Unveiling the Vastness of a Global Trading Arena

The foreign exchange market, commonly known as Forex or FX, is an immense and ever-evolving global network where currencies are traded. This dynamic arena attracts countless individuals, from retail traders to institutional players, propelling it to become the largest and most liquid financial market worldwide. In this comprehensive exploration, we embark on a quest to uncover the true extent of Forex participation: just how many Forex traders populate this vast financial landscape?

Image: www.youtube.com

Delving into the Forex Phenomenon

Forex trading, at its core, entails the exchange of one currency for another, seeking to capitalize on fluctuations in exchange rates. Unlike the stock market, which operates on centralized exchanges, Forex transactions occur over-the-counter, involving a decentralized network of banks, brokers, and other financial institutions. This decentralized nature, coupled with the Forex market’s 24-hour accessibility, has fostered a global trading community that transcends geographical boundaries.

The Allure of Forex: Accessibility and Opportunity

The allure of Forex trading lies in its accessibility, empowering individuals from all walks of life to participate in the financial markets. Online trading platforms, with their user-friendly interfaces and low entry barriers, have democratized access to Forex, removing traditional hurdles that once restricted trading to select few. This widespread accessibility has fueled exponential growth in the number of Forex traders worldwide.

Unveiling the Numbers: A Global Panorama

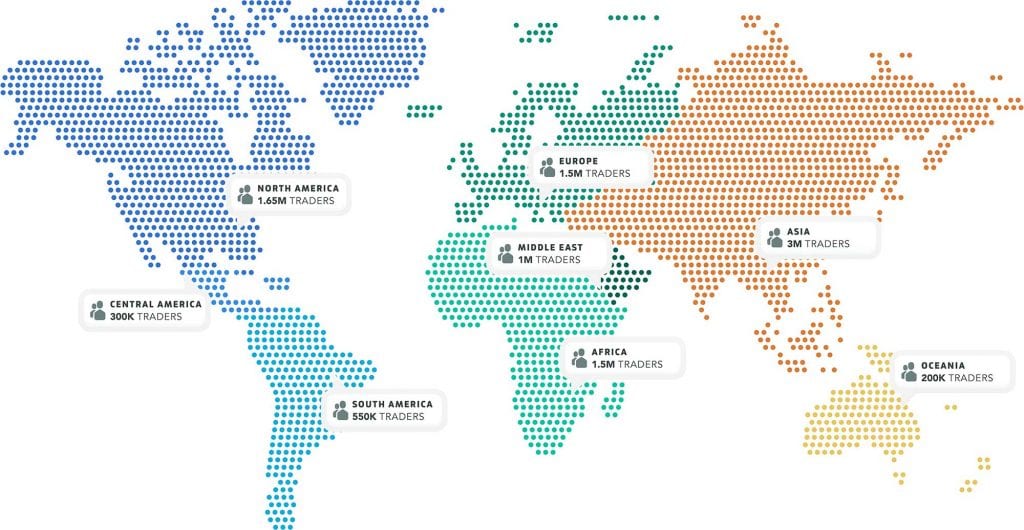

Accurately gauging the precise number of Forex traders globally poses a challenge due to the market’s decentralized nature. Estimates vary, but credible sources suggest that the number of retail Forex traders alone exceeds 10 million worldwide. Moreover, institutional players, including banks, hedge funds, and asset managers, account for a substantial share of Forex trading volume.

The Retail Trader Landscape: A Thriving Ecosystem

Within the vast Forex trading universe, retail traders constitute a significant contingent. These individuals trade currencies using their own capital, ranging from casual enthusiasts to astute professionals. While retail traders may account for a smaller portion of overall trading volume, their sheer numbers and diversity inject vibrancy into the Forex market.

Institutional Dominance: Whales of the Forex Sea

Institutional entities, such as banks, hedge funds, and asset managers, are the proverbial whales of the Forex market, commanding substantial trading power. Their deep pockets, sophisticated trading strategies, and access to advanced technologies give them an edge in executing large-scale transactions.

The Future of Forex: Continued Growth and Innovation

The Forex market is poised for continued growth, driven by technological advancements, favorable economic conditions, and an ever-expanding pool of traders. As the world becomes increasingly interconnected and financial markets evolve, Forex trading is destined to remain a lucrative and dynamic arena.

Image: www.asktraders.com

How Many Forex Traders In The World