Immerse yourself in a boundless trading arena where opportunities soar and profits multiply – welcome to the realm of forex brokers with maximum lot sizes. Join me as we delve into this pivotal aspect of forex trading, unveiling its significance and empowering you with the knowledge to navigate this dynamic market. Brace yourself for an exhilarating exploration that will redefine your trading horizons.

Image: www.youtube.com

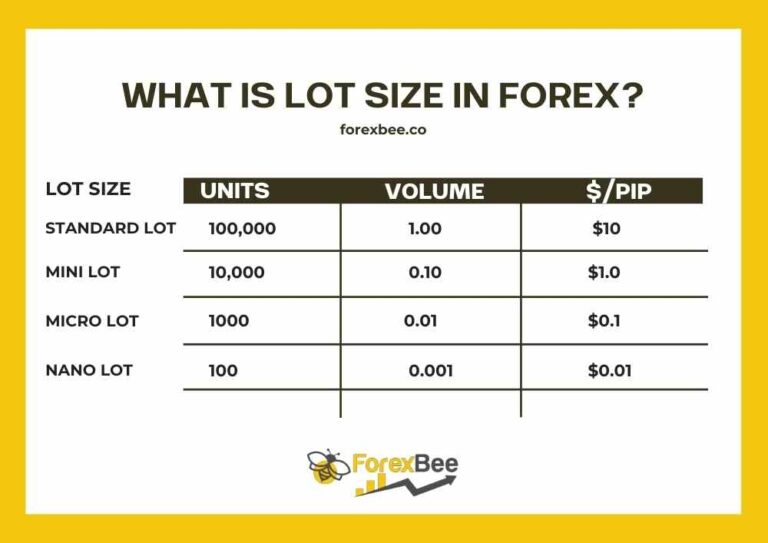

Within the multifaceted world of forex, lot sizes stand as the cornerstone of trade volume, dictating the number of units traded in a single transaction. Understanding the concept of maximum lot sizes is akin to unlocking the gateway to unrestricted trading potential – it empowers you to execute trades of unparalleled magnitude, aligning with your ambitious trading aspirations.

Maximum Lot Sizes: The Key to Unlocking Limitless Opportunities

The beauty of maximum lot sizes lies in their unparalleled ability to cater to traders of all levels, from risk-averse novices to seasoned market veterans. Whether you seek to dip your toes in the trading waters with smaller positions or dive headfirst into leviathan-sized trades, there’s a maximum lot size out there to match your trading appetite.

For fledgling traders, the prudence of limiting lot sizes cannot be overstated. By starting small, you mitigate potential losses while honing your skills and gaining familiarity with the ebb and flow of the market. Seasoned traders, on the other hand, can leverage the power of maximum lot sizes to amplify their profit potential, capitalizing on favorable market movements with amplified trading power.

Comprehensive Guide to Forex Broker Maximum Lot Sizes

To fully grasp the significance of maximum lot sizes, a comprehensive understanding of their definition, history, and implications is essential. Let’s embark on an educational journey to unravel the complexities of this pivotal trading concept.

Definition: Delving into the Essence of Maximum Lot Sizes

In forex trading, a lot represents a standardized unit of currency, typically set at 100,000 units. Maximum lot sizes, as the name suggests, impose an upper limit on the number of lots that can be traded in a single transaction. This limit varies across brokers, ranging from a few micro-lots to several standard lots, providing traders with a flexible range to choose from.

Image: forexbee.co

Historical Evolution: Tracing the Origins of Maximum Lot Sizes

The concept of maximum lot sizes has evolved over time, mirroring the dynamic nature of the forex market. In the early days of retail forex trading, lot sizes were often much larger, with some brokers offering up to 100 standard lots per trade. However, as the market matured and regulatory frameworks were introduced, maximum lot sizes were gradually reduced to enhance risk management and protect traders.

