contact Axis Bank prior to your departure to confirm your Forex Card limit and ensure it aligns with your anticipated expenses.

- Load Wisely: Load your card with an amount that sufficiently covers your estimated expenses while avoiding excessive funds.

- Monitor Your Transactions: Keep track of your spending through SMS alerts or online banking to avoid exceeding your limit.

- Seek Assistance: If you encounter any issues or need to increase your limit, reach out to Axis Bank’s 24/7 customer support for prompt assistance.

Expert Advice for Astute Card Utilization

To optimize your Forex Card usage, consider these expert recommendations:

- Avoid Cash Withdrawals: Cash withdrawals generally incur higher fees than currency exchanges.

- Maximize Currency Exchange Rates: Monitor currency fluctuations and exchange currencies when rates are favorable.

- Leverage Airport Exchanges: Airport currency exchange counters often offer competitive rates.

- Embrace Digital Payments: Utilize digital wallets or mobile banking to make payments seamlessly and securely.

Frequently Asked Questions (FAQs)

To address common queries regarding Axis Bank Forex Card limits, we present a comprehensive Q&A section:

- Q: What is the maximum overall limit on an Axis Bank Forex Card?

- A: The overall limit varies based on customer profile and destination but typically ranges from ₹2 lakhs to ₹10 lakhs.

- Q: Can I increase my Forex Card limit?

- A: Yes, you can request an increase by contacting Axis Bank and providing supporting documentation, such as income proof or a travel itinerary.

- Q: What happens if I exceed my Forex Card limit?

- A: Transactions exceeding the limit may be declined, potentially causing inconvenience. Avoid exceeding the limit by carefully monitoring your expenses.

- Q: How can I check my Forex Card limit?

- A: You can check your limit through Axis Bank’s mobile banking app, online banking portal, or by contacting customer support.

Axis Bank Forex Card Limit

Conclusion

Navigating the world with an Axis Bank Forex Card is an empowering experience, unlocking