Navigating the dynamic world of forex trading can be a daunting task, but armed with the right strategies, traders can increase their chances of success. Among these strategies, moving averages (MAs) stand out as a reliable and effective tool. This comprehensive guide delves into the intricacies of moving averages, empowering traders with the knowledge to harness their full potential in forex trading.

:max_bytes(150000):strip_icc()/dotdash_Final_Moving_Average_Strategies_for_Forex_Trading_Oct_2020-03-9233d85174f54b32bb4b0efdc710dcc7.jpg)

Image: www.investopedia.com

Unveiling the Essence of Moving Averages

In essence, a moving average is a technical indicator that tracks the average price of an asset over a specified period of time. This average “moves” forward as new data points are added, offering traders a smoothed-out representation of price dynamics. MAs play a pivotal role in forex trading by filtering out noise and highlighting underlying trends, making them indispensable for identifying trading opportunities and managing risk.

Customizing Moving Averages to Suit Your Trading Style

Forex traders have at their disposal a plethora of moving average types, each with its unique characteristics. The most commonly utilized MAs include the simple moving average (SMA), exponential moving average (EMA), and the smoothed moving average (SMMA). These MAs differ in their weighting of past prices, with shorter-term MAs being more sensitive to recent price action and longer-term MAs providing a smoother and more stable average. Choosing the appropriate MA type depends on the trader’s individual trading style and time frame preference.

Unveiling the Power of Moving Averages in Forex Trading

Moving averages offer a versatile toolkit for forex traders, serving multiple functions within a trading strategy. Here are some of their most notable applications:

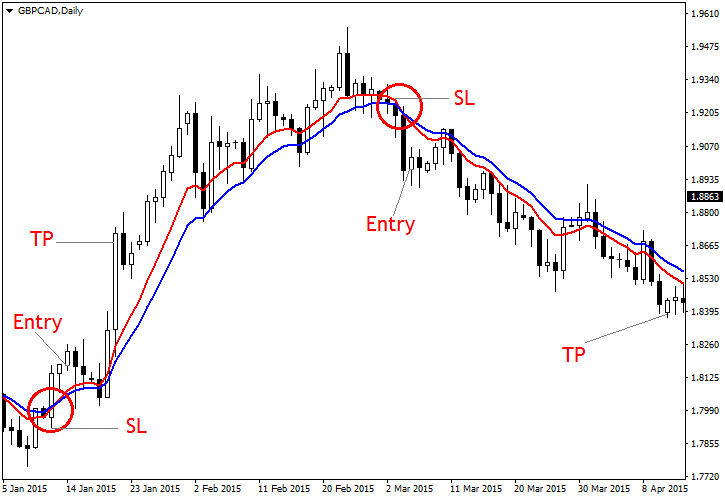

- Trend Identification: By overlaying multiple MAs on a price chart, traders can quickly identify the overall market trend. Rising MAs indicate an uptrend, while falling MAs suggest a downtrend.

- Support and Resistance Levels: MAs can act as dynamic support and resistance levels. When the price repeatedly bounces off a particular MA, it can signal a potential trend reversal or continuation.

- Dynamic Stop-Loss and Take-Profit Levels: Moving averages can be utilized to optimize stop-loss and take-profit placement. Trailing stop-losses based on MAs can protect profits, while take-profits set at key MA levels can maximize returns.

Image: gepahotalefi.web.fc2.com

Moving Average Trading Strategy Forex

The Art of Trading with Moving Averages

Mastering the art of trading with moving averages requires both technical proficiency and a disciplined approach. Here are a few key tips to enhance your trading strategy:

- Combine Multiple Moving Averages: Using a combination of different MA types and time frames can provide a more comprehensive view of market trends and reduce the risk of false signals.

- Confirm Signals with Other Indicators: While MAs are a valuable tool, it’s crucial to complement them with other technical indicators such as oscillators or momentum indicators for confirmation before executing trades.

- Manage Risk Effectively: Leverage MAs to set appropriate stop-loss levels and position size accordingly. Risk management is essential to protect capital and ensure long-term trading success.

Embracing moving averages in your forex trading arsenal can significantly enhance your trading decision-making process. By understanding their nuances, applying them effectively, and managing risk prudently, traders can unlock the full potential of this powerful technical tool, increasing their chances of navigating market fluctuations and achieving their financial goals.