Today, maximum lot sizes typically range from 50 standard lots to 100 standard lots, providing a sufficient level of flexibility for traders while ensuring responsible trading practices. However, it’s important to note that maximum lot sizes can vary significantly between brokers, so it’s crucial to research and compare before selecting a trading platform.

Implications: Unraveling the Impact of Maximum Lot Sizes

Maximum lot sizes have profound implications for both risk management and profit potential. Understanding these implications is paramount for traders seeking optimal trading outcomes.

- **Risk Management:** Maximum lot sizes act as a safety net, preventing traders from overleveraging their positions and exposing themselves to excessive risk. By limiting the maximum number of lots that can be traded, brokers help traders maintain a prudent risk profile and avoid catastrophic losses.

- **Profit Potential:** While maximum lot sizes may limit the trading volume in certain instances, they also enhance profit potential for experienced traders. By allowing traders to execute trades of significant size, maximum lot sizes amplify the potential returns on successful trades, particularly during periods of market volatility.

Tips and Expert Advice for Navigating Maximum Lot Sizes

To maximize your trading experience and harness the full potential of maximum lot sizes, consider incorporating these valuable tips and expert advice into your trading strategy.

Tips for Effective Utilization of Maximum Lot Sizes

1. **Risk Management First:** Always prioritize risk management when determining the appropriate lot size for your trades. Assess your risk tolerance, account balance, and trading strategy before selecting a lot size.

2. **Gradual Progression:** Avoid jumping into the deep end by trading maximum lot sizes from the get-go. Gradually increase your lot size as you gain experience and confidence in the market.

3. **Market Volatility Considerations:** Monitor market volatility and adjust your lot size accordingly. During periods of low volatility, you can afford to trade larger lot sizes, while in highly volatile markets, it’s wise to reduce your position size.

Expert Advice for Enhancing Trading Performance

1. **Expert Opinion on Maximum Lot Sizes:**

“Maximum lot sizes can be a powerful tool for experienced traders, providing the leverage necessary to amplify profits during favorable market conditions. However, it’s crucial to approach maximum lot sizes with caution and a sound understanding of risk management principles.” – John Carter, renowned trader and author

2. **Importance of Research and Education:**

“Before venturing into maximum lot size trades, it’s imperative to conduct thorough research on the broker, market conditions, and your own trading strategy. Education is the key to making informed decisions and minimizing risk.” – Mark Douglas, trading psychologist and performance coach

Frequently Asked Questions (FAQs) on Forex Broker Maximum Lot Sizes

To solidify your understanding of maximum lot sizes, let’s address some commonly asked questions and provide clear and concise answers.

**Q: Why do forex brokers impose maximum lot sizes?**

A: Maximum lot sizes serve multiple purposes, including risk management for traders, prevention of excessive leverage, and compliance with regulatory requirements.

**Q: How can I determine the maximum lot size for my trades?**

A: To determine the appropriate maximum lot size, consider your risk tolerance, account balance, trading strategy, and market volatility.

**Q: What are the benefits of using maximum lot sizes?**

A: Maximum lot sizes allow for higher trading volume and increased profit potential, especially during periods of favorable market conditions.

**Q: What are the risks associated with maximum lot sizes?**

A: Trading maximum lot sizes amplifies potential losses, making it crucial to employ sound risk management practices and avoid overleveraging.

Forex Broker Maximum Lot Size

Conclusion: Embracing the Limitless Possibilities

In the world of forex trading, maximum lot sizes stand as a testament to the boundless opportunities that await traders of all levels. Whether you navigate the markets with caution or embrace audacious trading strategies, understanding and leveraging maximum lot sizes can empower you to unlock limitless trading horizons.

Are you ready to transcend limits and delve into the realm of maximum lot sizes? Embrace the power of this trading concept, harness the potential for exceptional returns, and embark on a journey of financial liberation. The limitless possibilities await your discovery – seize the moment and conquer the forex market.