Introduction:

In the electrifying world of forex trading, where currency values fluctuate like a heartbeat, certain currency pairings stand out as the epitome of volatility. These most volatile forex pairs offer both immense opportunities and formidable risks, demanding the utmost attention and strategic prowess from traders. In this comprehensive exploration, we will delve into the realm of these forex powerhouses, uncovering their histories, dynamics, and the advantages and challenges they present.

Image: www.forextraders.com

The Nature of Forex Volatility

Forex volatility, measured by variances in exchange rates, is the lifeblood of the currency market. It arises from various factors, including economic indicators, political events, natural disasters, and market sentiment. Volatility presents both risks and rewards for traders; it can amplify both profits and losses, making it crucial to understand the factors that drive it.

Most Volatile Forex Pairs: A League of Their Own

Among the plethora of forex pairs traded globally, a select few have consistently demonstrated extraordinary volatility, attracting the attention of experienced traders seeking high-octane returns. These pairs include:

-

EUR/USD (Euro/US Dollar): The quintessential forex pair, EUR/USD, encapsulates the economic rivalry between the Eurozone and the United States. Its volatility stems from interest rate differentials, geopolitical events, and economic data releases.

-

GBP/USD (British Pound/US Dollar): Nicknamed “Cable” due to its historic transmission via transatlantic telegraph, GBP/USD is influenced by the UK’s political landscape, economic growth, and its relationship with the European Union.

-

USD/JPY (US Dollar/Japanese Yen): This pair reflects the contrasting economies and monetary policies of the US and Japan. USD/JPY’s volatility is often amplified by geopolitical tensions, natural disasters, and central bank interventions.

-

USD/CHF (US Dollar/Swiss Franc): Dubbed the “Swissy,” USD/CHF is a safe-haven pair sought during periods of market turmoil. Its volatility stems from Switzerland’s political neutrality, economic stability, and its central bank’s interventions.

-

AUD/USD (Australian Dollar/US Dollar): Affectionately known as the “Aussie,” AUD/USD is a commodity-driven pair influenced by Australia’s mining industry, economic data, and the Chinese economy.

Unleashing the Power of Volatility

While volatility can be a double-edged sword, savvy traders can leverage it to their advantage. Scalpers and day traders capitalize on short-term fluctuations, aiming for quick profits before the market reverses. Swing traders hold positions for slightly longer periods, profiting from broader price swings.

To harness volatility, traders employ various strategies, including:

-

Trend Trading: Identifying the underlying trend and riding it until it reverses.

-

Range Trading: Capitalizing on a currency pair’s tendency to fluctuate within a specific range.

-

News Trading: Utilizing economic news releases and geopolitical events to predict market movements.

Image: theforexscalpers.com

Challenges and Considerations

Pursuing volatile forex pairs is not without its challenges. Traders must navigate wide spreads, unpredictable price swings, and the potential for significant losses. Effective risk management is paramount, including proper position sizing, stop-loss orders, and a solid trading plan.

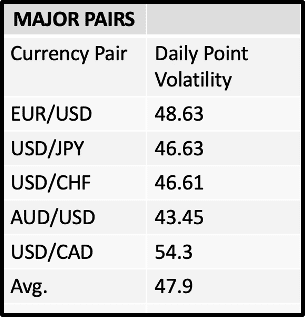

Most Volatile Forex Pairs Today

Conclusion:

The most volatile forex pairs offer a thrilling playground for experienced traders seeking high returns. By understanding their dynamics, leveraging volatility, and managing risk judiciously, traders can harness the power of these currency powerhouses. Remember, the forex market is a realm where fortunes can be made and lost, and success demands discipline, perseverance, and a relentless pursuit of knowledge.