Title: Master the Forex Lot Size: The Key to Maximizing Trades and Mitigating Risk

Image: forexearlywarningtrading.blogspot.com

Navigating the intricate realm of forex trading requires an astute understanding of its fundamental concepts. Among these, the enigmatic “lot size” holds immense significance, shaping the potential profits and risks of every trade. In this comprehensive guide, we embark on an enlightening journey to unravel the meaning of lot size in forex, empowering you with the knowledge to leverage this critical factor for optimal trading outcomes.

Unveiling the Essence of Lot Size

In the dynamic world of forex, a lot represents a predefined unit or quantity of currency. It serves as the standard measure for trades, allowing traders to standardize transaction sizes and facilitate market operations. Typically, a standard lot equals 100,000 units of a specific currency, although it varies in certain circumstances.

The Power and Peril of Lot Sizes

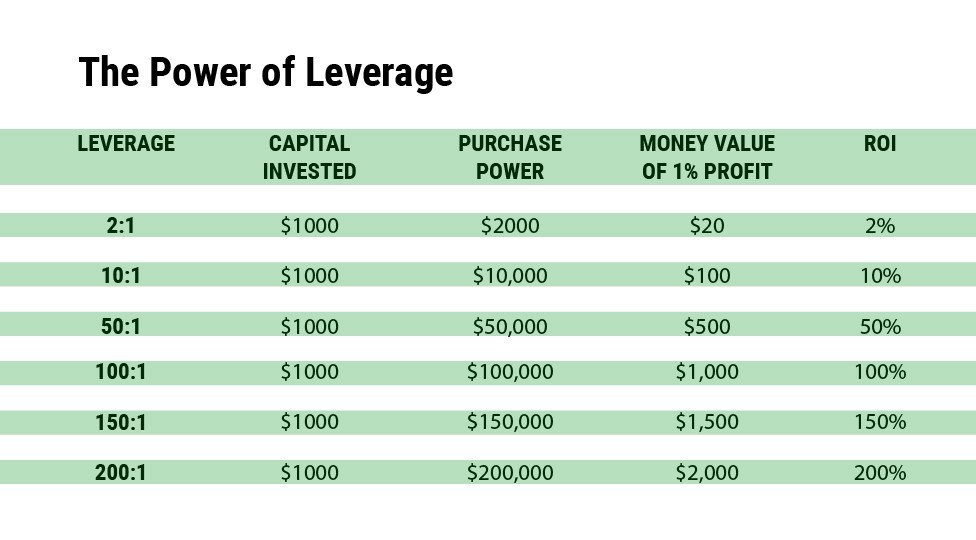

Magnifying Profitability:

Harnessing the power of lot size can elevate your profit-making potential in forex. By increasing the number of lots traded, you amplify the potential returns on successful positions. However, bear in mind that this strategy amplifies not only profits but also risks, a point we will delve into shortly.

Mitigating Market Volatility:

Navigating the capricious tides of market volatility demands a prudent approach to lot size selection. Smaller lot sizes provide a safety net by reducing the overall value exposed to market fluctuations. This conservative strategy can help preserve capital during periods of intense market swings.

Optimal Lot Size Determination: A Balancing Act

Optimal lot sizing hinges upon a delicate balance between risk tolerance and profit aspirations. Adept traders meticulously align their lot size selection with their financial situation and risk tolerance profile. Here’s a practical approach to determining your ideal lot size:

Capital Cushion:

The cornerstone of prudent lot sizing lies in ensuring you possess sufficient capital to absorb potential losses. Aim for a capital level that allows you to weather market downturns without experiencing undue financial strain.

Risk Appetite:

Every trader harbors a unique risk appetite, influencing their tolerance for potential losses. Ascertain your comfort level with risk and select a lot size that aligns with your personal preferences. Bear in mind that higher risk tolerance doesn’t equate to reckless trading; responsible risk management remains paramount.

Image: howtotradeonforex.github.io

Expert Insights: Navigating the Labyrinth of Lot Sizes

“Success in forex trading resides not in the pursuit of exorbitant profits but in cultivating the discipline to preserve capital while capitalizing on favorable market conditions.” – Mark Douglas, renowned trading psychologist

“Optimal lot size selection should mirror your risk tolerance. Smaller lot sizes provide a safety net during turbulent market conditions, while larger lot sizes magnify both profits and risks.” – George Soros, legendary investor and currency speculator

Lot Size Meaning In Forex

Conclusion: Embracing Lot Size as a Forex Trading Paragon

Comprehending lot size in forex empowers traders to wield this critical factor as a potent ally in their trading endeavors. By judiciously aligning lot size with risk tolerance and profit aspirations, traders can harness the potential for increased profitability while mitigating the perils of excessive risk. Remember, the forex market is a challenging but rewarding realm that rewards traders who master its intricacies. Embrace lot size as a foundational concept and elevate your trading prowess to new heights.