Prepare to embark on a captivating journey into the world of foreign exchange, where currencies dance in a vibrant symphony and the pips whisper secrets of market value. We unravel the enigma of EUR/USD pip value, its significance, and the intricate dynamics that shape its existence.

Image: www.dailyfx.com

The Genesis of Pip Value

Pips – the ubiquitous microcosm of currency fluctuation – trace their origins to the humblest of beginnings. In the realm of forex trading, precision is paramount, and the pip emerged as an indispensable tool for discerning even the most minuscule shifts in currency pairs. Defined as the fourth decimal place in a currency quotation, a pip represents a 0.0001 change in the value of one currency relative to another.

For the most widely traded currency pair globally, EUR/USD, a pip translates to a fluctuation of €0.0001 or $0.0001. This seemingly modest fluctuation holds immense significance for traders, investors, and market analysts alike.

Unveiling Pip Value’s Impact

Within the intricate tapestry of forex trading, pip value serves as a fundamental unit of measurement, quantifying both profit and loss. Traders closely track pip movements to gauge potential gains or losses on their positions. For instance, if the EUR/USD rate rises from 1.1200 to 1.1210, a long position of 100,000 units would yield a profit of €10 or $10.

Conversely, a drop from 1.1200 to 1.1190 would result in a loss of €10 or $10. The pip value, therefore, acts as a crucial yardstick for traders to assess the profitability of their trades and manage risk accordingly.

Navigating Pip Value in Practice

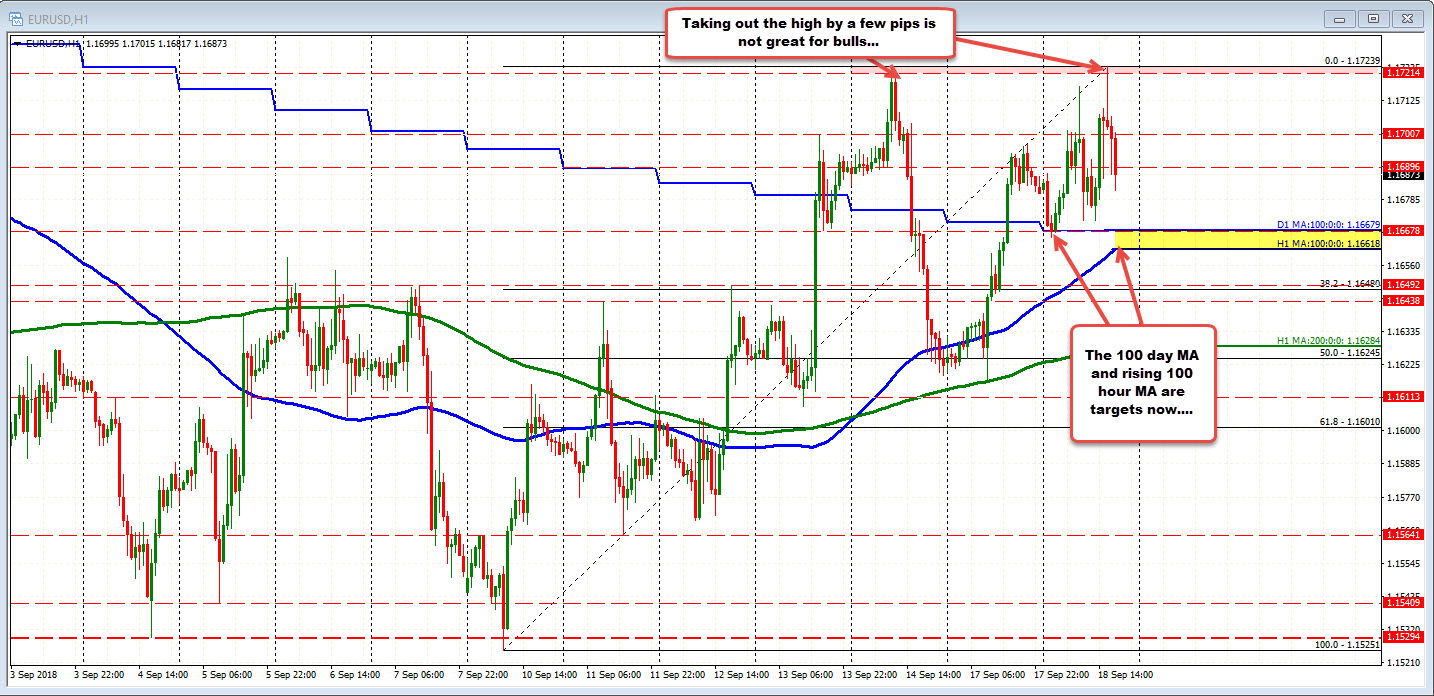

In the dynamic arena of forex trading, the pip value is not a static entity; it constantly adapts to the ebb and flow of market forces. Factors such as economic data releases, geopolitical events, and central bank decisions can all trigger fluctuations in pip value.

Traders and investors must possess a keen understanding of market conditions and employ sophisticated strategies to capitalize on favorable pip movements. Technical analysis, fundamental analysis, and risk management techniques form the bedrock of successful trading, enabling traders to make informed decisions based on market trends and potential price movements.

Image: forexscalpingstrategy5min.blogspot.com

Seeking Expert Guidance for Pip Value Success

As you venture into the realm of forex trading, seeking guidance from seasoned market experts can prove invaluable. Seasoned traders possess an intimate knowledge of historical trends, market dynamics, and successful trading strategies.

By tapping into their expertise, you can gain invaluable insights to refine your approach, navigate market volatility, and maximize your potential returns. Online platforms, seminars, and workshops provide ample opportunities to connect with industry professionals and glean from their vast experience.

Eur Usd Pip Value

Conclusion: Unlocking the Power of Pip Value

The journey of understanding EUR/USD pip value transcends mere monetary significance. It unveils a fascinating interplay of economic forces, risk management, and strategic decision-making. As you delve deeper into the world of forex trading, remember that pip value holds the key to unlocking both potential profits and mitigating losses.

Through continuous learning, expert guidance, and a keen eye on market trends, you can harness the power of pip value to navigate the dynamic realm of forex trading with confidence and reap its rewarding benefits.