In the ever-evolving landscape of forex trading, the double top pattern stands as a beacon of caution, warning traders of potential reversals that could lead to significant losses if not recognized and acted upon promptly. Understanding this formidable chart formation is paramount for traders who seek to navigate the treacherous waters of the currency markets with precision and profitability.

Image: www.tradingwithrayner.com

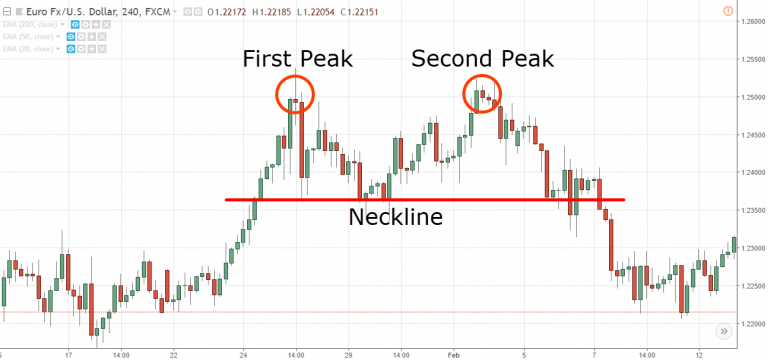

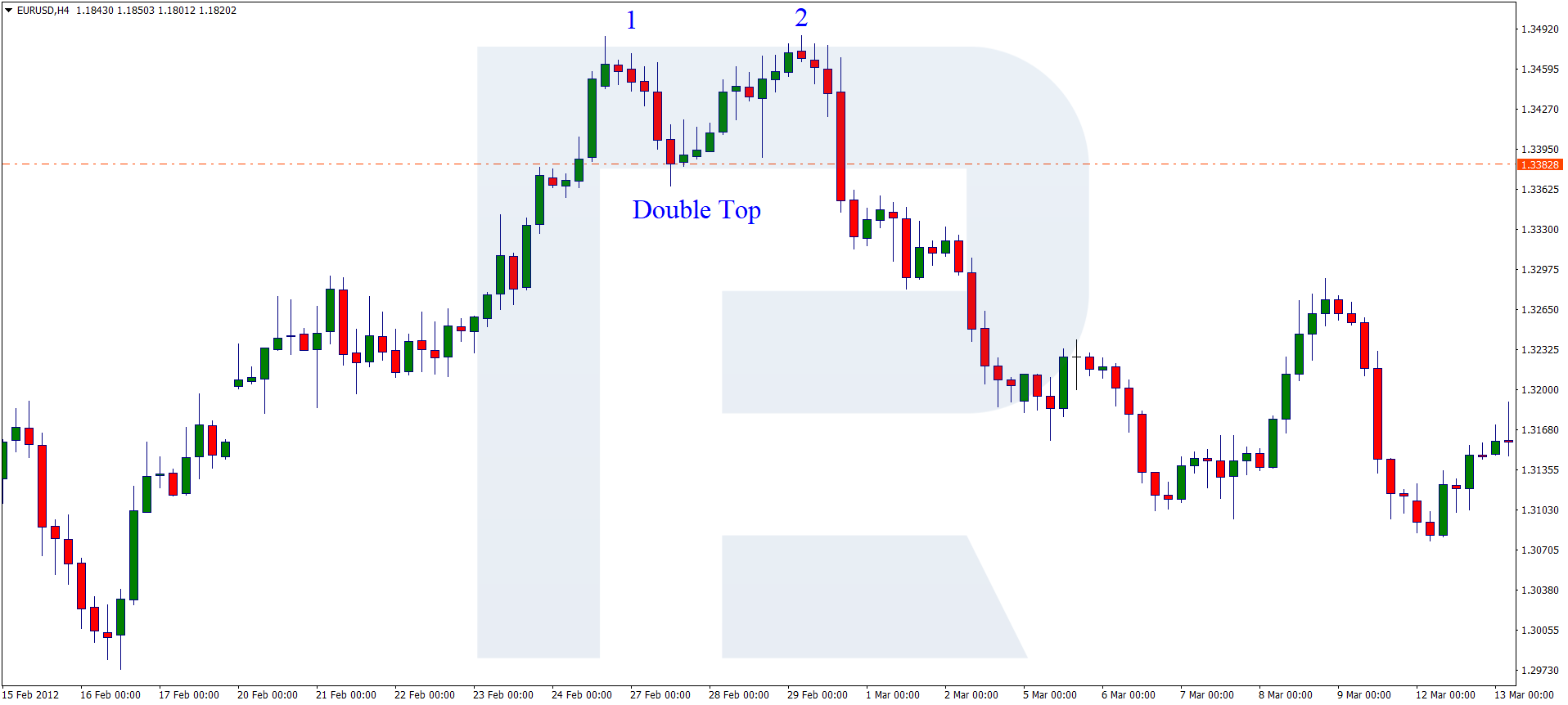

A double top forms when the price of a currency pair reaches a high twice, separated by a brief decline that does not surpass the previous low. It implies that there is a strong resistance level at that particular price point, and bulls are struggling to push the price any higher. As the second peak fails to break the first, a neckline is formed by connecting the lows of the price dips between the two tops. This pattern serves as a significant indicator of a potential trend reversal, signaling a shift from an uptrend to a downtrend.

Double tops are often seen in forex charts and can provide valuable insights into market sentiment. Traders who can accurately identify and interpret this pattern can gain an edge in the competitive world of forex trading. However, it’s important to note that double tops are not foolproof indicators, and there is always the possibility of false signals. Therefore, traders should exercise caution and consider other technical indicators and market analysis methods to confirm their trading decisions.

When a double top pattern is confirmed, traders can take advantage of the potential reversal by implementing various trading strategies. One common approach is to place a sell order at or slightly below the neckline of the pattern. The stop-loss can be placed above the resistance level, and the take-profit order can be set at a predetermined price level below the neckline.

Another strategy is to wait for a breakout below the neckline before entering a short position. This approach can help traders avoid false signals and ensure that the trend reversal is genuine. Traders can also consider using trailing stop-loss orders to protect their profits as the trade progresses in their favor.

To enhance the accuracy of double top trading, traders should pay attention to the following factors:

-

Volume: High volume during both tops and the breakout below the neckline indicates a strong reversal signal.

-

Time: The duration between the two tops and the subsequent breakout should not be too short or too long.

-

Confirmation: Look for other technical indicators and market analysis methods to confirm the double top pattern.

-

Risk management: Always practice proper risk management techniques by setting appropriate position sizes and stop-loss orders.

By understanding the intricacies of double tops in forex and applying the aforementioned trading strategies, traders can increase their chances of success in this dynamic and challenging market. Remember, trading involves risk, and the key to consistent profitability lies in diligent study, disciplined risk management, and a comprehensive understanding of market dynamics.

Image: blog.roboforex.com

What Is A Double Top In Forex