Understanding the concept of pips and points is crucial for anyone involved in forex trading. A pip, which stands for “point in percentage,” represents the smallest price change that a currency pair can experience. In the case of currency pairs with four decimal places, such as EUR/USD, a pip is equivalent to 0.0001.

Image: tradeciety.com

The Meaning of 0.01 in Forex

Therefore, in the forex market, 0.01 is referred to as one pip. It represents a one-point movement in the exchange rate between two currencies. For example, if the EUR/USD exchange rate changes from 1.1000 to 1.1001, that would be a one-pip increase for the euro against the US dollar.

Example of 0.01 in Forex

Let’s illustrate this with an example. Suppose you have a trading account with €10,000, and you decide to open a position of 1 standard lot (which is equal to 100,000 units of the base currency) of EUR/USD. If the EUR/USD exchange rate is currently 1.1000 and moves in your favor by 20 pips (equivalent to 0.0002), your account balance will increase by €20 (100,000 units of EUR x 0.0002).

Importance of Understanding Pips

Understanding pips is essential for forex traders for several reasons:

- Calculating profits and losses: Pips are the basis for calculating profits and losses in forex trading.

- Managing risk: By understanding the value of a pip, traders can better manage their risk exposure.

- Setting realistic profit targets: Pips help traders establish achievable profit targets based on the potential market movement.

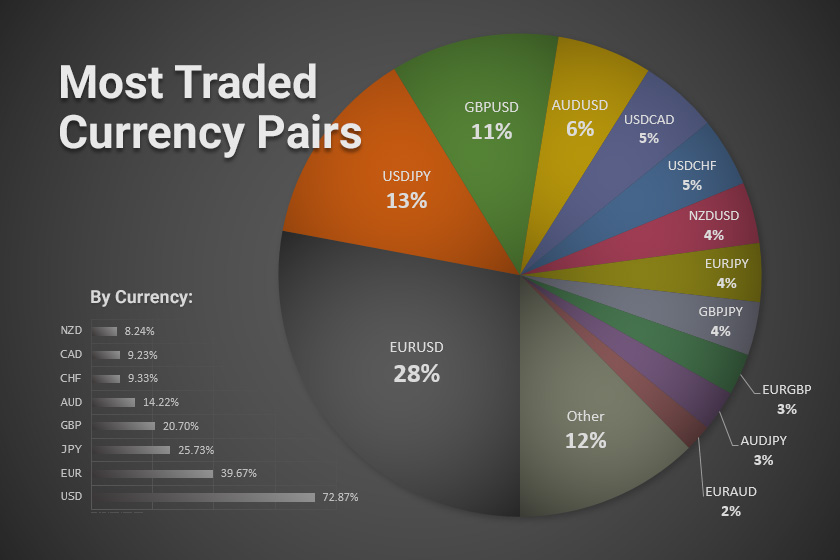

- Comparing currency pairs: Pips facilitate comparison of volatility and liquidity across different currency pairs.

Image: howtotradeonforex.github.io

Tips for Using Pips in Forex Trading

- Calculate pip value: Determine the pip value for each currency pair you trade to understand the potential profit or loss per pip movement.

- Set realistic expectations: Don’t expect to make significant profits from small pip movements. Aim for realistic, achievable profit targets.

- Manage risk: Use stop-loss and take-profit orders to limit potential losses and secure profits.

- Stay informed: Monitor economic news and events that could impact currency prices and influence pip movements.

FAQ on Forex Pips

- What is the difference between a pip and a point?

- Pips and points are often used interchangeably in forex trading, referring to the smallest price movement of a currency pair. However, points are typically used for currency pairs with two decimal places, while pips are more common for those with four decimal places.

- How much is a pip worth?

- The value of a pip varies depending on the currency pair and the trader’s account currency. It can be calculated using the following formula: Pip value = (1 / Pip value in counter currency) x (Trading lot size) x (Account currency / Counter currency).

- How do I calculate pips?

- To calculate pips, simply subtract the previous price of a currency pair from the current price. For example, if the EUR/USD exchange rate changes from 1.1000 to 1.1020, the pip value would be 20 pips (1.1020 – 1.1000).

- I’m new to forex trading. Should I focus on pips?

- While understanding pips is essential for forex trading, beginners should not be overly focused on them. Instead, they should focus on developing a solid understanding of market dynamics, risk management, and trading strategies.

What Is 0.01 In Forex

Conclusion

Comprehending the concept of pips, particularly 0.01 in forex, is fundamental for achieving success in forex trading. By understanding pip values, calculating potential profits and losses, managing risk effectively, and utilizing available resources, traders can improve their chances of making informed decisions and achieving their financial goals.