In the ever-evolving realm of international finance, where fortunes are made and lost in the blink of an eye, understanding the intricacies of currency exchange is paramount. Enter the realm of pips, the minuscule yet mighty units of measurement that play a vital role in the foreign exchange market, commonly known as forex.

Image: forextraininggroup.com

Decoding the mysteries of Forex pips

Forex, a global marketplace where currencies are traded, thrives on the interplay of buying and selling orders. Currency pairs, such as EUR/USD or GBP/JPY, represent the value of one currency against another. These pairs fluctuate continuously, driven by a myriad of factors, including economic data, political events, and market sentiment. Forex traders seek to profit from these fluctuations by buying currencies expected to appreciate in value and selling those anticipated to depreciate.

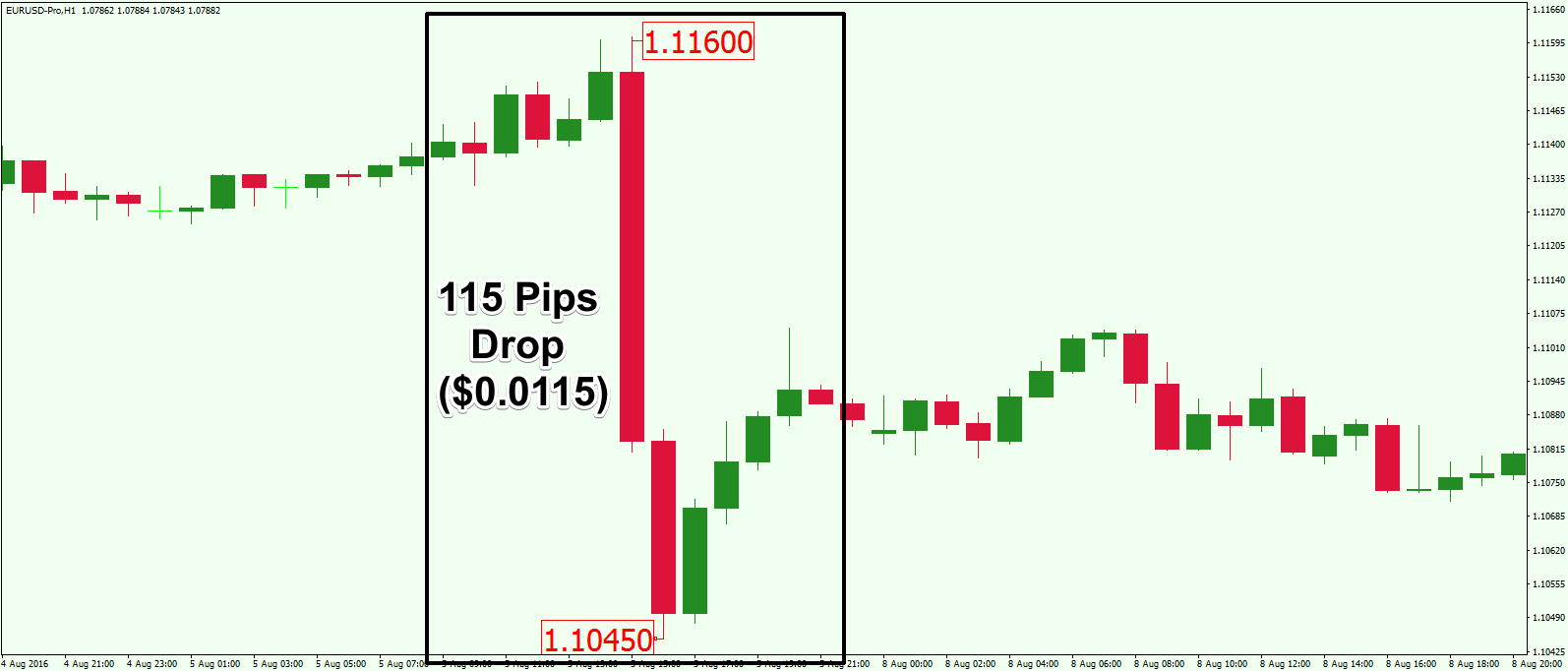

The Pip, short for “point in percentage,” stands as the basic unit of measurement in forex. It represents the smallest possible change in the exchange rate of a currency pair. In most currency pairs, a pip is equivalent to 0.0001, while in currency pairs involving the Japanese Yen, it is worth 0.01.

Consider the EUR/USD currency pair. A change of one pip represents a shift of 0.0001 in the value of the Euro against the US dollar. For instance, if the EUR/USD rate moves from 1.1000 to 1.1001, it signifies a one-pip increase in the value of the Euro.

The significance of Pips in forex dealings

Pips may seem insignificant at first glance, but they hold immense importance for Forex traders. Pips serve as the benchmark for calculating profits and losses, enabling traders to assess the performance of their trades with precision.

Imagine a scenario where you buy 100,000 units of EUR/USD at 1.1000. If the exchange rate rises by 10 pips to 1.1010, your position gains a profit of 1000 pips (10 pips x 100,000 units). Conversely, a drop of 10 pips would result in a loss of 1000 pips.

Pips, Leverage, and Risk management

Leverage, a double-edged sword in Forex trading, allows traders to amplify their profits. However, it also magnifies potential losses. Understanding pips becomes even more crucial when leverage is applied, as even slight movements in exchange rates can have significant impacts on trading outcomes.

Risk management is the lifeblood of successful Forex trading. Pips serve as a valuable tool in assessing risk, enabling traders to determine the potential value at risk per pip. By calculating the pip value for a given trade size and leverage, traders can implement appropriate risk management strategies to mitigate losses and protect their capital.

Image: blog.dhan.co

Pips and Trading Platforms

Trading platforms, the digital gateways to the Forex market, provide traders with real-time market data and charting tools. These platforms often offer features that allow traders to customize their pip settings, such as changing the number of decimal places displayed or setting up alerts based on specific pip values.

What Is Pip In Forex Example

Conclusion

Pips, the fundamental units of measurement in forex, embody the essence of currency fluctuations. They are indispensable for calculating profits, losses, and risk exposure. By comprehending pips and their application in forex dealings, traders gain a competitive edge, enabling them to navigate the complexities of the currency exchange market and make informed trading decisions that can steer them towards success.