In the ever-evolving tapestry of the global economy, currencies engage in a ceaseless ballet, their values rising and falling in a delicate interplay. One such dance is that of the Indian Rupee (INR) and the Australian Dollar (AUD), two currencies whose destinies are intertwined through the intricate threads of the foreign exchange (forex) market.

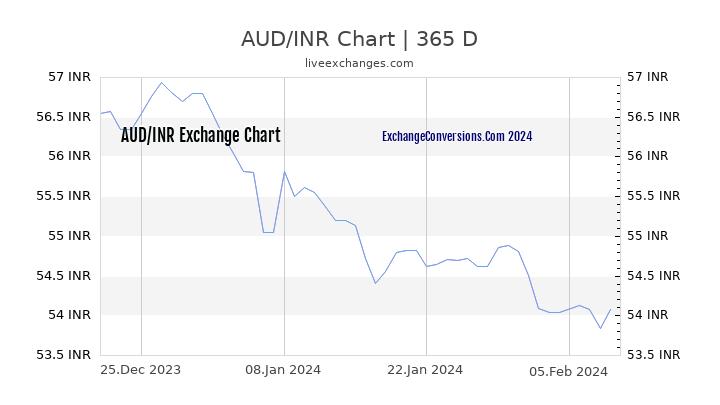

Image: aud.exchangeconversions.com

Delving into the intricacies of this currency pair, we uncover a world of fluctuations, influences, and opportunities. From the bustling trading floors of Mumbai to the vibrant streets of Sydney, the INR-AUD exchange rate serves as a barometer of economic sentiment, political events, and the ebb and flow of global trade.

Exploring the Forex Market: The Stage for Currency Exchange

The forex market, often hailed as the world’s largest financial market, is a vast and dynamic arena where currencies are constantly traded. This decentralized marketplace facilitates the conversion of one currency into another, enabling businesses, investors, and individuals to engage in global commerce and manage currency risk.

Within this sprawling market, specific currency pairs, such as INR to AUD, become focal points for traders and investors. The value of one currency relative to another is expressed through the exchange rate, which fluctuates incessantly in response to a myriad of factors.

Unveiling the Determinants of the INR-AUD Exchange Rate

The INR-AUD exchange rate is a complex interplay of economic indicators, political developments, and market sentiment. Key factors shaping its trajectory include:

-

Interest Rates: Central bank policy decisions regarding interest rates exert a significant influence on currency values. Higher interest rates tend to strengthen a currency, attracting foreign investment seeking higher returns.

-

Inflation: Differences in inflation rates between India and Australia can impact the exchange rate. Higher inflation in India relative to Australia could erode the value of the INR, making AUD relatively stronger.

-

Economic Growth: A country’s economic growth prospects influence the demand for its currency. Strong economic growth in India could boost the value of INR, while a slowdown in Australia could weaken the AUD.

-

Political Stability: Political turmoil or uncertainty can adversely affect currency values. Stable political environments foster confidence in a currency, whereas instability can diminish its appeal.

Impact of INR-AUD Exchange Rate on Trade and Investment

Fluctuations in the INR-AUD exchange rate have tangible implications for trade and investment between India and Australia. When the INR is weaker against the AUD, Indian exports to Australia become more competitive, and Australian goods and services become more expensive for Indian consumers. Conversely, when the INR is stronger, Australian exports to India become more attractive, and Indian goods become pricier for Australian consumers.

Investors also closely monitor the INR-AUD exchange rate to gauge the potential impact on their investments. A depreciating INR can erode the value of Indian stocks and bonds held by Australian investors, while a strengthening INR can boost returns.

Image: www.gigo-ice.org

Navigating the Forex Market: Tips for Individuals and Businesses

Understanding the dynamics of the forex market empowers individuals and businesses to make informed decisions. For those engaging in international trade, currency fluctuations can have a direct impact on profit margins. It is prudent to stay abreast of market trends and to consider hedging strategies to mitigate currency risk.

Individual investors can also leverage the forex market to diversify their portfolios, reduce risk, and potentially enhance returns. However, currency trading carries inherent risks, and investors should approach it with caution and seek professional guidance where necessary.

Forex Rate Inr To Aud

Conclusion: The Ongoing Saga of the INR-AUD Exchange Rate

The INR-AUD exchange rate is a microcosm of the global economic landscape, reflecting the delicate dance of currencies. Its fluctuations are shaped by a complex interplay of economic forces, political developments, and market sentiment. By understanding the determinants of the exchange rate, individuals and businesses can navigate the forex market with greater confidence and make informed decisions to maximize opportunities and mitigate risks. As the world continues to evolve, the INR-AUD exchange rate will remain a captivating subject of observation and analysis, offering insights into the ever-changing tapestry of the global economy.