Entering the forex market can be a lucrative opportunity, but maximizing your profits relies on understanding the best trading times. In South Africa, identifying the optimal trading hours is crucial due to the country’s unique market dynamics and time zone difference from major financial centers.

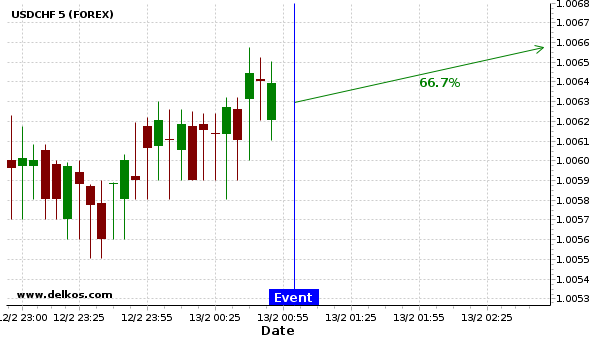

Image: forexengulfingcandletradingmethod.blogspot.com

Navigating the Time Zones for Optimal Trading

South Africa adheres to South African Standard Time (SAST), which is two hours ahead of Coordinated Universal Time (UTC). This time difference has implications for forex trading, as major market sessions in London and New York occur during specific intervals in SAST:

- London Session (08:00 – 17:00 SAST): Characterized by high liquidity and volatility as European traders become active.

- New York Session (14:00 – 21:00 SAST): The peak liquidity period, as American traders join the market.

The overlap between the London and New York sessions, known as the “European-American overlap” or “New York open,” is particularly significant. During this period (14:00 – 17:00 SAST), market activity surges, liquidity is at its highest, and trading opportunities multiply.

Capitalizing on Market Volatility

The volatility of a currency pair measures its price fluctuations over time. During periods of high volatility, traders have greater potential for profit but also face increased risk. South African forex traders should target trading during the most volatile periods, which typically occur during major market sessions:

- London Open (08:00 – 09:00 SAST): Influenced by economic data releases and breaking news from Europe.

- London-New York Overlap (14:00 – 17:00 SAST): Boosted by the confluence of European and American market activity.

li>New York Close (20:00 – 21:00 SAST): Driven by position adjustments and profit-taking before the market closes.

Expert Tips for South African Forex Traders

To optimize your forex trading experience in South Africa, consider implementing these expert tips:

- Prioritize Major Market Sessions: Concentrate your trading during the London and New York sessions for maximum liquidity and volatility.

- Monitor Economic Events: Stay informed about upcoming economic announcements and news events that may impact market sentiment and volatility.

- Manage Risk Effectively: Employ proper risk management strategies such as stop-loss orders and position sizing to mitigate potential losses.

- Use Technical Analysis: Analyze price charts using technical indicators to identify trading opportunities and predict market trends.

- Stay Updated: Keep abreast of market news, research reports, and expert insights to make informed trading decisions.

Image: isycihe.web.fc2.com

Frequently Asked Questions (FAQs)

Q: What are the advantages of trading forex during major market sessions?

A: Increased liquidity, higher volatility, and a wider range of trading opportunities.

Q: How do I determine the optimal trading times for South Africa?

A: Convert the session times from UTC to SAST using an online time zone converter.

Q: Is it possible to trade forex outside of major market sessions?

A: Yes, but liquidity and volatility may be lower, making it riskier and less profitable.

Best Time To Trade Forex In South Africa

https://youtube.com/watch?v=FfYMIhxG-1g

Conclusion

Understanding the best time to trade forex in South Africa is crucial for maximizing profits and minimizing risks. By strategically navigating the time zone differences and capitalizing on major market sessions and periods of high volatility, South African traders can increase their chances of success in the dynamic forex market. Are you ready to embark on your forex trading journey and conquer the markets?